Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

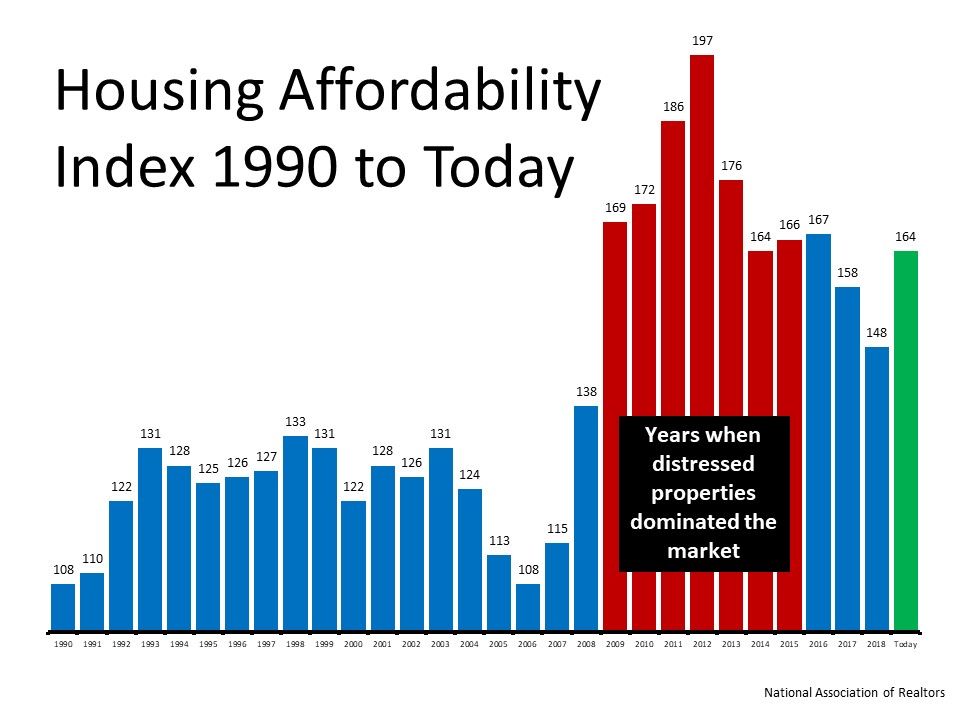

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

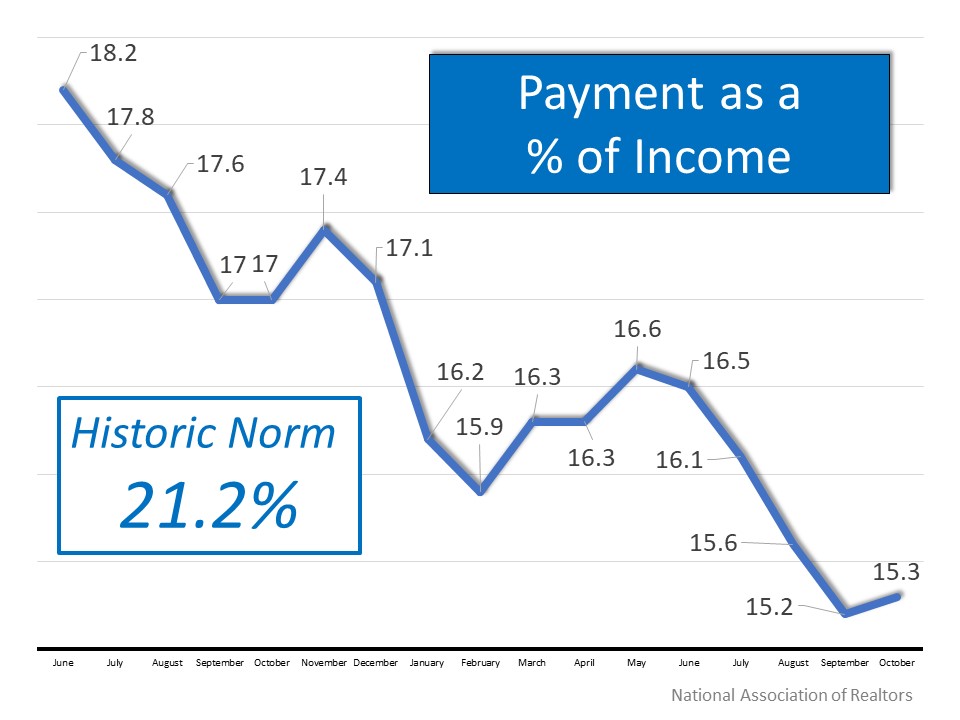

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Will Utah Home Values Appreciate or Depreciate in 2020?

Will Home Values Appreciate or Depreciate in 2020?With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined...

A Day When Americans Can Return to Work

A Day When Americans Can Return to WorkSome HighlightsTaking a moment to reflect upon what we’ve heard from historical leaders can teach us a lot about getting through the many challenges we face today.We're all eager for the day when every American can safely return...

Unemployment: Hope on the Horizon

Unemployment: Hope on the HorizonTomorrow, the unemployment rate for April 2020 will be released by the U.S. Bureau of Labor Statistics. It will hit a peak this country has never seen before, with data representing real families and lives affected by this economic...

Caremongering Spreads Goodness, Not Fear

Caremongering Spreads Goodness, Not Fear As news of Covid-19 started gearing up, Allison Bradley felt heartbroken when she spotted seniors running errands and grocery shopping around her town, Kelowna, B.C. “My goodness, you are risking so much by being out here. It’s...

Why Home Equity Is a Bright Spark in the Housing Market

Why Home Equity Is a Bright Spark in the Housing MarketGiven how we have seen more unemployment claims than ever before over the past several weeks, fear is spreading widely. Some good news, however, shows that more than 4 million initial unemployment filers have...

More Temporary Bumps in the Road to Recovery

We know there are bumps in the road when it comes to today’s economy and the housing market, and that’s to be expected under the current conditions. The good news is, experts are forecasting that home prices will continue to rise. DM me to discuss your plans in this...

Confused About the Economic Recovery? Here’s Why.

Confused About the Economic Recovery? Here’s Why.As we continue to work through the health crisis that plagues this country, more and more conversations are turning to economic recovery. While we look for signs that we’ve reached a plateau in cases of COVID-19, the...

U.S. Homeownership Rate Rises to Highest Point in 8 Years

U.S. Homeownership Rate Rises to Highest Point in 8 YearsFor nearly two months, most of us have been following strict stay-at-home orders from our state and local governments. It is a whole new way of life that has put our daily lives on pause. On the other hand, many...

The 3 Sciences That Are Driving Today’s Expert Economic Projections

Why the Housing Market Is a Powerful Economic Driver?

Why the Housing Market Is a Powerful Economic Driver?With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned...