Buying a Home Early Can Significantly Increase Future Wealth

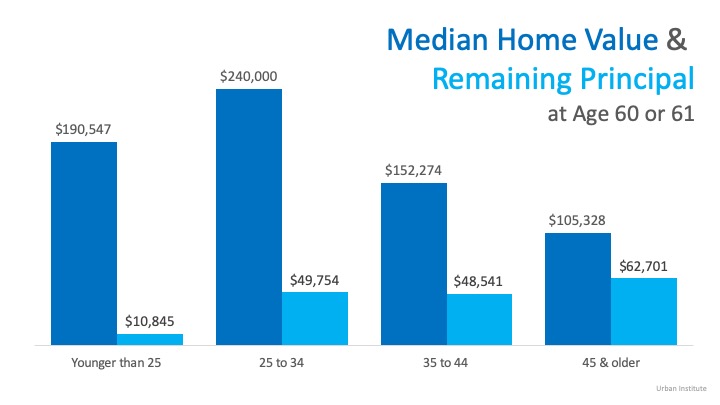

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

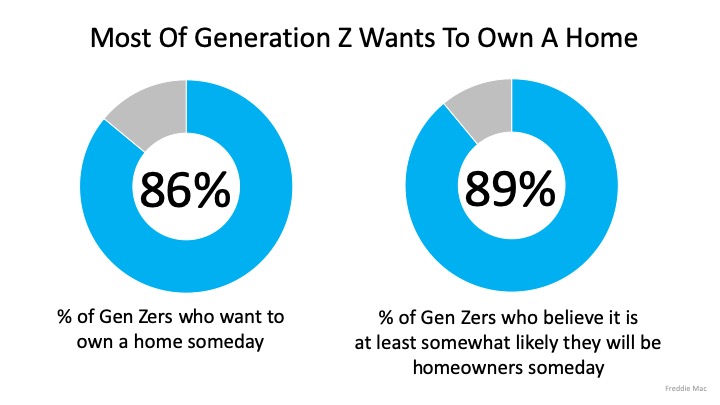

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

VA Loans Can Help Veterans Achieve Their Dream of Homeownership

VA Loans Can Help Veterans Achieve Their Dream of Homeownership For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand...

What’s Ahead for Mortgage Rates and Home Prices?

Utah Realty Blog & News The Latest news for Real Estate both local and National. Buyers Sellers SeniorsWhat’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next...

The Majority of Americans Still View Homeownership as the American Dream

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view...

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s...

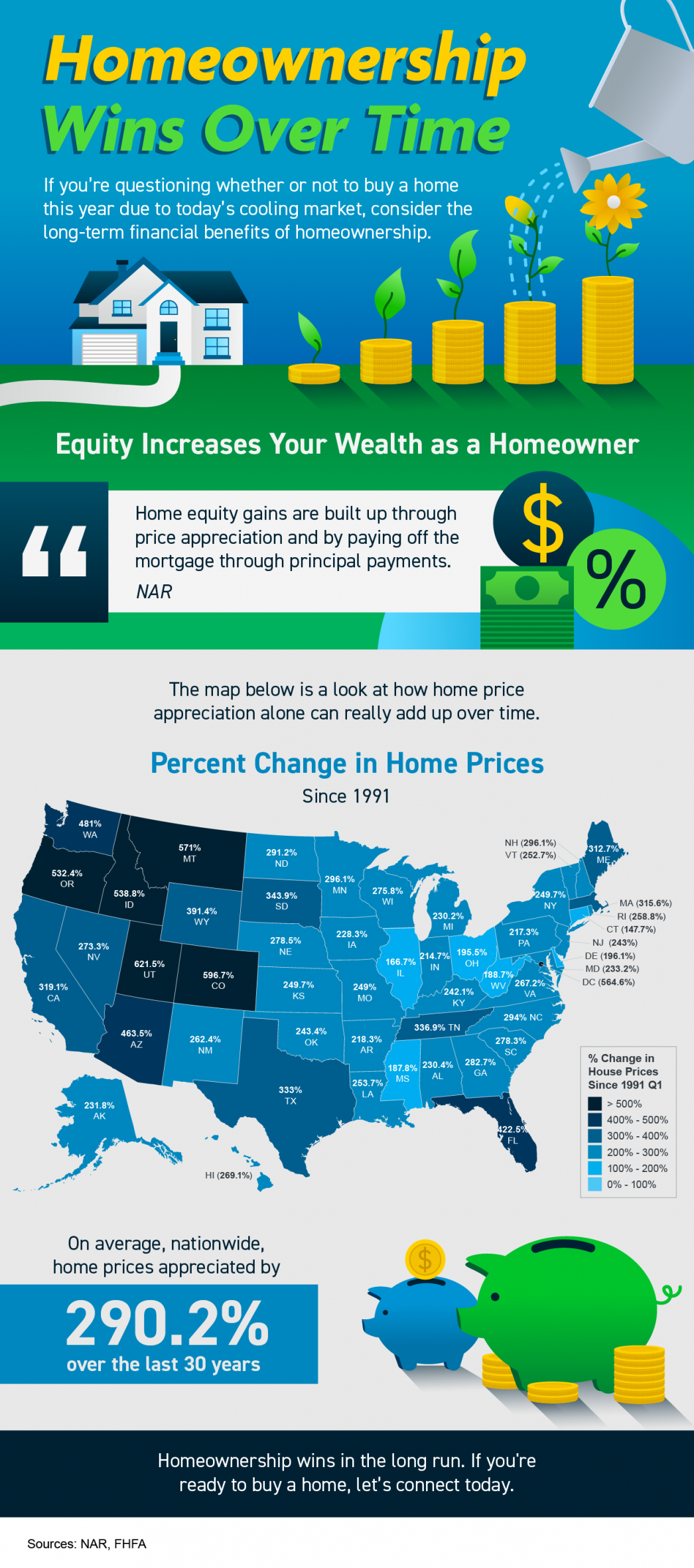

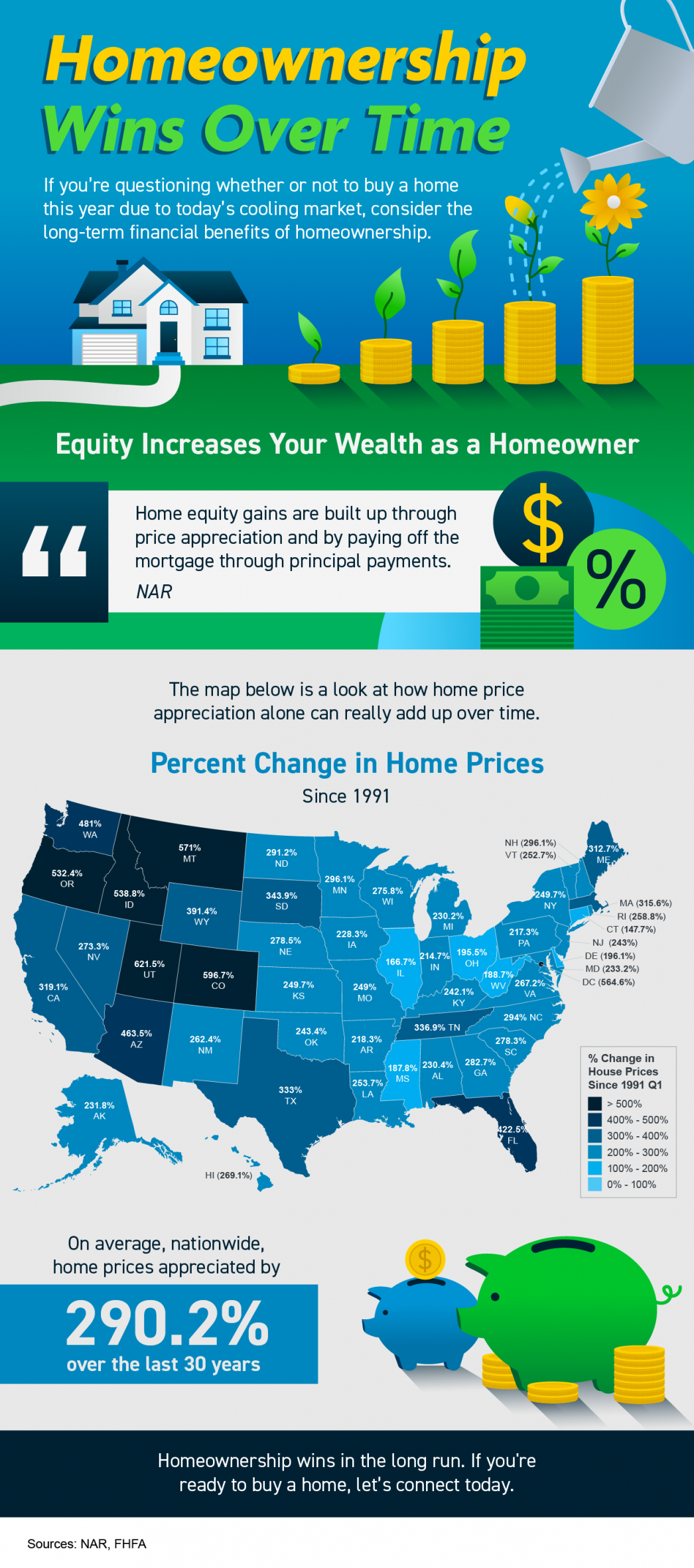

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

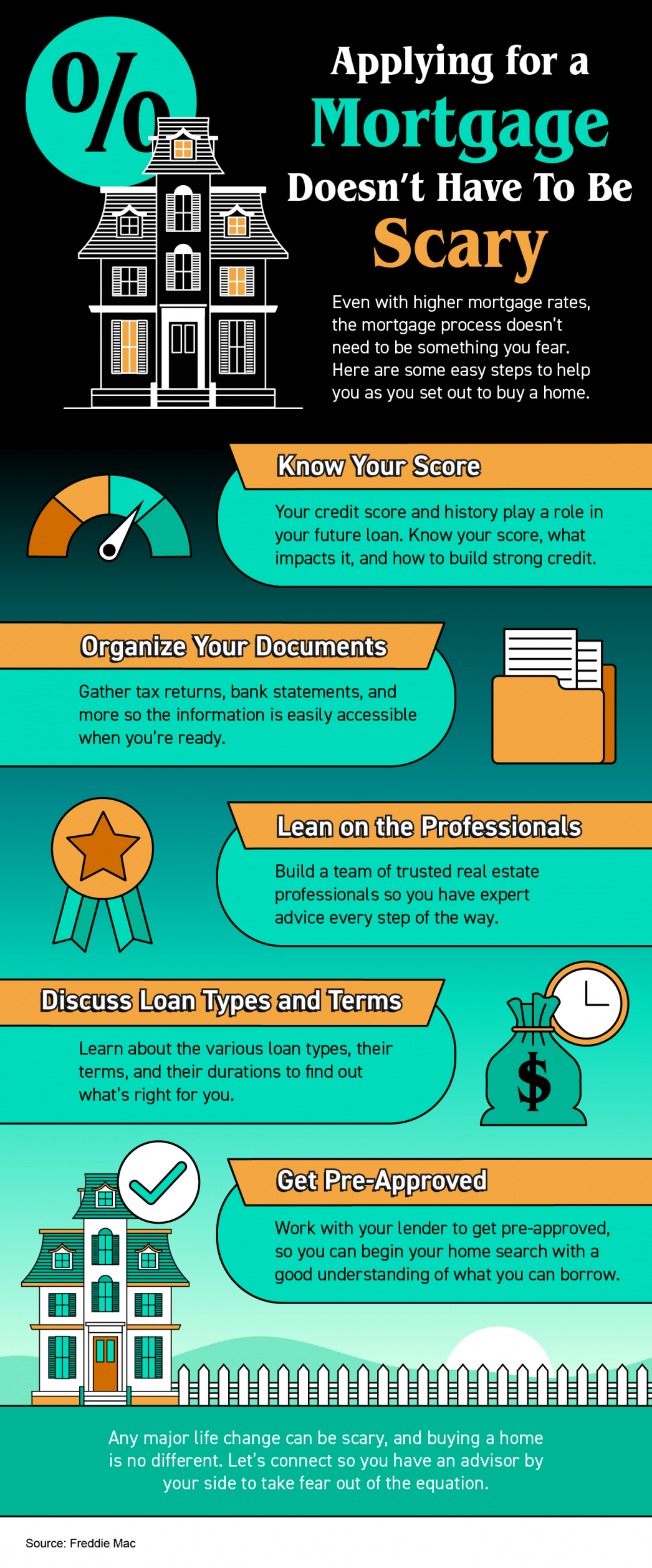

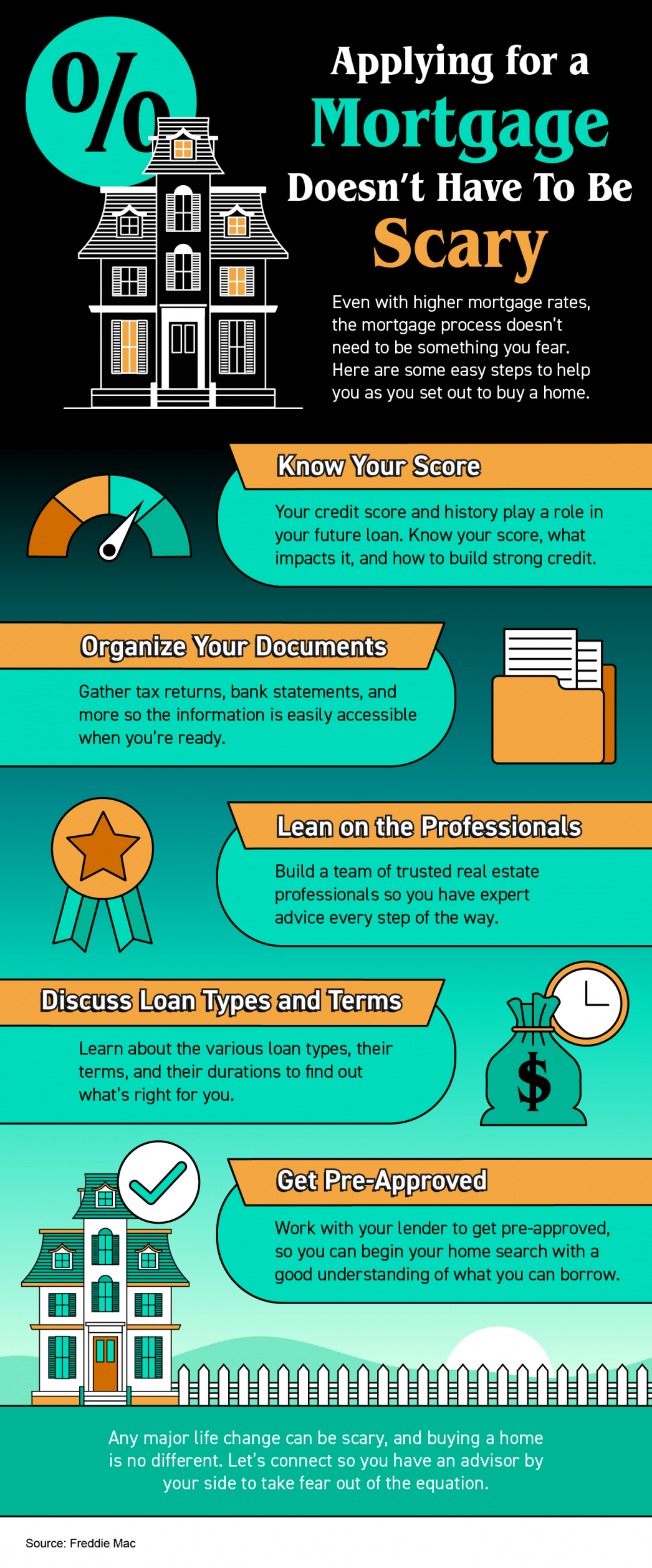

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

VA Loans Can Help Veterans Achieve Their Dream of Homeownership

VA Loans Can Help Veterans Achieve Their Dream of Homeownership For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand...

What’s Ahead for Mortgage Rates and Home Prices?

Utah Realty Blog & News The Latest news for Real Estate both local and National. Buyers Sellers SeniorsWhat’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next...

The Majority of Americans Still View Homeownership as the American Dream

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view...

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s...

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

[mlcalc default=”mortgage_only”]