Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

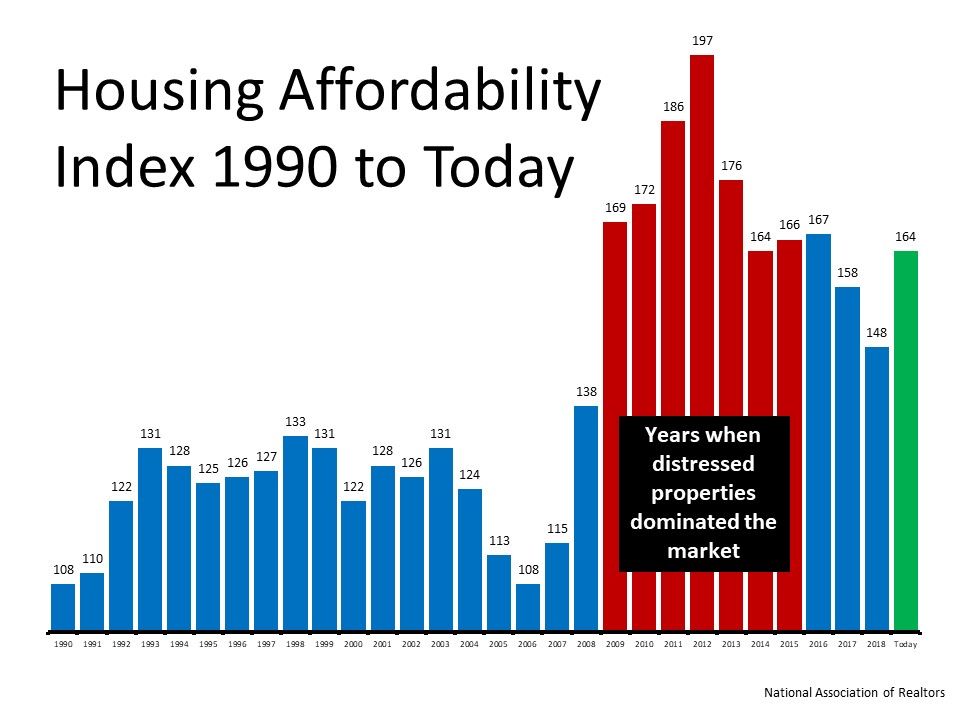

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

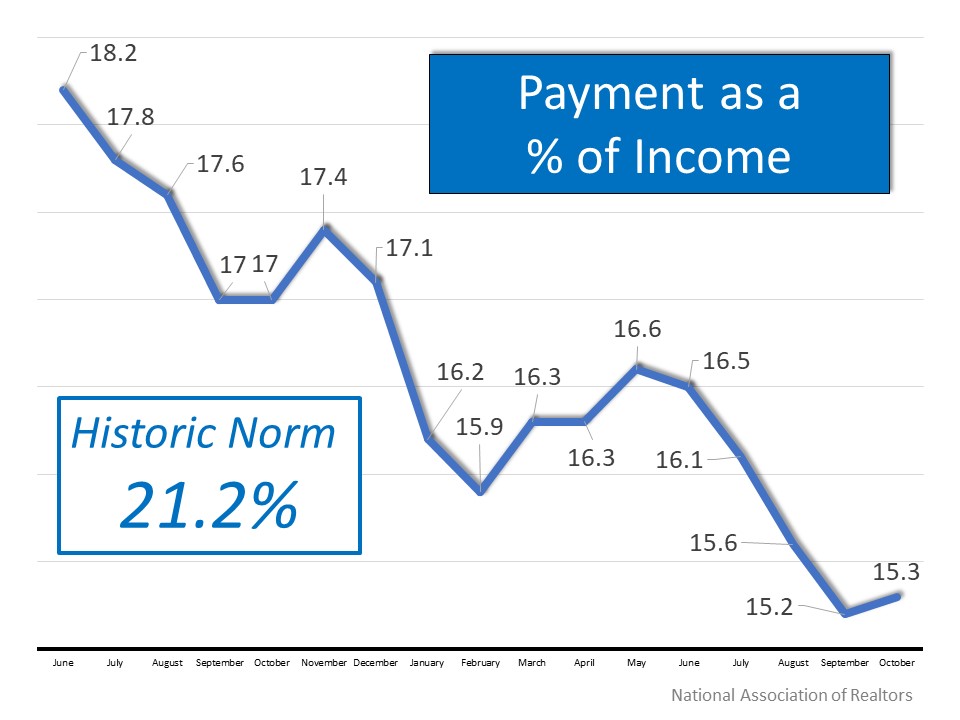

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

4 Simple Graphs Showing Why This Is Not a Housing Bubble

4 Simple Graphs Showing Why This Is Not a Housing Bubble A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However,...

What Every Seller Needs To Know About Renovating This Year

What Every Seller Needs To Know About Renovating This Year If you’re planning to sell this year, you’re probably thinking about what you’ll need to do to get your house ready to appeal to the most buyers. It’s crucial to work with a trusted real estate professional...

Pugs and Kisses

I know I look a lot younger in my photo! Wishing You The Best Valentines Ever!

Is This Your Year To Break Up with Renting?

Is This Your Year To Break Up with Renting? If you aren't in love with renting, you're not alone. Let's...

Want Top Dollar for Your House? Now’s the Time To List It.

Want Top Dollar for Your House? Now’s the Time To List It. When you’re selling any item, you usually want to sell it for the greatest profit possible. That happens when there’s a strong demand and a limited supply for that item. In the real estate market, that time is...

Wasatch Front Home Prices Soared

Median single-family home prices on the Wasatch Front soared in the fourth quarter. Home prices in the 10 most expensive Wasatch Front ZIP Codes now rival many other large U.S. cities. Alpine’s median price climbed to $1.3 million, a higher median price than Los...

Consumers Agree: It’s a Good Time To Sell

Consumers Agree: It’s a Good Time To Sell In today’s sellers’ market, many homeowners are weighing their options and trying to decide if they should sell their house. If you’re in that group, you may be balancing things like the ongoing health crisis, rising mortgage...

How Remote Work Impacts Your Home Search

How Remote Work Impacts Your Home Search Some Highlights If your workplace is delaying its return to office plans or is allowing permanent work from home options, that may open up new possibilities for your home search. Ongoing remote work could give you the chance...

Pre-Approval Gives You The Edge

Pre-approval gives you a competitive edge when you make an offer on a house. Let's connect so you're in the best position when you find your dream home. [video width="1920" height="1080"...

Sam and Lacie Diamond

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...