2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

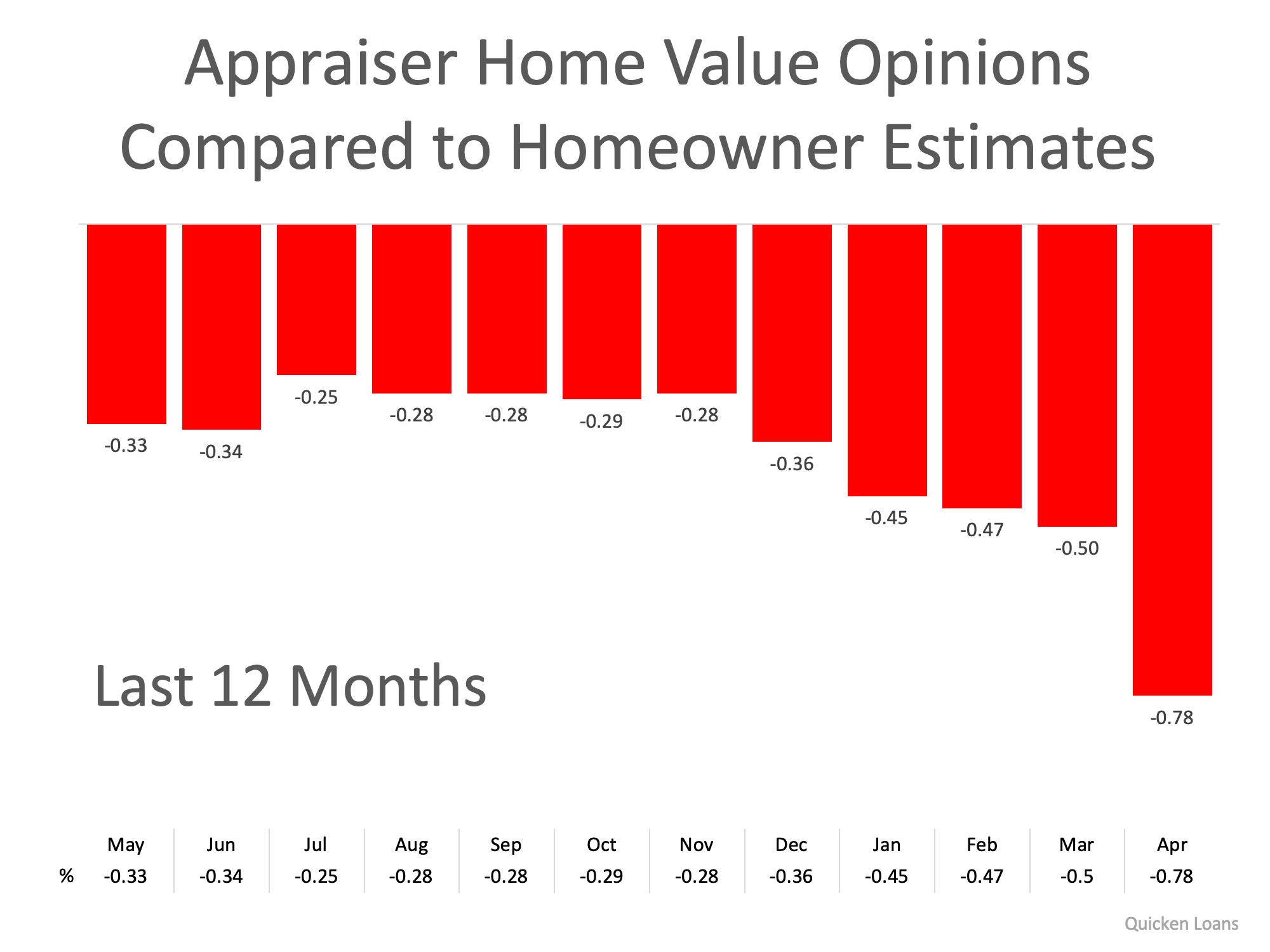

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Value Adjustments according to Ai

Appraisal adjustments vary according to build quality and area While specific dollar values for adjustments in residential home appraisals can vary based on numerous factors, including the specific neighborhood and current market conditions, here are some typical...

7 Things I Wish I’d Known as a First-Time Homebuyer

Robert and Kacie share insights on personal finance and home buying. Robert emphasizes the importance of a good real estate agent and home inspections. Kacie advises looking beyond bad online listings for potential hidden gems. Both stress the financial challenges and...

10 Tips for Finding Cheap Housing

Looking in less popular neighborhoods or cities and being willing to relocate can reduce housing costs. Strategies include low-income housing programs, finding roommates, negotiating rent, and making compromises. Making a detailed budget plan is crucial to determine...

Selling Your Home in 2025? Expect More Competition

More homeowners will list their properties as mortgage rates stabilize, improving inventory but increasing competition.Buyers may gain leverage, leading sellers to offer price cuts or concessions in competitive markets.

New Tariffs Could Raise Construction Costs by 60%!

U.S. construction faces rising costs as new tariffs could increase material prices by up to 60%. Construction inputs for multifamily projects have already surged 35% in 5 years, squeezing project feasibility.

Follow These 5 Steps to Own a Home in 2025!

Before buying a house in 2025, ensure you are debt-free and have 3–6 months of expenses saved. Limit your home budget to 25% of your take-home pay, covering mortgage, taxes, insurance, and HOA fees.

Renting costs a lot less than buying a home, especially in the West

Salt Lake City ranks fifth in the U.S. for the rent-buy cost gap, with renting at $1,680 monthly and buying at $3,197, making buying 90.4% more expensive. Nationwide, renting is cheaper as mortgage payments rise while rents decline or stabilize. The largest gaps are...

Happy Mother’s Day

Mother's Day is a celebration honoring the mother of the family or individual, as well as motherhood, maternal bonds, and the influence of mothers in society. The origins of commemorating motherhood dates back to the Ancient Greeks, where in spring festival, they...

What 2025 Housing Trends Keep Foreclosure Rates Low?

2025 home prices will rise slowly, with an average price of $510,300 and median at $419,200. In 2025, home prices will stabilize; expect to pay close to asking price, especially in tight markets.

Tax Cuts for All Utahns at Every Stage of Life

Utah's Legislature is set to provide $127 million in tax relief, aimed at supporting retirees, young families, and individuals. Key measures include reducing the income tax rate to 4.5%, eliminating social security tax for those earning up to $90,000, and...