2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

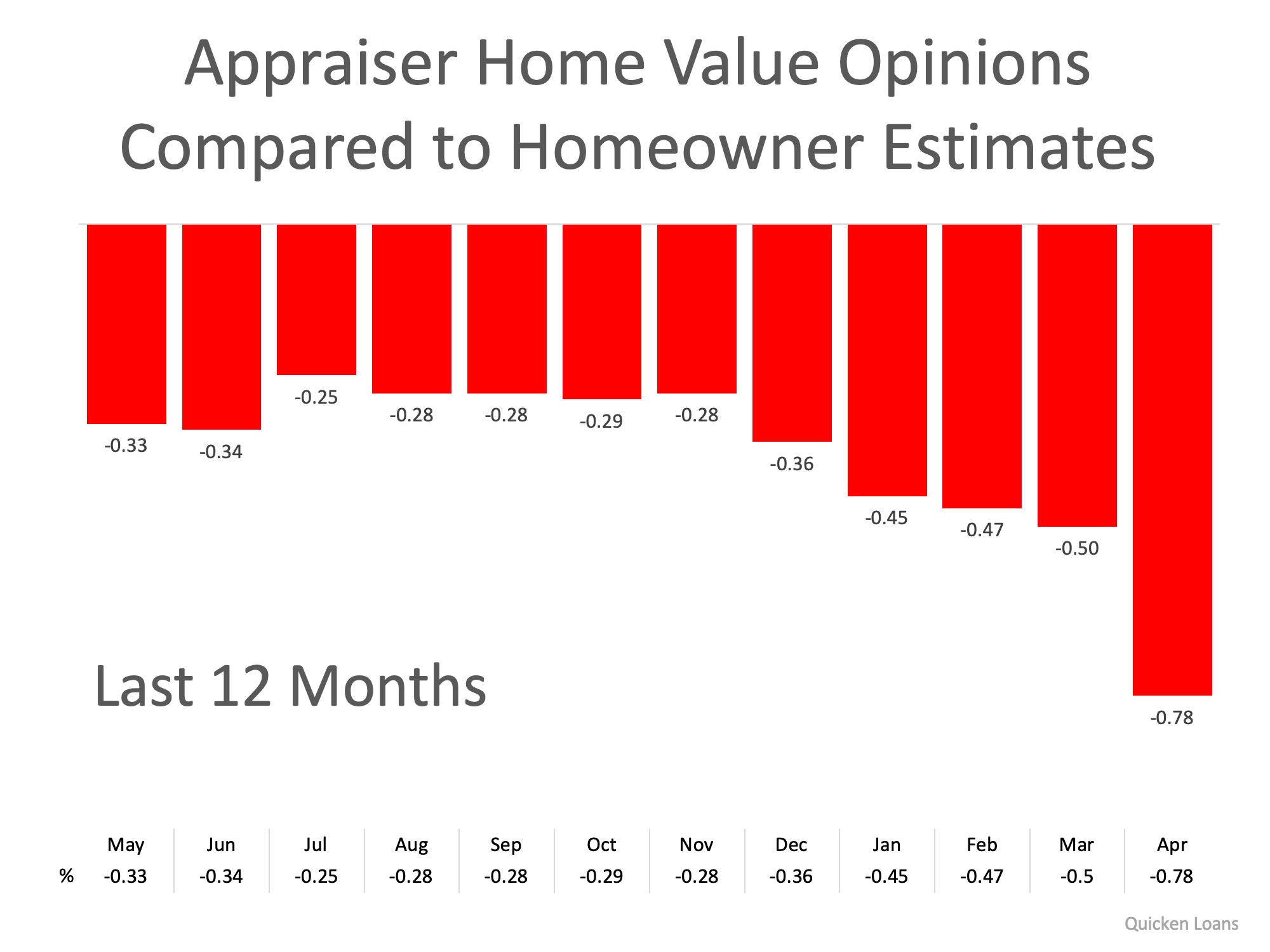

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Tariffs to Inflate Remodeling and Home Prices

Tariffs on building materials are driving up construction costs, raising home prices, and slowing the housing market.New tariffs could add $7,500–$10,000 to home costs, making homeownership harder as demand continues to decline.

Key Benefits that most Veterans Overlook

Navigating the path to homeownership can often seem daunting, particularly for veterans who have dedicated a significant portion of their lives to serving their country. The VA home loan program stands as a beacon of hope, offering a unique opportunity to those who...

Honoring Our Nation’s Heroes on Memorial Day.

This day honors the brave men and women who have sacrificed their lives to defend America's freedom.It became an official federal holiday in 1971. Americans observe Memorial Day by visiting cemeteries and memorials.

How to Determine Your Home’s Value

Robert and Kim are experts in personal finance at Newsweek. Determining your home value is crucial for selling your property. Methods include online tools, comparative market analysis, and professional appraisal. Factors like location, size, condition, comparable...

Real Estate Fortune: Why 2025 Is the Golden Year

2025 may present a unique opportunity for Real Estate agents despite ongoing industry challenges. An increase in inventory could lead to lower prices and more successful deals for agents.

New report reveals how one fast-growing expense is impacting homeowners: ‘Many may feel like they can never own a home’

Home insurance premiums in Utah have surged by 59% in three years, the highest increase nationwide, driven largely by climate change-related extreme weather. Rising costs are worsening the housing crisis, making homeownership harder, especially for first-time buyers....

US Homes: Will Growth Return in 2025?

U.S. home sales peaked in 2021, declined through 2024, and are expected to see mild growth in 2025-2026.Mortgage interest rates will continue influencing market trends, impacting prices and buyer demand.

Property Tax Trends Across the US

Rising property values have led to higher tax burdens, though some states cap assessments to limit drastic increases. Northeastern and Midwestern states generally impose higher property taxes, while Southern and Western states tend to have lower rates.

Value Adjustments according to Ai

Appraisal adjustments vary according to build quality and area While specific dollar values for adjustments in residential home appraisals can vary based on numerous factors, including the specific neighborhood and current market conditions, here are some typical...

7 Things I Wish I’d Known as a First-Time Homebuyer

Robert and Kacie share insights on personal finance and home buying. Robert emphasizes the importance of a good real estate agent and home inspections. Kacie advises looking beyond bad online listings for potential hidden gems. Both stress the financial challenges and...