Hot Sellers Market is Cooling of as Fall Approaches

Stats are for April, May, and June of 2018

Secong Quarter of 2018 (April-June)

Secong Quarter of 2018 (April-June)

An article in Realtor Magazine.

The fall season is cooling down more than the temperature outside; it’s also putting a much-needed chill on hot housing markets, where home prices have become unaffordable to the average buyer. More than one in four home sellers dropped their asking price last month, according to a new report by real estate brokerage Redfin. With inventory starting to inch up, sellers are facing stiffer competition in the market and adjusting their price expectations, according to the report.

Nearly 27 percent of homes that were listed in the four weeks ending Sept. 16 saw a price drop, according to the report. Redfin defines a price drop as a reduction in the home’s value between 1 percent and 50 percent. The areas seeing some of the biggest price drops year over year are Las Vegas; San Jose, Calif.; Seattle; Atlanta.

“After years of strong price growth and intense competition for homes, buyers are taking advantage of the market’s easing pressure by being selective about which homes to make an offer on and how high to bid,” says Redfin Senior Economist Taylor Marr. “But there are some early signs of a softening market, and the increase in price drops may be another indicator that sellers are going to have trouble getting the prices—and the bidding wars—that they may have just months ago. Instead, many are finding their homes are sitting on the market without much interest until they start reducing their prices.”

Courtesy of Realtor Magazine

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...

The Sun Is Shining on Sellers This Summer

The Sun Is Shining on Sellers This Summer Some Highlights If your needs have changed, now’s a great time to sell and get the features you want most. Many buyers are eager to move between the school years, so you may see a faster sale, multiple offers, a higher...

How Buying or Selling a Home Benefits Your Community

How Buying or Selling a Home Benefits Your Community If you're thinking of buying or selling a house, it's important to know it doesn't just impact you—it helps out the local economy and your community, too. Every year, the National Association of Realtors (NAR) puts...

Gen Z Buyers – Directors Mortgage Quote

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly...

What’s Motivating Your Move?

Considering making a move? According to Realtor.com, profit potential and family priorities are the top motivators for homeowners right now.Let’s d What's Motivating Your Move? Thinking about selling your house? As you make your decision, consider what's pushing you...

Now’s a Great Time To Sell Your House

Now’s a Great Time To Sell Your House Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move. Here’s something else to consider. According to the latest Home...

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

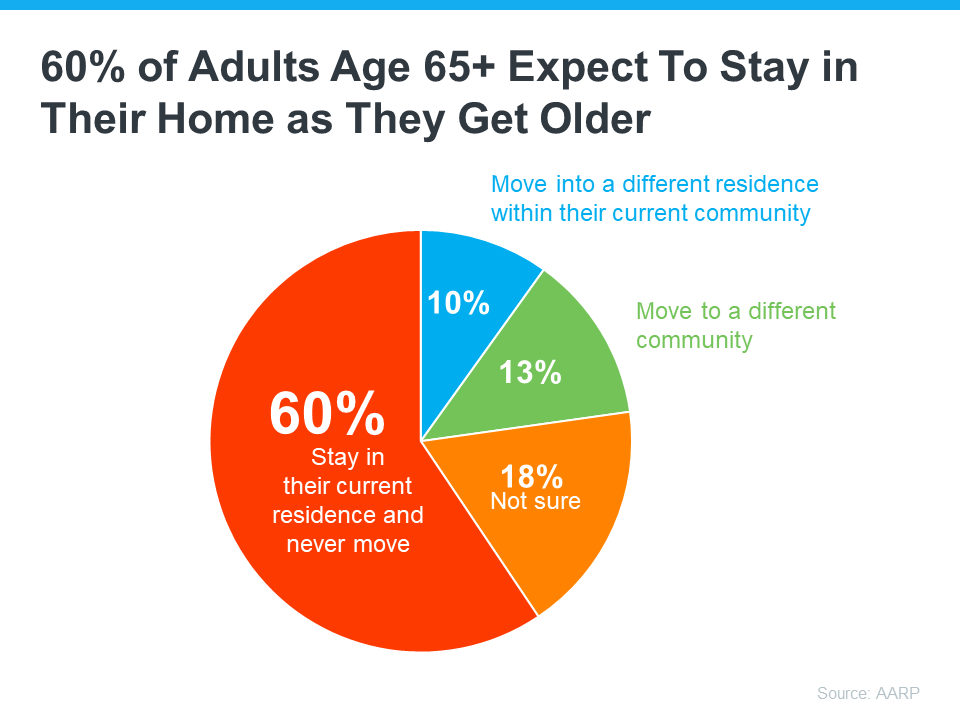

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...