2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

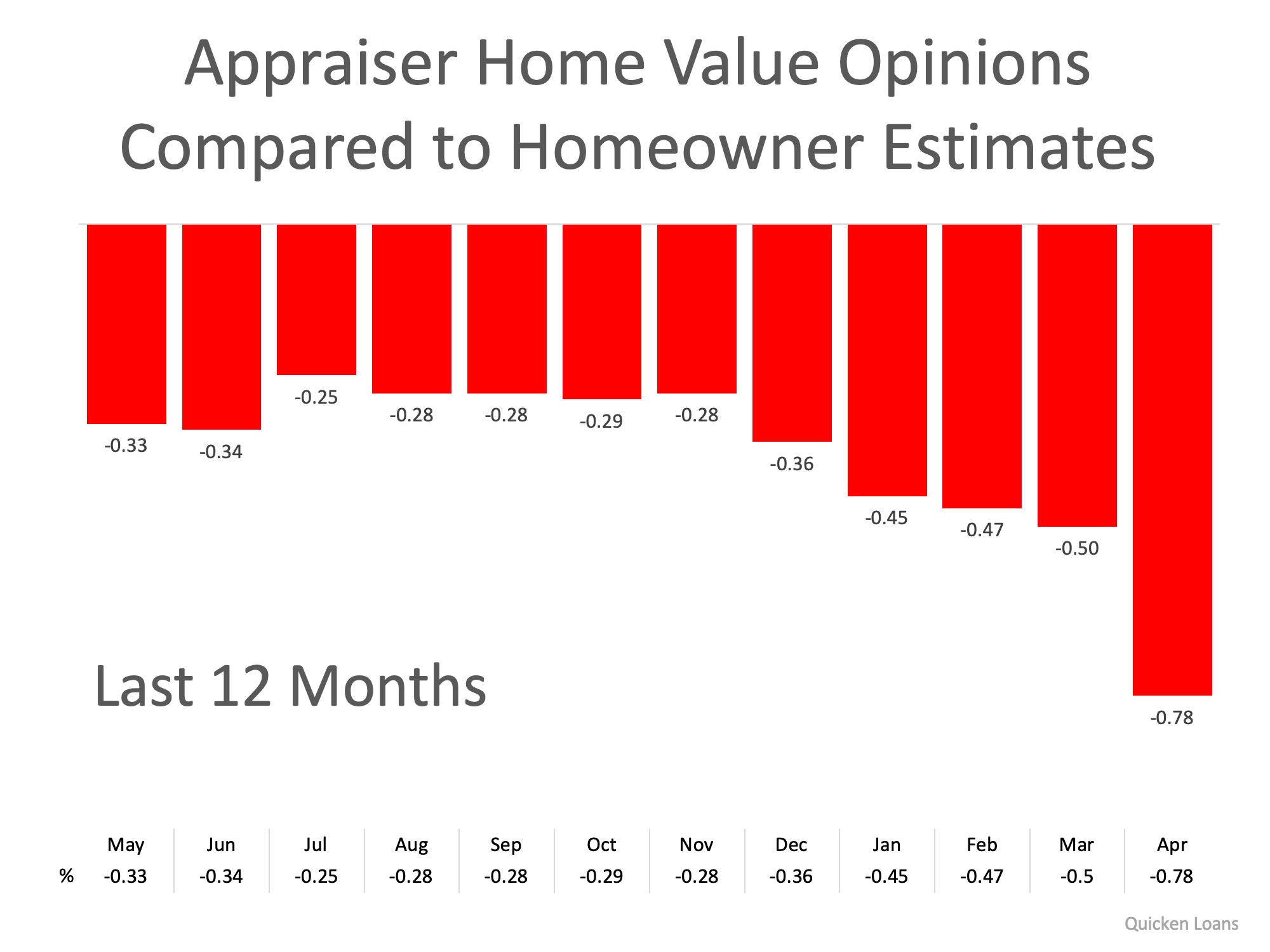

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

4 Smart Ways To Find a Reliable Real Estate Agent

Homebuyers and sellers can benefit from working with reliable real estate agents, as 89% of recent homebuyers chose to do so. To find a trustworthy agent, consider these strategies: 1. Research recent property sales in your area to identify active agents. 2. Call...

5-Year Forecast Favors Buying Over Renting

Buying isn’t just a home — it’s a wealth-building move for your future. Example: Buy a $300K home with 5% down = $82K equity in 5 years.

Do New Roofs Save Money and Energy?

Impact-resistant shingles and metal roofs extend roof life while safeguarding against costly storm damage. Solar-compatible roofs allow easier renewable energy adoption, even for homeowners not installing panels yet. Cool roofing systems lower household cooling bills...

Smart Steps to Buy Your First Home

Start with patience, flexibility, and assembling a trustworthy Real Estate team from day one. Work with a reliable realtor to avoid rushed or financially risky buying decisions. Compare lenders to find strong pre-approval options, like a pre-underwritten mortgage....

Steps to Take Between Mortgage Closing and Moving Day

After closing on your mortgage, follow this checklist to prepare for moving into your new home. Change your address with the Post Office and update utilities. Review your inspection report for necessary repairs and create a maintenance schedule. Deep clean your new...

Guide for First-Time Homebuyers

Buying your first house can be both exciting and overwhelming. Resources are available to empower you with the knowledge needed for homeownership. You can save up to $1,250, and if you find lower costs elsewhere, there are incentives. Local experts are available to...

Housing Market Predictions 2025

In 2025, the housing market shows slow stabilization with mortgage rates declining from near 7%, boosting buyer interest. Home sales remain sluggish but may rise 6% by year-end, while prices continue modest growth due to limited supply. Inventory has increased,...

What Mortgage Rate Will Get Buyers Moving?

A 6% mortgage rate could make homes affordable for 5.5 million more households, potentially unlocking major buying activity across key U.S. metro areas. NAR forecasts rates falling to 6% by 2026, possibly increasing home sales 14%. Current high rates and inventory...

Homeowner Equity Grows Even as Home Prices Dip

After 3 quarters of slipping, equity-rich homes finally ticked up in Q2 2025. ~50% of U.S. homes with mortgages are now equity-rich. Equity-rich = owing less than 50% of your home’s value. In just one quarter, equity-rich homes jumped from 46.2% to 47.4% nationwide....

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...