Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

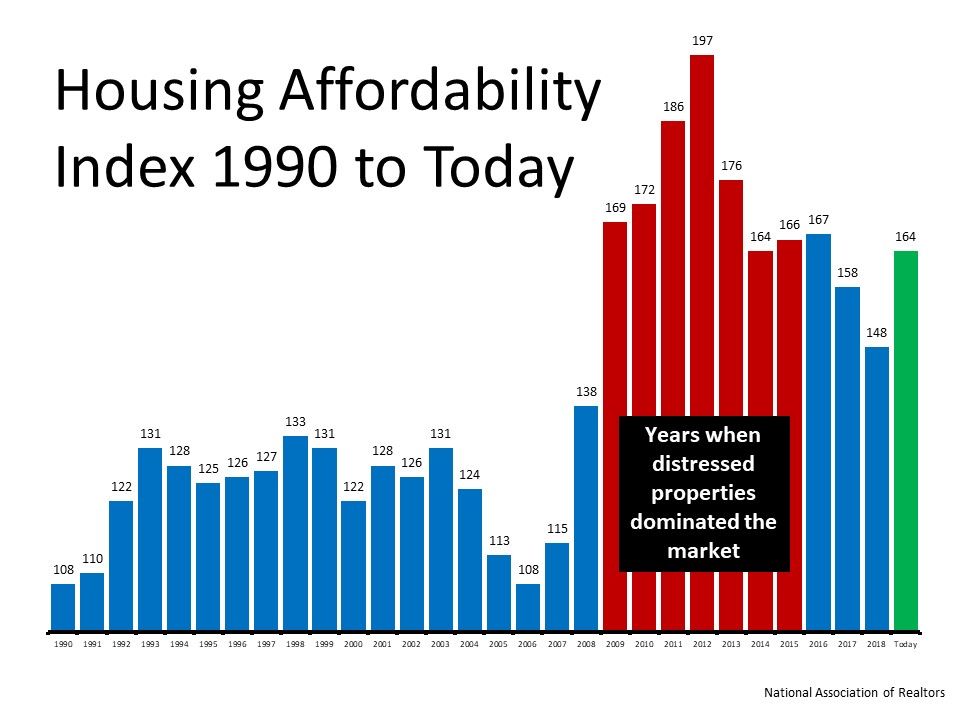

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

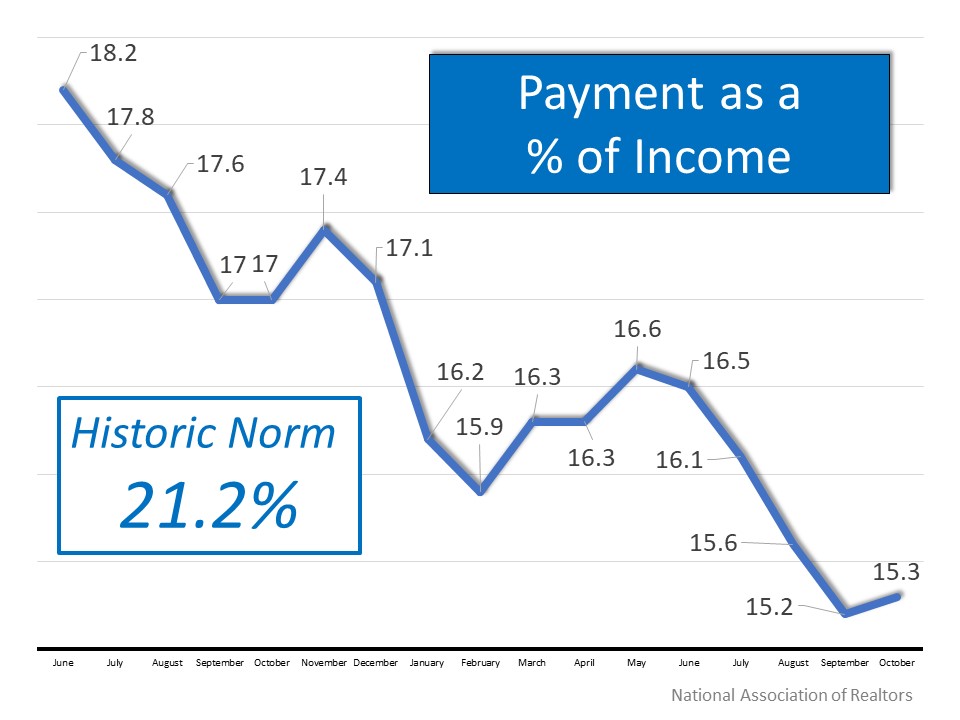

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

A Real Estate Agent Helps Take the Fear Out of the Market

A Real Estate Agent Helps Take the Fear Out of the Market Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should...

8 Great Quotes

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

7 Things Homebuyers Should Know Right Now

7 Things Homebuyers Should Know Right Now Navigating The Home Loan Process Amid Today's Sky-high Mortgage Rates Is Extremely Complicated—particularly For First-time Homebuyers. With mortgage rates soaring to unprecedented heights, it's crucial for homebuyers to...

The Perks of Selling Your House When Inventory Is Low

The Perks of Selling Your House When Inventory Is Low When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs as you plan your move. One thing that may be working in your favor is how few homes there are...

Why Home Prices Keep Going Up

Why Home Prices Keep Going Up If you've ever dreamed of buying your own place, or selling your current house to upgrade, you're no stranger to the rollercoaster of emotions changing home prices can stir up. It's a tale of financial goals, doubts, and a dash of anxiety...

Home Price Growth Is Returning to Normal

Home Price Growth Is Returning to Normal Some Highlights If you're wondering what’s happening with home prices, know they’re still rising, just at a slower pace – and that’s perfectly normal for this time of year. Based on typical seasonality in the market, prices go...

Are Higher Mortgage Rates Here To Stay?

Are Higher Mortgage Rates Here To Stay? Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over...

The Latest Expert Forecasts for Home Prices in 2023

The Latest Expert Forecasts for Home Prices in 2023 Are you thinking about making a move? If so, all the speculation that home prices would crash this year may have you feeling a bit on edge about your decision. Let the data and the experts reassure you. Prices aren’t...

Key Skills You Need Your Listing Agent To Have

Key Skills You Need Your Listing Agent To Have Selling your house is a big decision. And that can make it feel both exciting and a little bit nerve-wracking. But the key to a successful sale is finding the perfect listing agent to work with you throughout the process....

What’s in store for the Greater Salt Lake City housing market this fall?

Utah Realty has an exciting topic for our fall Season blog. As the leaves change colors and the temperatures start to cool, we find ourselves eagerly anticipating the shifts and trends that will shape the real estate landscape in one of Utah's most vibrant and...