2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

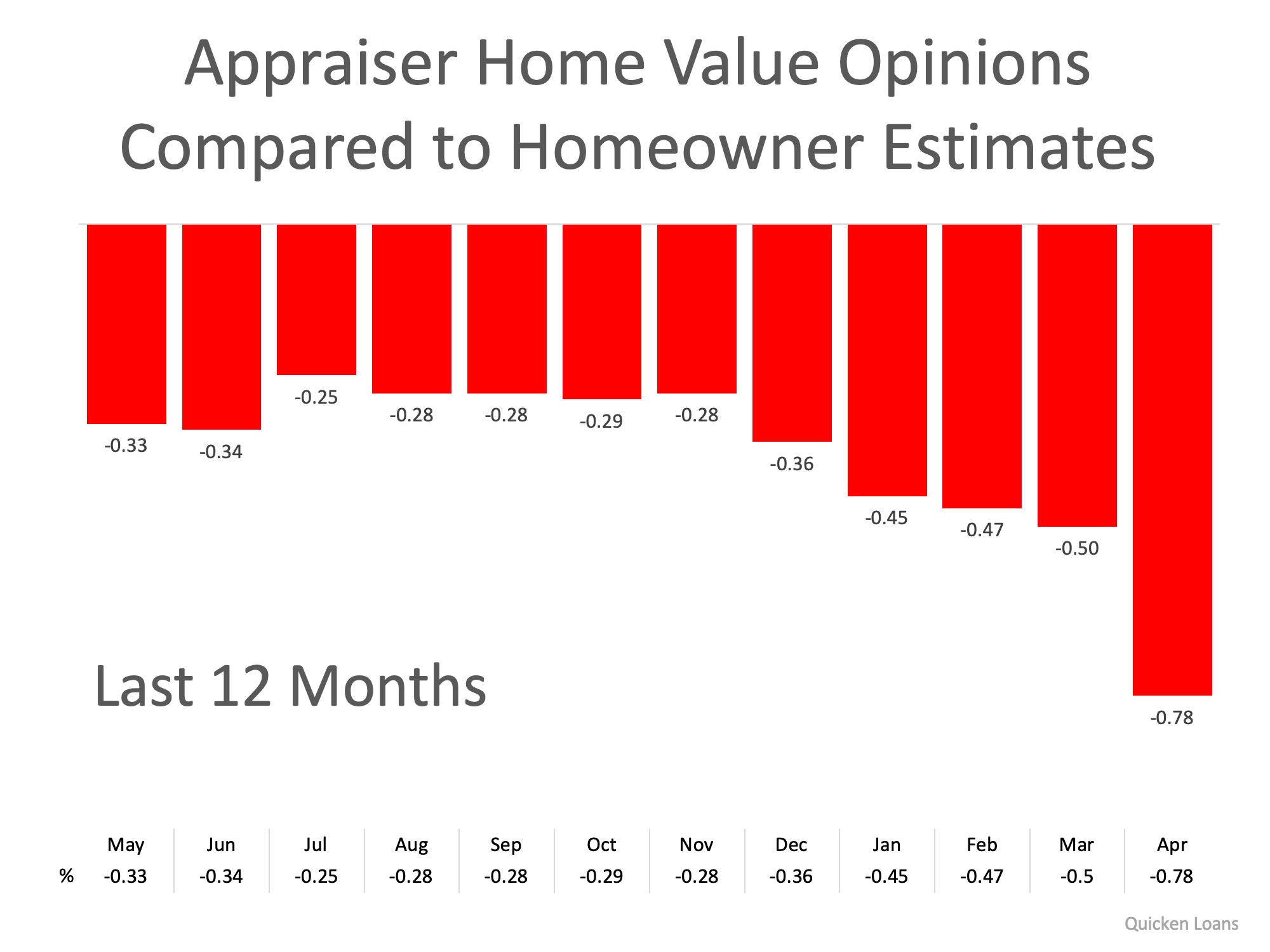

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Trusted Professionals Make Homebuying Easier

How Trusted Professionals Make Homebuying Easier to Understand In the spring, many excited buyers get ready to enter the housing market. Others continue dreaming about the homes they’d like to buy. The truth is, many potential buyers continue to dream longer than they...

The Overlooked Financial Advantages of Homeownership

The Overlooked Financial Advantages of Homeownership There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can...

Why the Electoral College Is So Important

Why The Electoral College Is So Important?

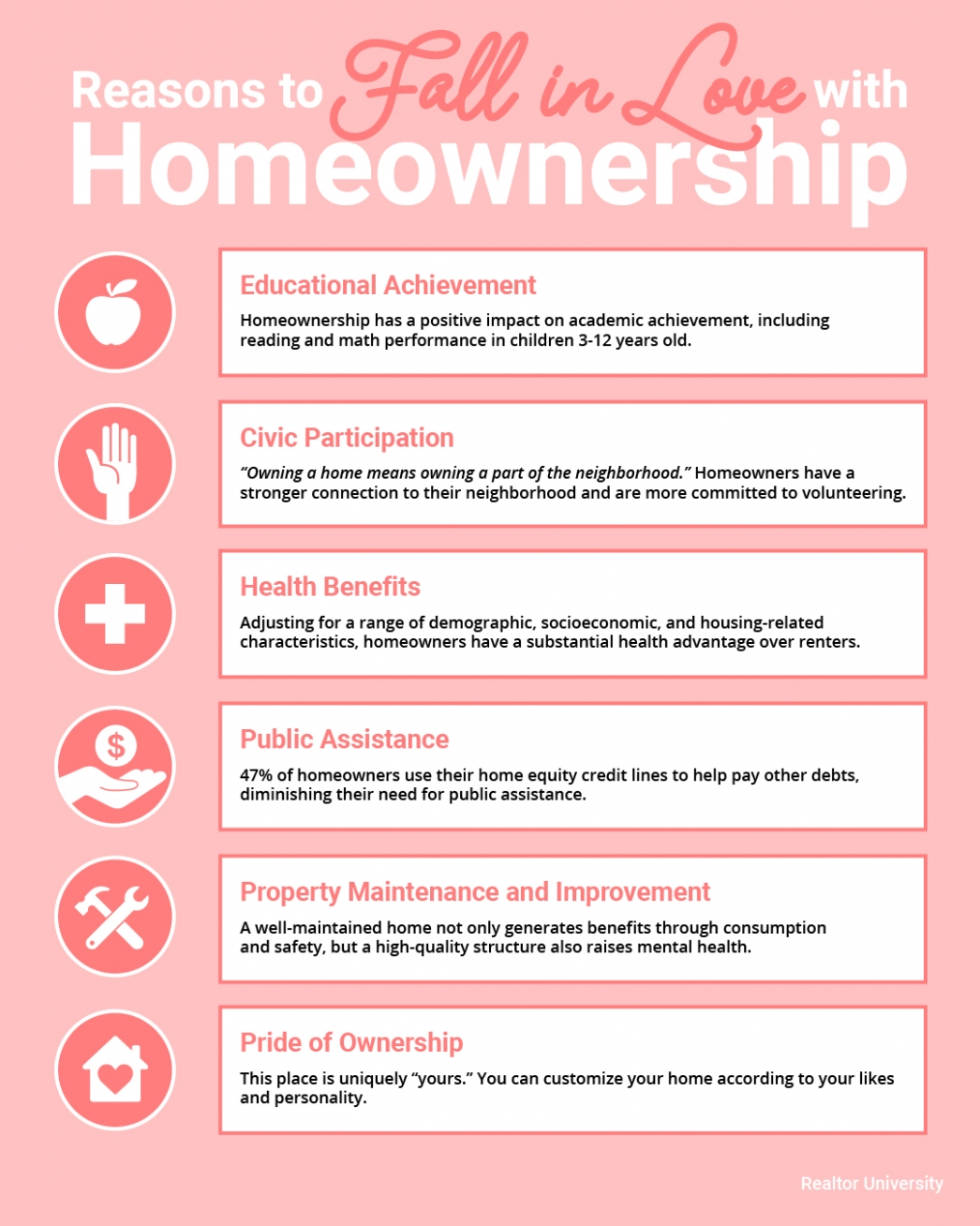

Reasons to Fall in Love with Homeownership

Reasons to Fall in Love with Homeownership Some Highlights: There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these...

Home Prices Are on the Rise This Year and to 2024

Home prices are appreciating, and they're forecasted to continue doing so through the next few years. Let's connect to see if now is a great time to make your next move.

How the Housing Market Benefits with Uncertainty in the World

How the Housing Market Benefits with Uncertainty in the World It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have...

The #1 Reason to List Your House Right Now

The #1 Reason to List Your House Right Now The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that...

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Underwater with Two Mortgages? Here are 5 Ways to Refinance Having a second mortgage or home equity line can make refinancing an underwater mortgage nearly impossible, but one of these five strategies might bail out your refinance. The mortgage market is awash in...

Homeownership Rate on the Rise to a 6-Year High

Homeownership Rate on the Rise to a 6-Year High Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing...

How Pricing Your Home Right Makes a Big Difference

How Pricing Your Home Right Makes a Big Difference Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is...