Is Your House “Priced to Sell Immediately”?

In today’s real estate market, more houses are coming to market every day. Eager buyers are searching for their dream homes, so setting the right price for your house is one of the most important things you can do.

According to CoreLogic’s latest Home Price Index, home values have risen at over 6% a year over the past two years, but have started to slow to 3.6% over the last 12 months. By this time next year, CoreLogic predicts home values will be 5.4% higher.

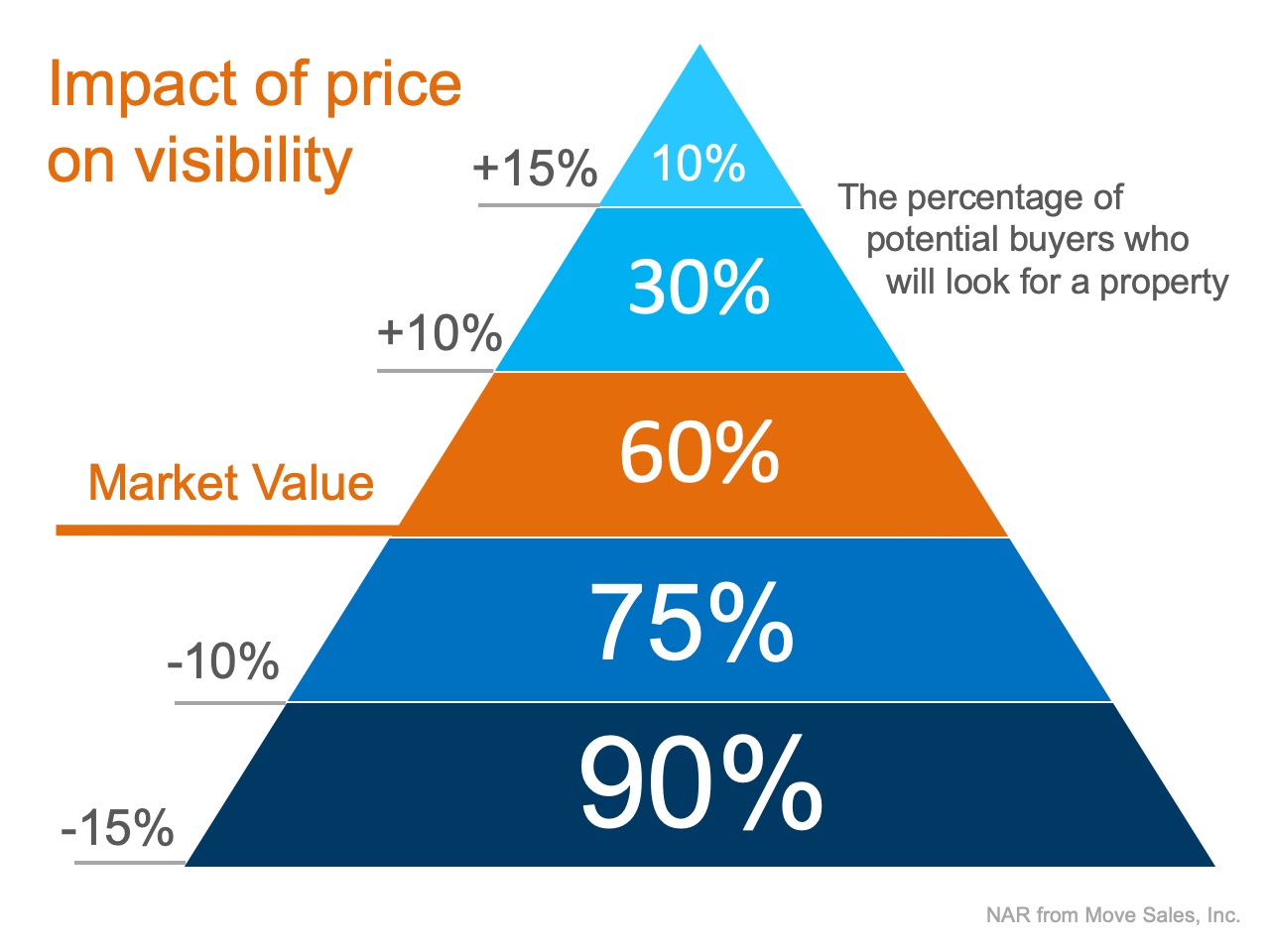

With prices slowing from their previous pace, homeowners must realize that pricing their homes a little over market value to leave room for negotiation will actually dramatically decrease the number of buyers who will see their listing (see the chart below). Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so demand for the home is maximized. By doing so, the seller will not be negotiating with a buyer over the price, but will instead have multiple buyers competing with each other over the house.

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so demand for the home is maximized. By doing so, the seller will not be negotiating with a buyer over the price, but will instead have multiple buyers competing with each other over the house.

The secret is making sure your house is Priced To Sell Immediately (PTSI). That way, your home will be seen by the most potential buyers. It will sell at a great price before more competition comes to the market.

Bottom Line

If you’re debating listing your house for sale, let’s get together to discuss how to price your home appropriately and maximize your exposure.

Tips To Reach Your Homebuying Goals in 2023

Tips To Reach Your Homebuying Goals in 2023 Some Highlights If you’re planning to buy a home in 2023, here are a few things to focus on. Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved,...

3 Best Practices for Selling Your House This Year

3 Best Practices for Selling Your House This Year A new year brings with it the opportunity for new experiences. If that resonates with you because you’re considering making a move, you’re likely juggling a mix of excitement over your next home and a sense of...

Avoid the Rental Trap in 2023

Avoid the Rental Trap in 2023 If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true...

Planning To Sell Your House? It’s Critical To Hire a Pro

Planning To Sell Your House? It’s Critical To Hire a Pro. With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has...

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do. While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may...

Financial Fundamentals for First-Time Homebuyers Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus...

Utah Realty Marty & Laurie Gale

Thank You for All of Your Support

What To Expect From the Housing Market in 2023

What To Expect From the Housing Market in 2023 The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it's put the market into a reset position. As the Federal Reserve (the Fed) made moves this year...

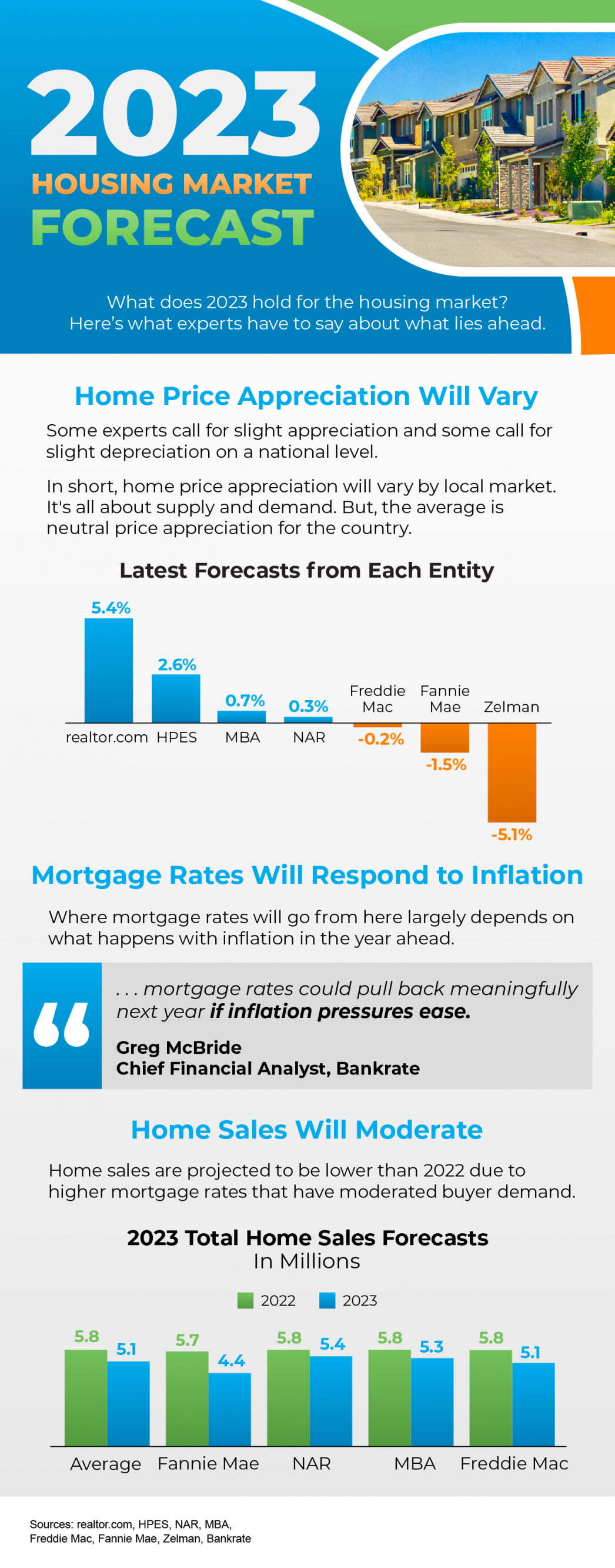

2023 Housing Market Forecast (National)

2023 Housing Market Forecast Some Highlights From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation. If you’re thinking of buying or selling a home this year, let’s connect so you...

Planning to Retire? It Could Be Time To Make a Move

Planning to Retire? It Could Be Time To Make a Move. If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs....