Hot Sellers Market is Cooling of as Fall Approaches

Stats are for April, May, and June of 2018

Secong Quarter of 2018 (April-June)

Secong Quarter of 2018 (April-June)

An article in Realtor Magazine.

The fall season is cooling down more than the temperature outside; it’s also putting a much-needed chill on hot housing markets, where home prices have become unaffordable to the average buyer. More than one in four home sellers dropped their asking price last month, according to a new report by real estate brokerage Redfin. With inventory starting to inch up, sellers are facing stiffer competition in the market and adjusting their price expectations, according to the report.

Nearly 27 percent of homes that were listed in the four weeks ending Sept. 16 saw a price drop, according to the report. Redfin defines a price drop as a reduction in the home’s value between 1 percent and 50 percent. The areas seeing some of the biggest price drops year over year are Las Vegas; San Jose, Calif.; Seattle; Atlanta.

“After years of strong price growth and intense competition for homes, buyers are taking advantage of the market’s easing pressure by being selective about which homes to make an offer on and how high to bid,” says Redfin Senior Economist Taylor Marr. “But there are some early signs of a softening market, and the increase in price drops may be another indicator that sellers are going to have trouble getting the prices—and the bidding wars—that they may have just months ago. Instead, many are finding their homes are sitting on the market without much interest until they start reducing their prices.”

Courtesy of Realtor Magazine

Utah Real Estate Housing Stats

Expert News on Mortgage Rates

What Do Experts Say About Today’s Mortgage Rates? Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison.Generally speaking, when rates are...

Auto DraftTime Is Money When It Comes to Your Home

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today's low mortgage rates. Let's connect to make sure you don't miss out.

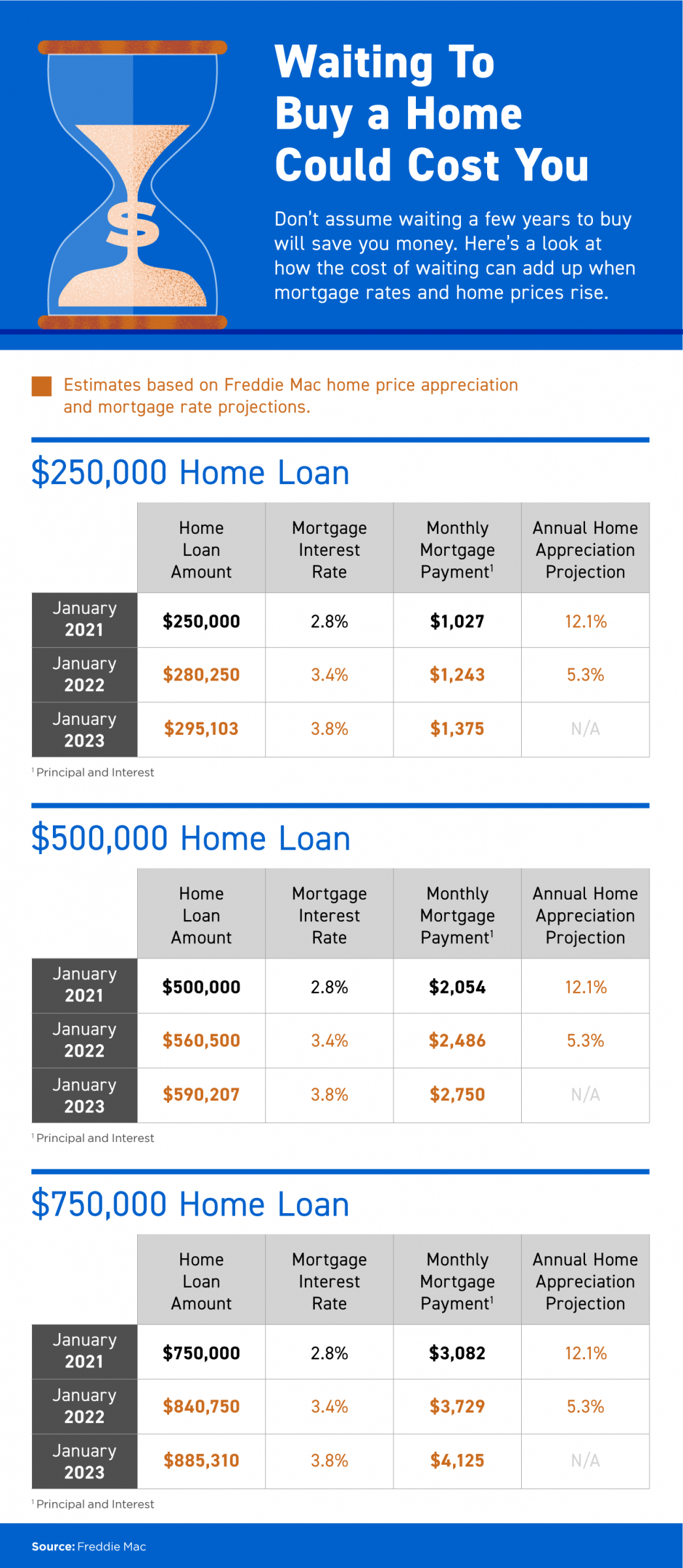

Important News! Buying a Home Could Cost You!

Waiting To Buy a Home Could Cost You Some Highlights If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again. The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise....

A Look at Home Price Appreciation Through 2025

A Look at Home Price Appreciation Through 2025 Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s...

Happy Independence Day

Happy Independence Day!Wishing you a happy and safe Independence Day.

What Do Experts See on the Horizon for the Second Half of the Year 2021?

What Do Experts See on the Horizon for the Second Half of the Year?As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off...

What To Expect as Appraisal Gaps Grow

What To Expect as Appraisal Gaps GrowIn today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association...

Save Time and Effort by Selling with the Right Agent

Save Time and Effort by Selling with the Right AgentSelling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations,...

Tips for Today’s Sellers

Tips for Today's Sellers Even in today's ultimate sellers' market, it's key to have an expert guide when you sell your house. Let's connect to optimize your home sale this summer.