The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

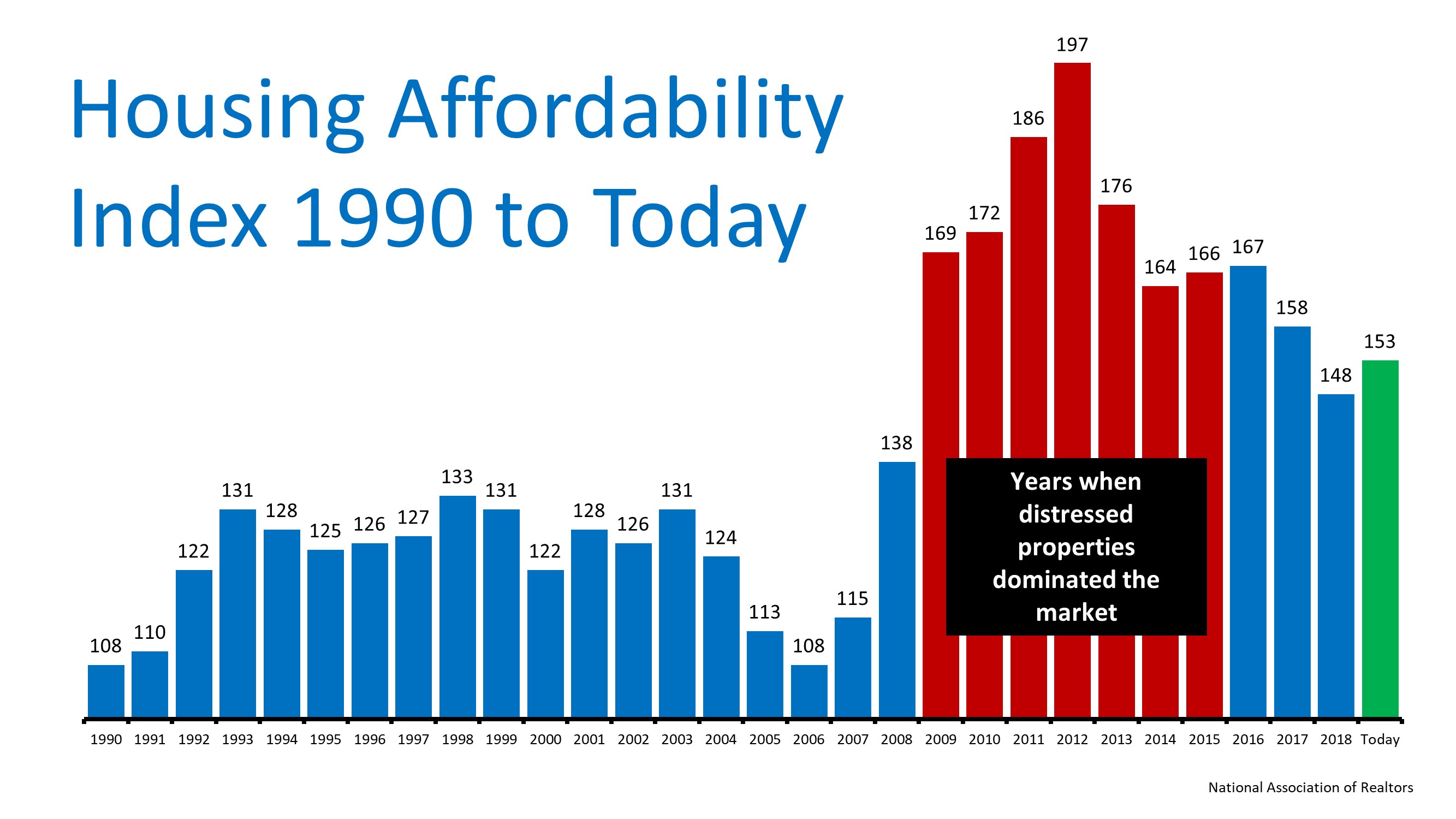

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

The Best Advice Does Not Mean Perfect Advice

The Best Advice Does Not Mean Perfect AdviceThe angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol...

What You Can Do to Keep Your Dream of Homeownership Moving Forward

What You Can Do to Keep Your Dream of Homeownership Moving ForwardSome Highlights:Don’t put your homeownership plans on hold just because you’re stuck inside.There are several things you can do right now to keep your home search moving forward.Connect with an agent,...

With so much changing in today’s market

Does the News have you Scared

Don’t Let Frightening Headlines Scare YouThere’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.Amidst all this anxiety, anyone with a...

According to the Salt Lake Board of Realtors®Salt Lake home sales year-to-date are roughly the same as they were last year at this time. While everyday life has changed, the current economic quarantine could be short-lived, according to Lawrence Yun, chief economist...

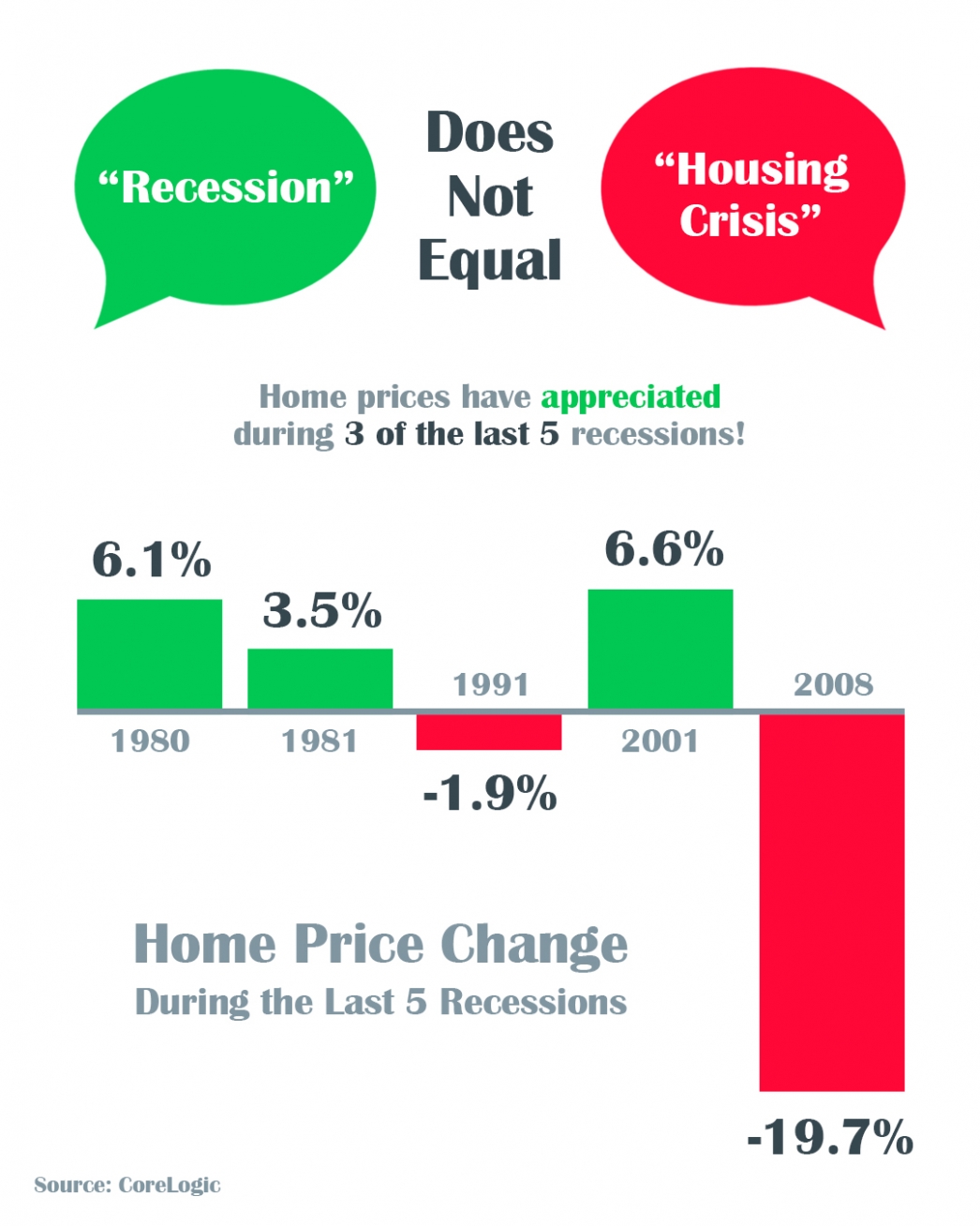

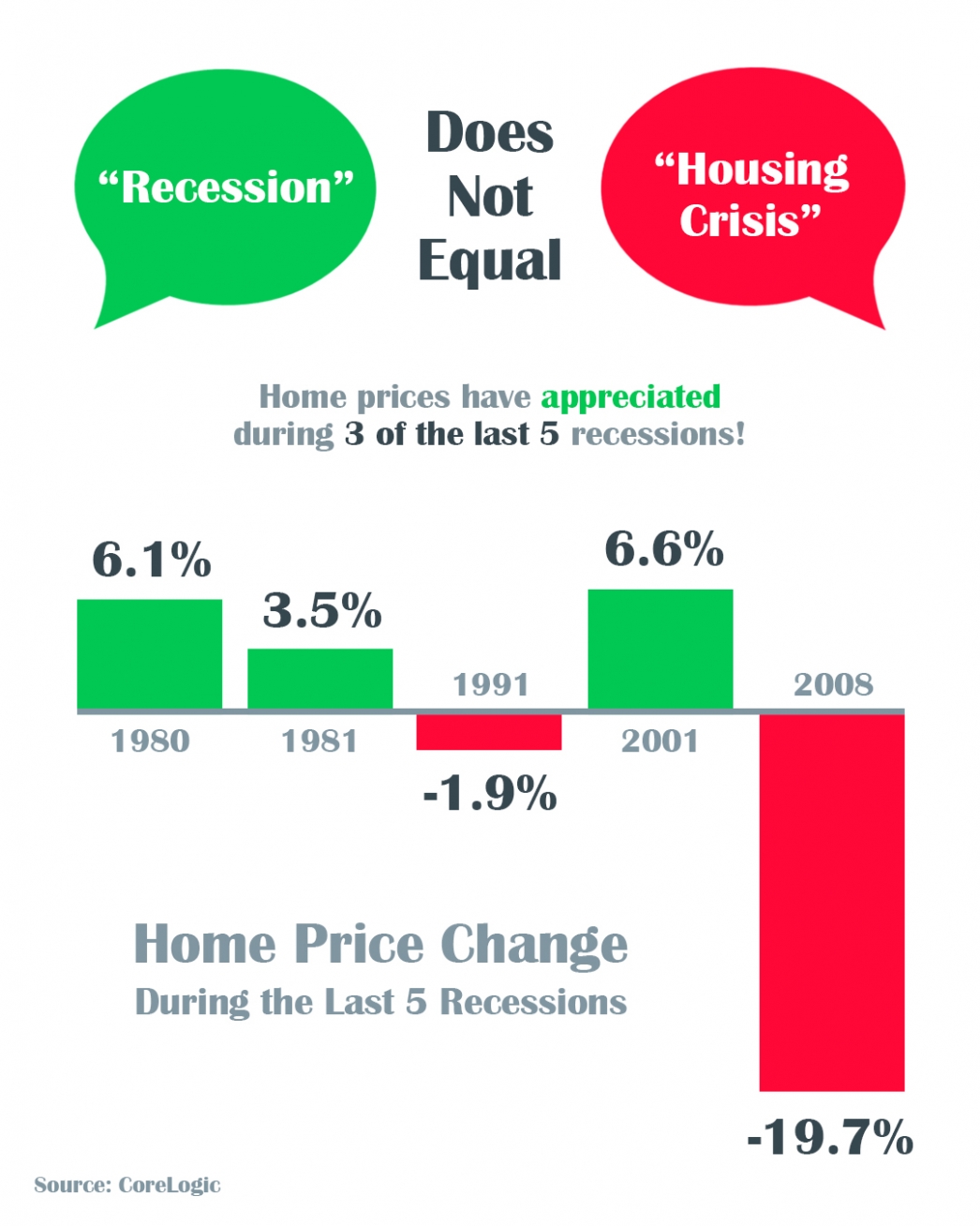

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Why the Stock Market Correction Probably Won’t Impact Home Values

Why the Stock Market Correction Probably Won’t Impact Home ValuesWith the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking...

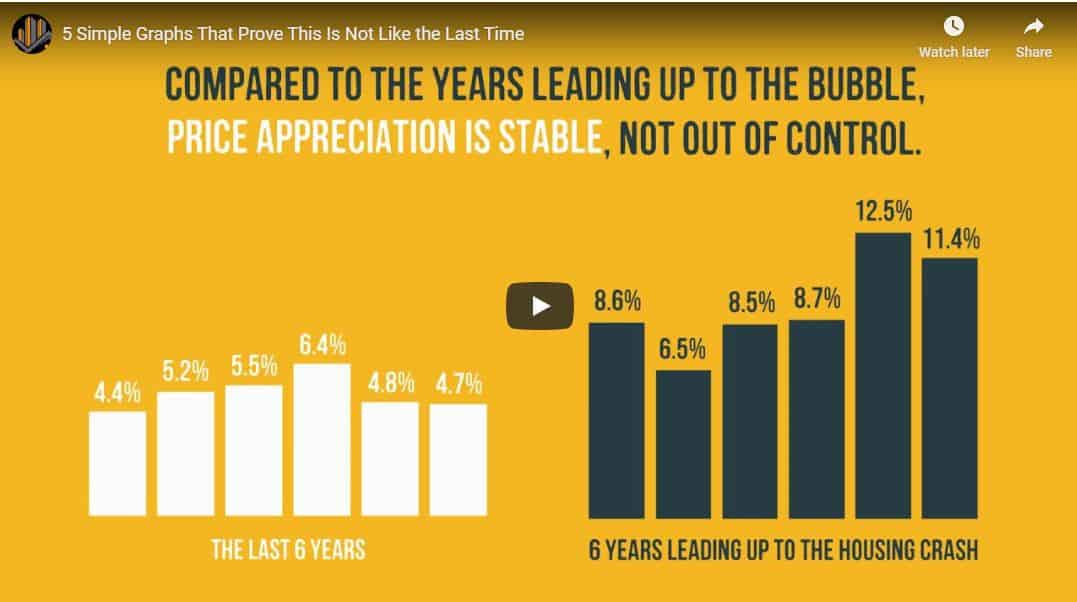

5 Simple Graphs That Prove This Is Not Like the Last Time

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map