Does “Aging in Place” Make the Most Sense?

A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means,

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

There is no doubt about it – there’s a comfort in staying in a home you’ve lived in for many years instead of moving to a totally new or unfamiliar environment. There is, however, new information that suggests this might not be the best option for everyone. The familiarity of your current home is the pro of aging in place, but the potential financial drawbacks to remodeling or renovating might actually be more costly than the long-term benefits.

A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults explained,

“Given their high homeownership rates, most older adults live in single-family homes. Of the 24 million homeowners age 65 and over, fully 80 percent lived in detached single-family units…The majority of these homes are now at least 40 years old and therefore may present maintenance challenges for their owners.”

If you’re in this spot, 40 years ago you may have had a growing family. For that reason, you probably purchased a 4-bedroom Colonial on a large piece of property in a child-friendly neighborhood. It was a great choice for your family, and you still love that home.

Today, your kids are likely grown and moved out, so you don’t need all of those bedrooms. Yard upkeep is probably very time consuming, too. You might be thinking about taking some equity out of your house and converting one of your bedrooms into a massive master bathroom, and maybe another room into an open-space reading nook. You might also be thinking about cutting back on lawn maintenance by installing a pool surrounded by beautiful paving stones.

It all sounds wonderful, doesn’t it? For the short term, you may really enjoy the new upgrades, but you’ll still have to climb those stairs, pay to heat and cool a home that’s larger than what you need, and continue fixing all the things that start to go wrong with a 40-year-old home.

Last month, in their Retirement Report, Kiplinger addressed the point,

“Renovations are just a part of what you need to make aging in place work for you. While it’s typically less expensive to remain in your home than to pay for assisted living, that doesn’t mean it’s a slam dunk to stay put. You’ll still have a long to-do list. Just one example: You need to plan ahead for how you will manage maintenance and care—for your home, and for yourself.”

So, at some point, the time may come when you decide to sell this house anyway. That can pose a big challenge if you’ve already taken cash value out of your home and used it to do the type of remodeling we mentioned above. Realistically, you may have inadvertently lowered the value of your home by doing things like reducing the number of bedrooms. The family moving into your neighborhood is probably similar to what your family was 40 years ago. They probably have young children, need the extra bedrooms, and may be nervous about the pool.

Bottom Line

Before you spend the money to remodel or renovate your current house so you can age in place, let’s get together to determine if it is truly your best option. Making a move to a smaller home in the neighborhood might make the most sense.

Gen Z Buyers – Directors Mortgage Quote

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly...

What’s Motivating Your Move?

Considering making a move? According to Realtor.com, profit potential and family priorities are the top motivators for homeowners right now.Let’s d What's Motivating Your Move? Thinking about selling your house? As you make your decision, consider what's pushing you...

Now’s a Great Time To Sell Your House

Now’s a Great Time To Sell Your House Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move. Here’s something else to consider. According to the latest Home...

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

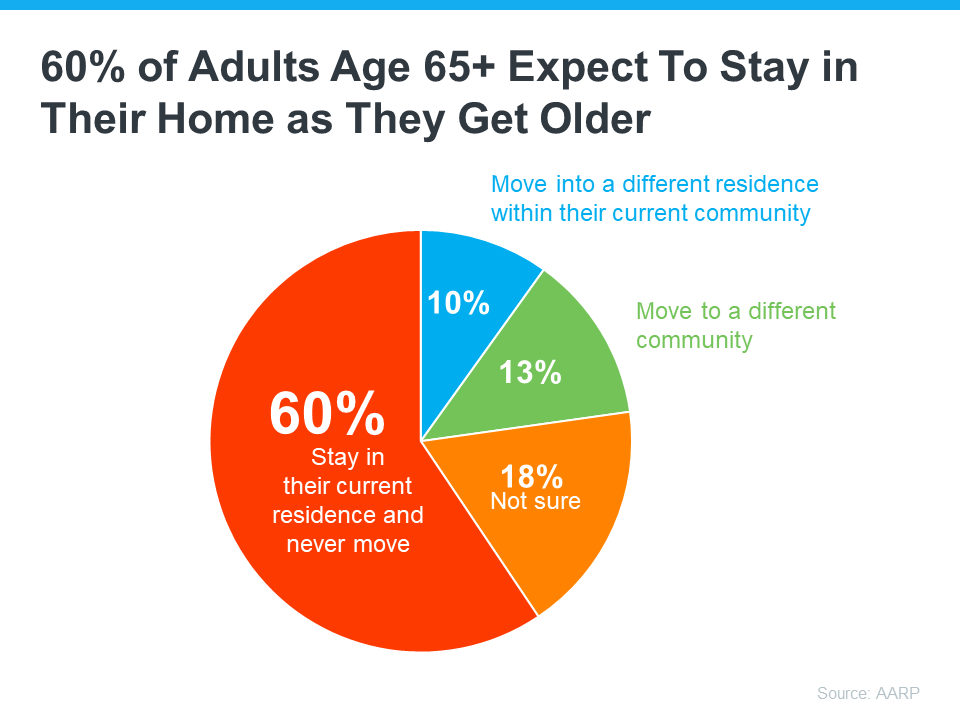

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...

Utah Licensed Real Estate Agents

In the past, we have had over 30,000 Active licenses. At the End of 2023 here is where we stand. Data is sourced from the Utah Division of Real Estate 22, 853 Active Licensees Sales Agent - 18,517 Principal Broker - 2442 Branch Broker - 171 Inactive - 4016 In...

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....