2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

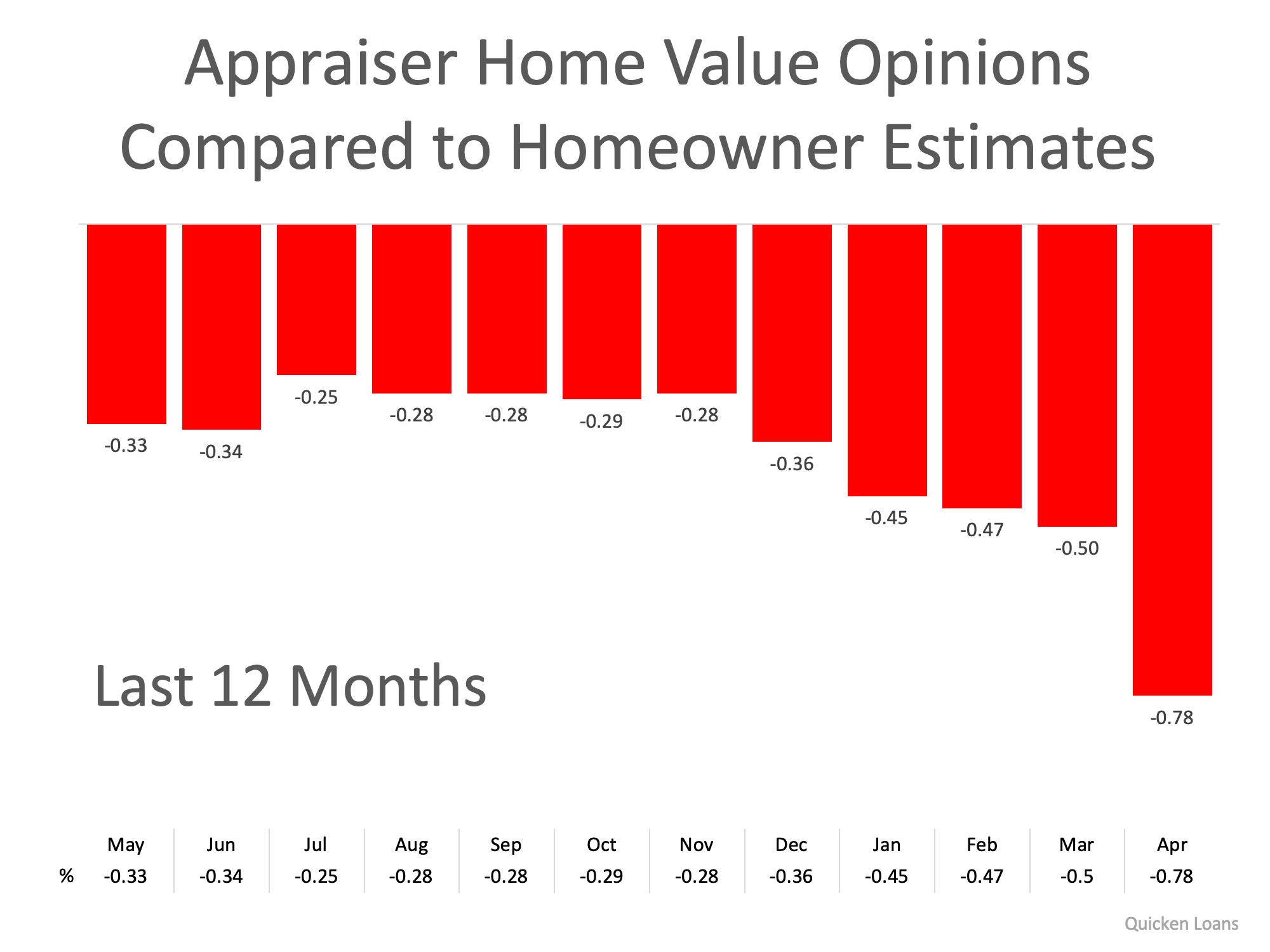

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Does Home Insurance Shield Hurricane Damage?

Dwelling and personal property coverage repair your home and replace belongings, subject to policy limits and deductibles. Hurricane deductibles differ: Typically 1–5% of dwelling coverage, significantly impacting your out-of-pocket costs.

Utah rent increase proposal fails for third year in a row

A bill in Utah aimed at requiring landlords to provide 60 days' notice for rent increases was rejected for the third consecutive year, with a tied vote in the House Business, Labor, and Commerce Committee. Supporters argued it would benefit renters, but the...

Happy Presidents’ Day

Presidents' Day celebrates all past and present U.S. presidents. It reflects on the nation's founding principles and values, including the Constitution and union. Reading of Washington's Farewell Address by a U.S. senator remains an annual event for...

Utahns agree housing is a problem. What they don’t agree on is why

A recent survey by Envision Utah reveals that over two-thirds of Utah residents believe the state faces serious housing issues, yet many are unclear about the causes. Key factors identified include rising interest rates, construction costs, and an influx of new...

Fannie Mae’s 2025 Housing Forecast

Mortgage rates remain above 6%, with slight home price growth and low supply continuing to pressure affordability. Existing home sales expected to recover slightly from multi-decade lows due to limited inventory and affordability barriers.

Happy Valentine’s Day

Valentine’s Day occurs every February 14 around the world, and candy, flowers and gifts are exchanged between loved ones, all in the name of St. Valentine Valentine greetings were popular as far back as the Middle Ages, though written Valentine’s didn’t begin to...

How to Invest Globally in Real Estate

Investing globally in Real Estate requires understanding market dynamics, including rent growth and job creation trends.Tap into local expertise, including brokers, property managers, and market analysts, to gain on-the-ground insights.

Looking to Sell a Home in 2025? Take These 5 Steps

Start by researching and interviewing realtors knowledgeable about your local market before selling.A fresh home makeover, including new paint and flooring, boosts appeal and first impressions.

Homeowner Tax Breaks: All the Ways Your House Can Boost Your Tax Refund

Owning a house in the US is expensive, with rapidly rising home prices and hidden expenses. However, tax credits and deductions for homeowners can lead to a bigger tax refund. Homeowners can take advantage of tax deductions by itemizing their deductions using Form...

How 2025 Trends Fuel Homeownership Potential

Home sales may rise 1.5%, prices climb 3.7%, and mortgage rates stay above 6% despite slight cuts. A historic 11.7% home inventory jump and 13.8% new construction surge mark supply resurgence in 2025.