Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

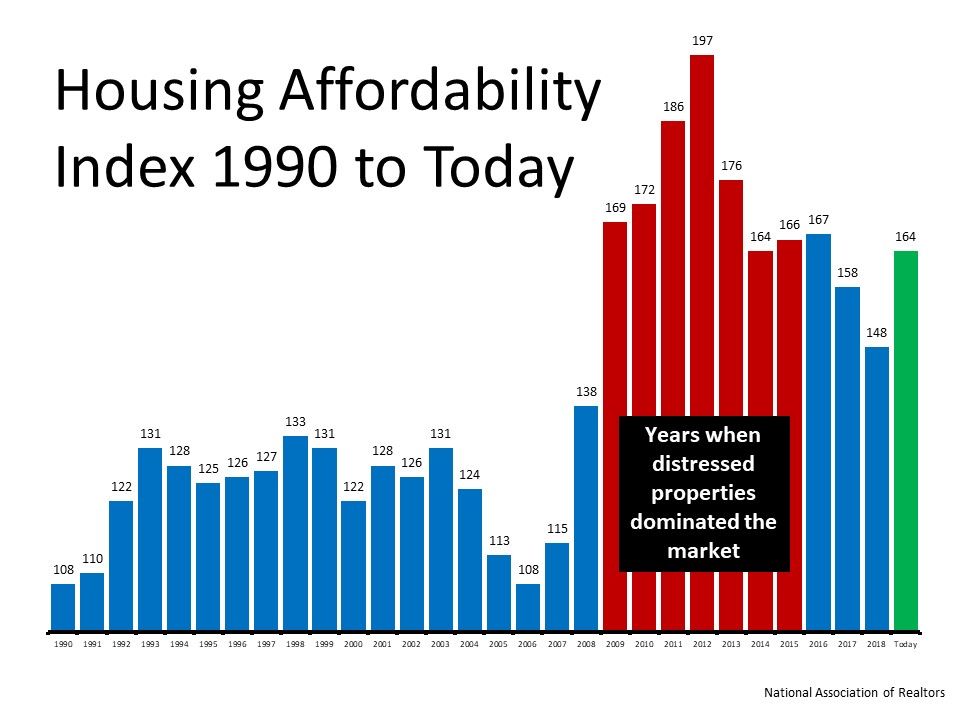

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

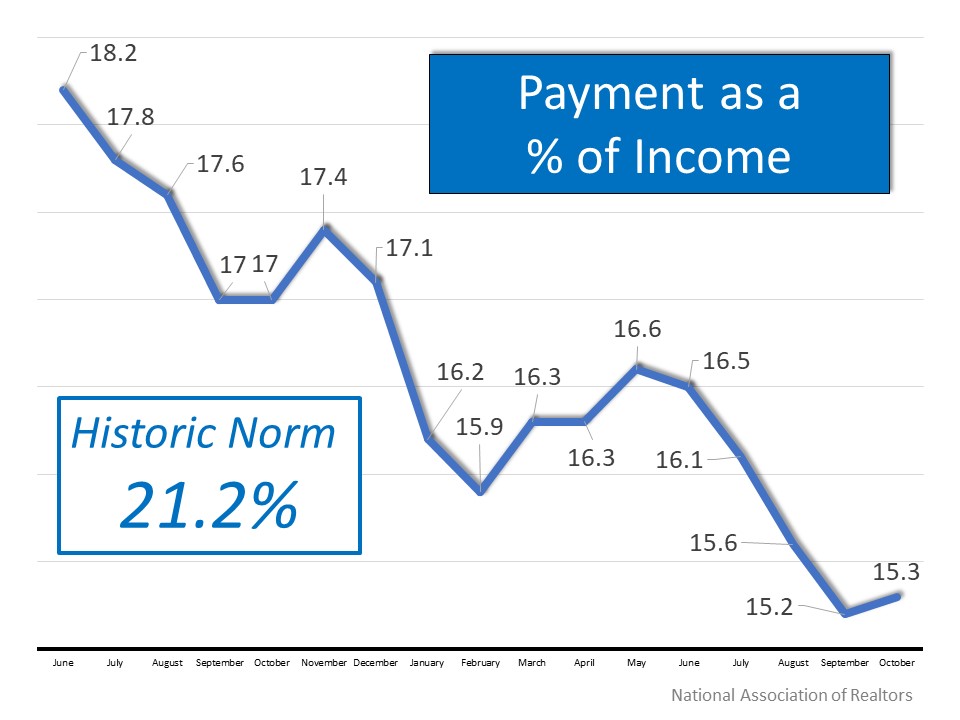

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Forget Tariffs! There’s a New Crisis Impacting Rate Cuts

The Fed held rates at 4.25–4.5%, ignoring Trump’s calls for aggressive cuts. Trump imposed steep tariffs, triggering fears of price hikes on goods and vehicles.

How to Know if a Home Fits Your Lifestyle?

Research local schools even if you don’t have kids — they influence home values. Consider internet availability and speed, especially for remote work or streaming needs.

Are Buyers Really Optimistic About Housing?

Over half of U.S. buyers feel the market is better than last year, showing cautious optimism. Seventy-five percent of buyers are waiting for lower prices and interest rates before purchasing homes.

Why You Should Move to Utah

Suburbs of Salt Lake City are booming with new homes. Low unemployment and tech sector growth fuel migration. Affordable pricing compared to West Coast states. Access to skiing, hiking, and national parks. Ideal for families seeking active, balanced lifestyles.

Is Utah Real Estate Finally Cooling Down?

Utah Real Estate prices remain high, but the pace of growth has clearly slowed in recent months. Median monthly mortgage payments in Utah have dropped, improving affordability for first-time homebuyers. Listings are up across Utah, giving buyers more options and...

Utah 2025: Buyers Gain From Balance

Rising listings in Salt Lake suburbs support choice and negotiation. Family-oriented neighborhoods showing long-term value potential.

Where are the most new homes being built in the U.S.? In Utah?

Utah ranks 4th nationally for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah's median home price remains high at $535,217. The Salt Lake City-Murray area ranked...

Utah ranks No. 4 for most new homes being built in the US

Utah ranks fourth in the U.S. for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah maintains one of the highest median home prices at $535,217. The Salt Lake City-Murray...

Global Vacation Rental Market Grows 5% CAGR by 2033

Global vacation rental market to grow from $92.61B in 2025 to $136.83B by 2033. 5% CAGR driven by tech, personalization, remote work trends, and flexible travel preferences.

The price has reduced for this Listing, check it out Listing Address: 614 W ANDERSON Murray, UT 84123

New Carpet! 4 Bedroom 2 Bath updated Murray home. Granite counters, multiple gathering spaces, hardwood floors, and a large yard. Conveniently located, close to freeway access, IMC, shopping, schools, and canyons.