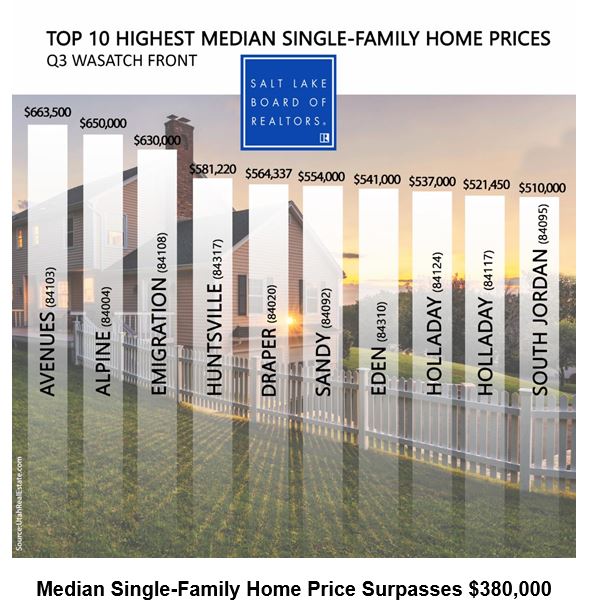

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front

Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the July-through-September period reached $381,500. That’s up 7.5 percent compared to a median price of $355,000 in last year’s third quarter. Just three years ago, the median single-family home price reached $300,000, which was then an all-time high price. The previous peak home price was in the third quarter of 2007, when home prices topped $256,000 (or $298,085 in inflation-adjusted dollars). Home prices increased across all Wasatch Front counties including: Davis, up 6.2 percent; Tooele, up 2.6 percent; Utah, up 4.4 percent; and Weber, up 10.3 percent. Sales of single-family homes in Salt Lake County were flat (up 0.7 percent) in the third quarter year-over-year. Davis County saw sales increase 9.8 percent. Sales in Tooele County were up 4.7 percent. Utah County sales were up 11.8 percent. Sales in Weber County were up 12.1 percent. In the third quarter, the typical Salt Lake home was on the market 37 days before it sold – six days longer than the average time for a home to sell during the third quarter of 2018

Why Pre-Approval Is Even More Important This Year

Why Pre-Approval Is Even More Important This Year On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024. What Pre-Approval Is...

There’s No Foreclosure Wave in Sight

There’s No Foreclosure Wave in Sight Some Highlights Headlines saying foreclosures are rising might make you feel uneasy. But the truth is, there’s no need to worry. If you look at the latest numbers, they’re still below pre-pandemic norms and way below what happened...

Don’t Wait Until Spring To Sell Your House

Don’t Wait Until Spring To Sell Your House As you think about the year ahead, one of your big goals may be moving. But, how do you know when to make your move? While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell....

Blockchain technology and its integration with real estate transactions

Blockchain technology and its integration with real estate transactions. Blockchain has been making waves in various industries, revolutionizing the way we store and transfer data securely. And with the ever-evolving real estate market, it comes as no surprise that...

2 of the Factors That Impact Mortgage Rates

2 of the Factors That Impact Mortgage Rates If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?...

Trends in Senior Housing

Trends in Senior Housing In this article, we dive into the fascinating realm of senior purchasing habits when it comes to housing. With the aging population, the needs and preferences of seniors have transformed, leading to new trends and demands in the housing...

Will a Silver Tsunami Change the 2024 Housing Market?

Will a Silver Tsunami Change the 2024 Housing Market? Have you ever heard the term “Silver Tsunami” and wondered what it's all about? If so, that might be because there’s been lot of talk about it online recently. Let's dive into what it is and why it won't...

Why It’s More Affordable To Buy a Home This Year

Why It’s More Affordable To Buy a Home This Year Some Highlights Home affordability depends on three factors: mortgage rates, home prices, and wages. Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are...

Experts Project Home Prices Will Increase in 2024

Experts Project Home Prices Will Increase in 2024 Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the...

3 Must-Do’s When Selling Your House in 2024

3 Must-Do’s When Selling Your House in 2024 If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to...