2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

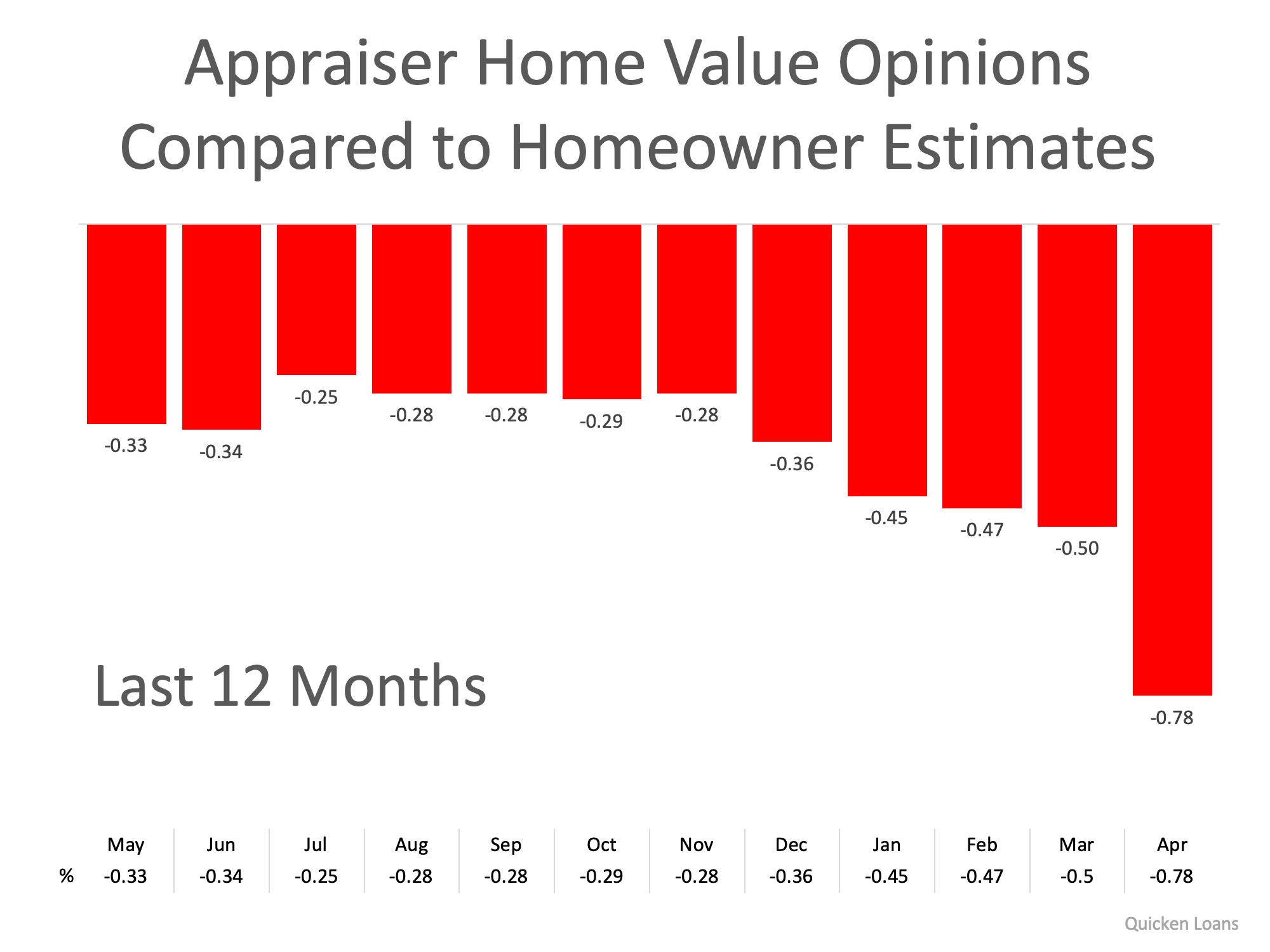

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Mortgage Rate Predictionsfor Q3 2025

Long Forecast predicts slight drops: July 6.84%, August 6.79%, September 6.74%. MBA expects 6.7% average in Q3; NAR, Realtor.com see 6.2%–6.4% by year-end. 15-year fixed rates forecasted to drop from 6.01% in July to 5.88% in September. Experts expect gradual rate...

Are mortgage rates falling? What homebuyers need to know

Mortgage rates for 30-year fixed loans have dropped to around 6.63%, the lowest since April, due to a weaker-than-expected jobs report causing Treasury yields to fall. Experts suggest this dip may be temporary but advise buyers to act now rather than wait for perfect...

The Salt Lake metro area is shifting to a renter’s market after an apartment construction boom.

Apartment vacancy rates rose to 7.1% in July, signaling an overbuilt market with slowed rent growth. Despite high rents, the market favors renters, with rent days on market decreasing. Utah's average rent dropped to $1,399 in 2025, causing many to delay home...

Forget Tariffs! There’s a New Crisis Impacting Rate Cuts

The Fed held rates at 4.25–4.5%, ignoring Trump’s calls for aggressive cuts. Trump imposed steep tariffs, triggering fears of price hikes on goods and vehicles.

How to Know if a Home Fits Your Lifestyle?

Research local schools even if you don’t have kids — they influence home values. Consider internet availability and speed, especially for remote work or streaming needs.

Are Buyers Really Optimistic About Housing?

Over half of U.S. buyers feel the market is better than last year, showing cautious optimism. Seventy-five percent of buyers are waiting for lower prices and interest rates before purchasing homes.

Why You Should Move to Utah

Suburbs of Salt Lake City are booming with new homes. Low unemployment and tech sector growth fuel migration. Affordable pricing compared to West Coast states. Access to skiing, hiking, and national parks. Ideal for families seeking active, balanced lifestyles.

Is Utah Real Estate Finally Cooling Down?

Utah Real Estate prices remain high, but the pace of growth has clearly slowed in recent months. Median monthly mortgage payments in Utah have dropped, improving affordability for first-time homebuyers. Listings are up across Utah, giving buyers more options and...

Utah 2025: Buyers Gain From Balance

Rising listings in Salt Lake suburbs support choice and negotiation. Family-oriented neighborhoods showing long-term value potential.

Where are the most new homes being built in the U.S.? In Utah?

Utah ranks 4th nationally for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah's median home price remains high at $535,217. The Salt Lake City-Murray area ranked...