Buyer Demand Surging in Utah as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

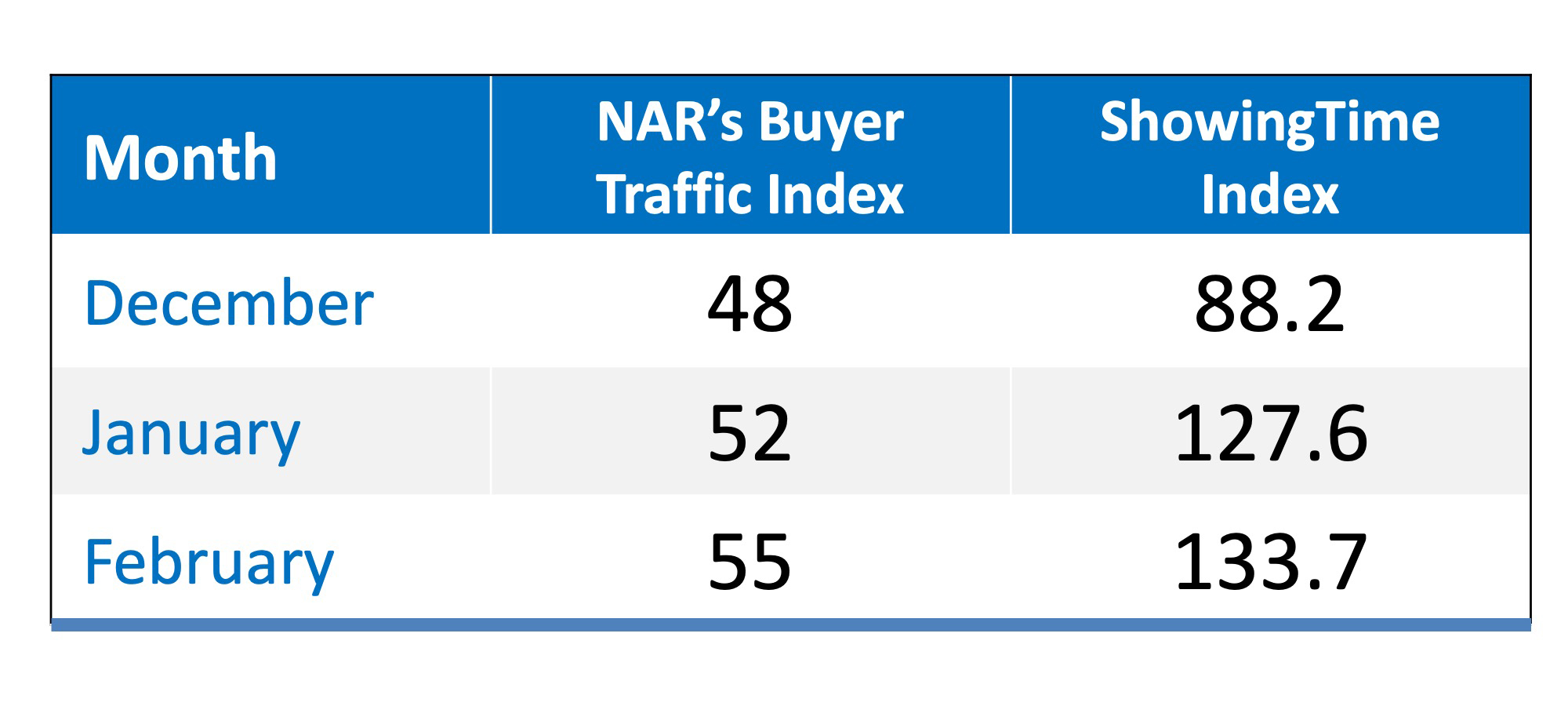

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

*The methodology behind the indices:

The ShowingTime Showing Index

“The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.”

The National Association of REALTORS® Buyer Traffic Index

“In a monthly survey of REALTORS®, NAR asks respondents ‘Compared to the same month last year, how would you rate the past month’s traffic in neighborhood(s) or area(s) where you make most of your sales?’ NAR compiles the responses into an index, where an index above 50 indicates that more respondents reported “stronger” traffic than “weaker” traffic.”

Beginning with Pre-Approval

Beginning with Pre-Approval If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and...

The Many Non-Financial Benefits of Homeownership

The Many Non-Financial Benefits of Homeownership Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it's essential to think about the non-financial benefits that make a home more than just a...

Remote Work Is Changing How Some Buyers Search for Their Dream Homes

Remote Work Is Changing How Some Buyers Search for Their Dream Homes The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it’ll continue to be popular for years to come and project that 36.2 million...

What is Housing going to do this fall in Salt Lake County?

Housing is always a hot topic in Utah and the anticipated Fall housing market in Salt Lake County. As seasons change, so do the dynamics of real estate, and we are here to provide you with an insightful glimpse into what can be expected in this vibrant and dynamic...

Plenty of Buyers Are Still Active Today

Plenty of Buyers Are Still Active Today Some Highlights Holding off on selling your house because you believe there aren’t any buyers out there? Data shows buyers are still active, even with higher mortgage rates. This goes to show, people still want to buy homes, and...

Should Baby Boomers Buy or Rent After Selling Their Houses?

Should Baby Boomers Buy or Rent After Selling Their Houses? Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different...

Today’s Housing Market Has Only Half the Usual Inventory

Today’s Housing Market Has Only Half the Usual Inventory Some Highlights There are only about half the number of homes for sale compared to the last normal years in the market. That means buyers don’t have enough options right now. So, if you work with an agent to...

Why You Need a True Expert in Today’s Housing Market

Why You Need a True Expert in Today’s Housing Market The housing market continues to shift and change, and in a fast-moving landscape like we’re in right now, it’s more important than ever to have a trusted real estate agent on your side. Whether you’re buying your...

How To Get Property Tax Relief In Salt Lake County. Elderly Or Low Income

How To Get Property Tax Relief In Salt Lake County. Elderly Or Low Income Navigating through the maze of property taxes can be a daunting task, particularly for the elderly or those with low incomes. However, in Salt Lake County, there are several options available to...

People Want Less Expensive Homes – And Builders Are Responding

People Want Less Expensive Homes – And Builders Are Responding In today’s housing market, there are two main affordability challenges impacting buyers: mortgage rates that are higher than they’ve been the past couple of years, and rising home prices caused by low...