2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

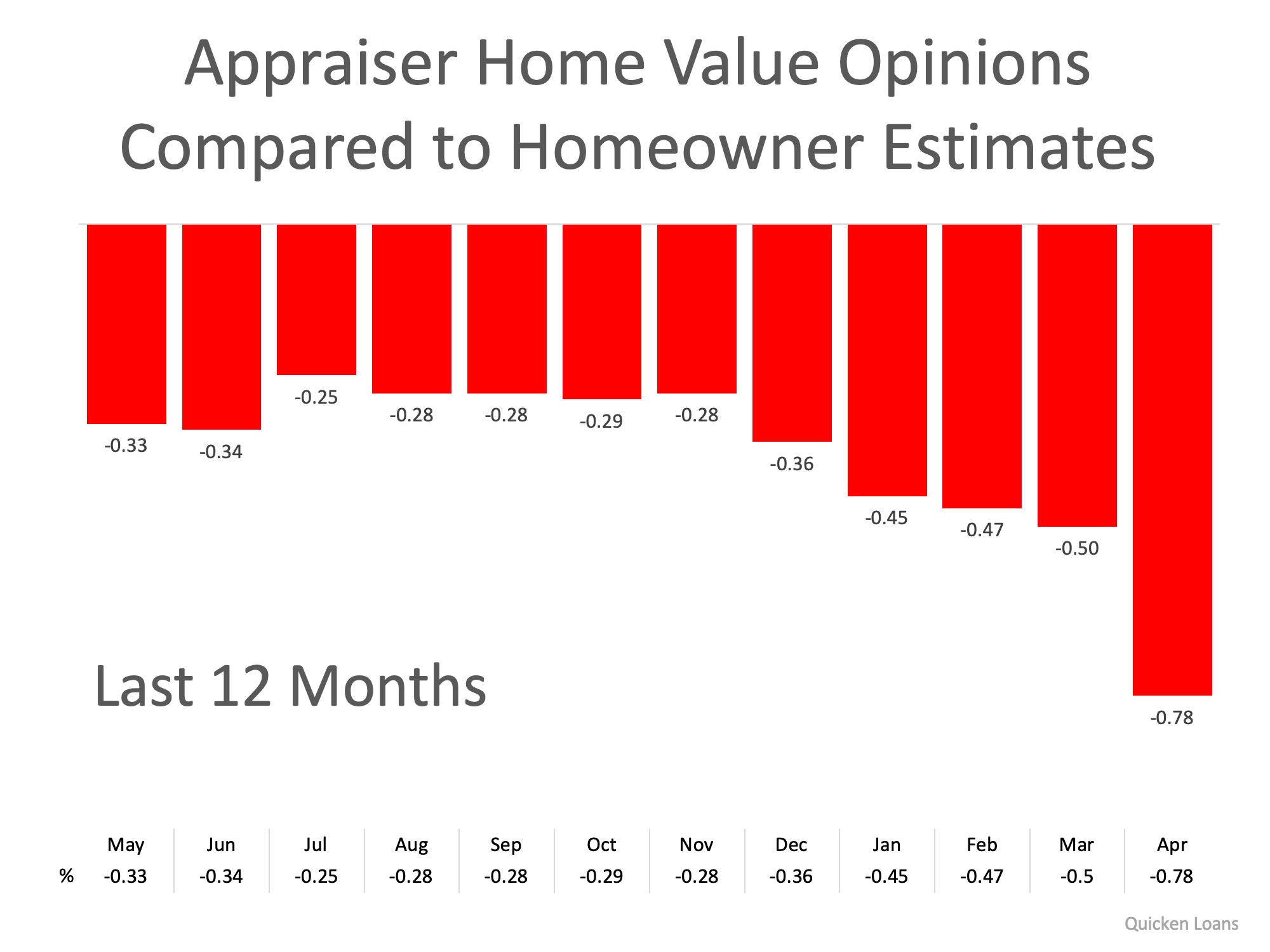

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

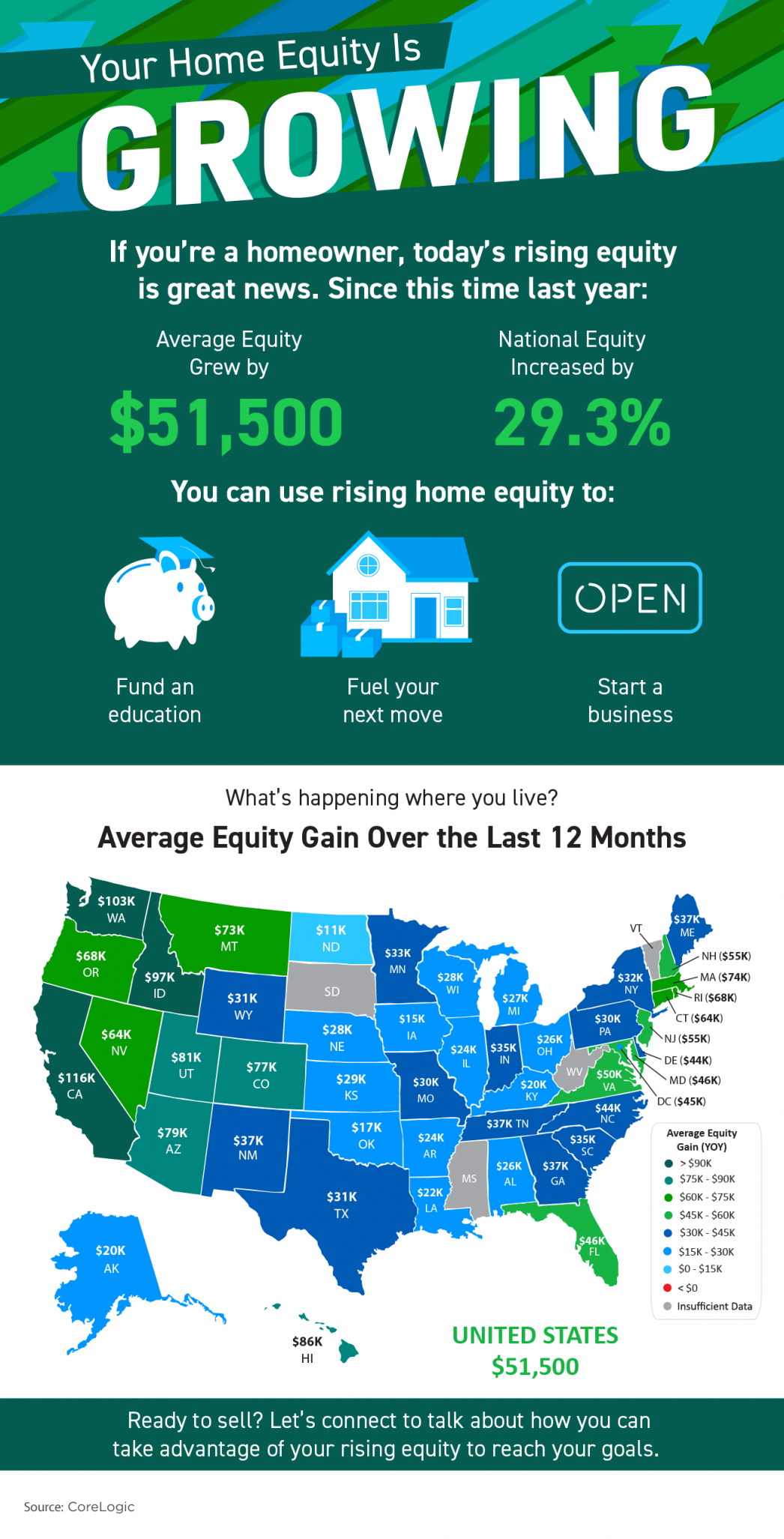

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent...

Perfect Combination

In today’s housing market, houses are selling quickly and are receiving multiple offers from eager buyers. That combination means it’s a great time to sell. DM me so we can discuss how your house plus today’s sellers’ market adds up to a great opportunity for you this...

Utah Local Market Update Utah County

Homebuyer Tips for Finding the One

Homebuyer Tips for Finding the One Some Highlights The best advice carries across multiple areas of life. When it comes to homebuying, a few simple tips can help you stay on track. Because of increased demand, you’ll need to be patient and embrace compromises during...

Local Market Update for September 2021

Auto Draft

What Do Past Years Tell Us About Today’s Real Estate Market?

What Do Past Years Tell Us About Today’s Real Estate Market? As you follow the news, you’re likely seeing headlines discussing what’s going on in today’s housing market. Chances are high that some of the more recent storylines you’ve come across mention terms...

The Big Question: Should You Renovate or Move?

The Big Question: Should You Renovate or Move? The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following: 70%...