2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

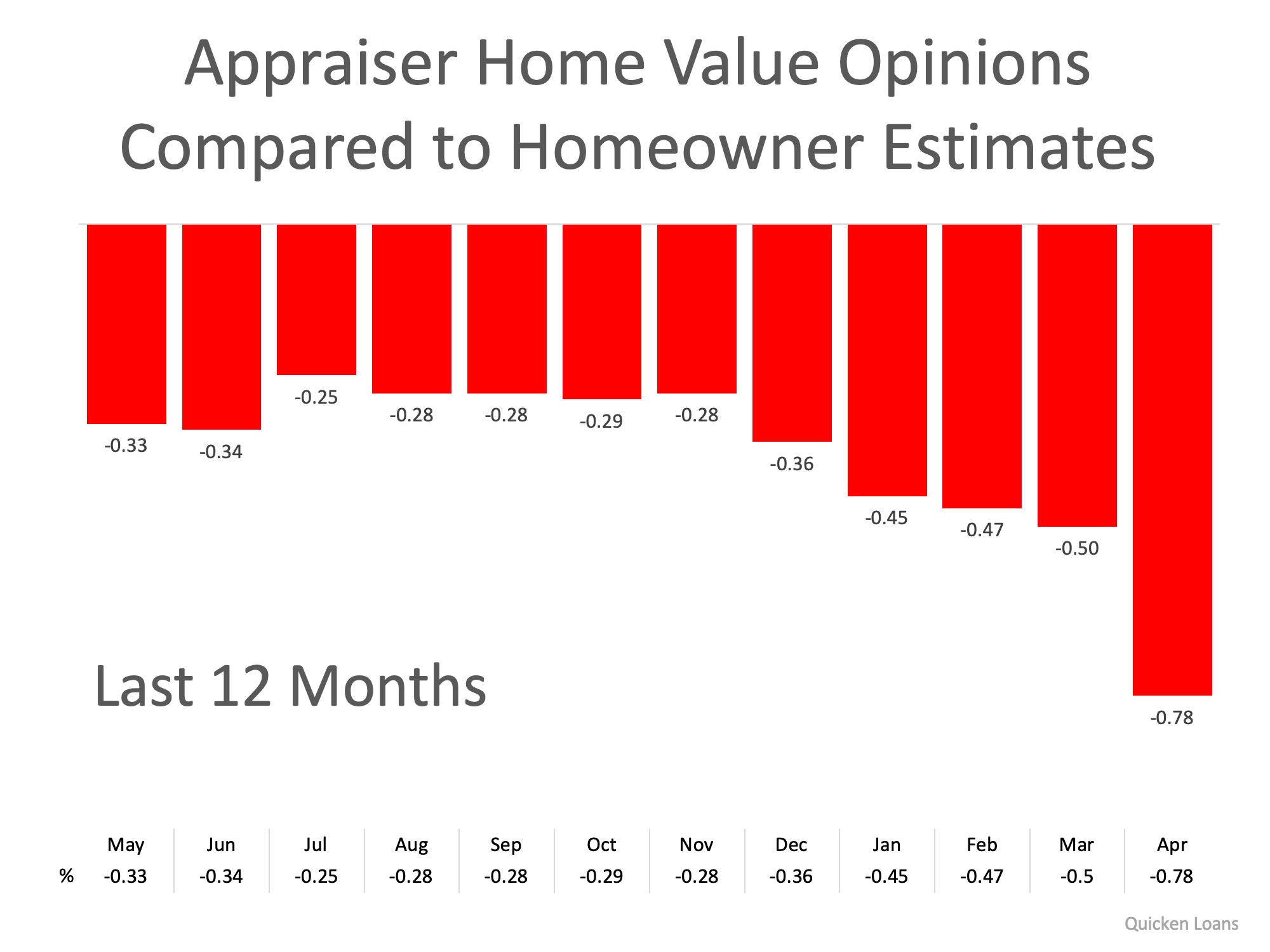

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Looking to sell your home in this intense real estate market?

Looking to sell your home in this intense real estate market? Looking to sell your home in this intense real estate market? If you are, it's possible you will receive multiple offers on your home depending on its condition, location and price. Reviewing multiple...

How Smart Is It to Buy a Home Today

How Smart Is It to Buy a Home Today?Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into...

What Are the Benefits of a 20% Down Payment?

What Are the Benefits of a 20% Down Payment? If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment. Many people may think it’s 20% of the loan to secure a mortgage. While there are plenty of...

Are There Going to Be More Homes to Buy This Year?

Are There Going to Be More Homes to Buy This Year?If you’re looking for a home to purchase right now and having trouble finding one, you’re not alone. At a time like this when there are so few houses for sale, it’s normal to wonder if you’ll actually find one to buy....

Question ? How Much Leverage Do Today’s House Sellers Have?

How Much Leverage Do Today’s House Sellers Have? The housing market has been scorching hot over the last twelve months. Buyers and their high demand have far outnumbered sellers and a short supply of houses. According to the latest Existing Home Sales Report from...

Where Have All the Houses Gone?

Where Have All the Houses Gone?In today’s housing market, it seems harder than ever to find a home to buy. Before the health crisis hit us a year ago, there was already a shortage of homes for sale. When many homeowners delayed their plans to sell at the same time...

Homeowners Today Have Tremendous Equity

You may have more home equity today than you realize. Let's connect to plan how you can leverage that equity in your next move.

3 Ways Home Equity Can Have a Major Impact on Your Life

3 Ways Home Equity Can Have a Major Impact on Your Life There have been a lot of headlines reporting on how homeowner equity (the difference between the current market value of your home and the amount you owe on your mortgage) has dramatically increased over the past...

Why It’s Easy to Fall in Love with Homeownership

Why It’s Easy to Fall in Love with Homeownership Some Highlights Homeownership provides comfort, stability, and security, and it makes you feel more connected to your community. Your home is something to be proud of and is uniquely yours, so you can customize it to...