3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

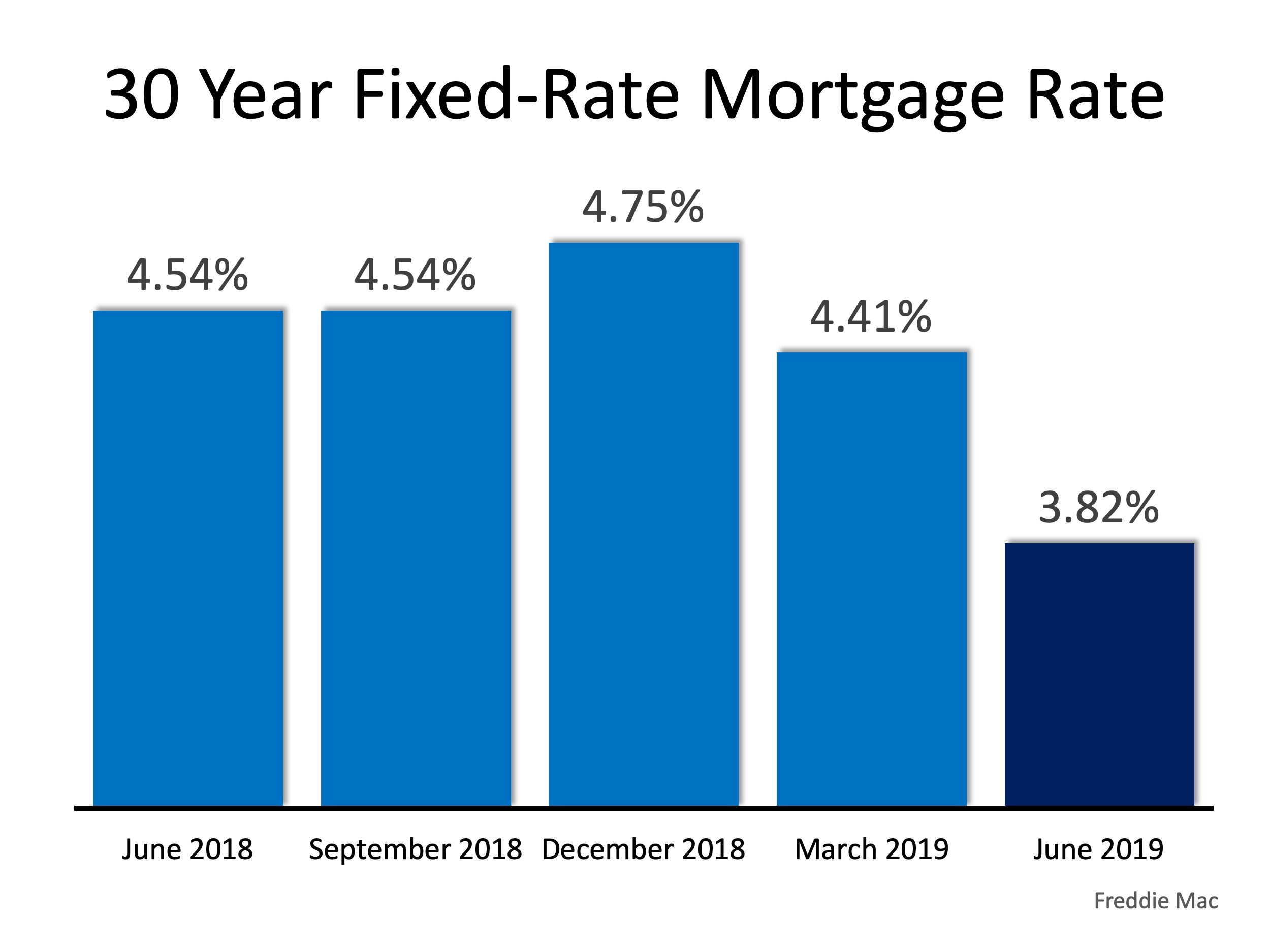

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

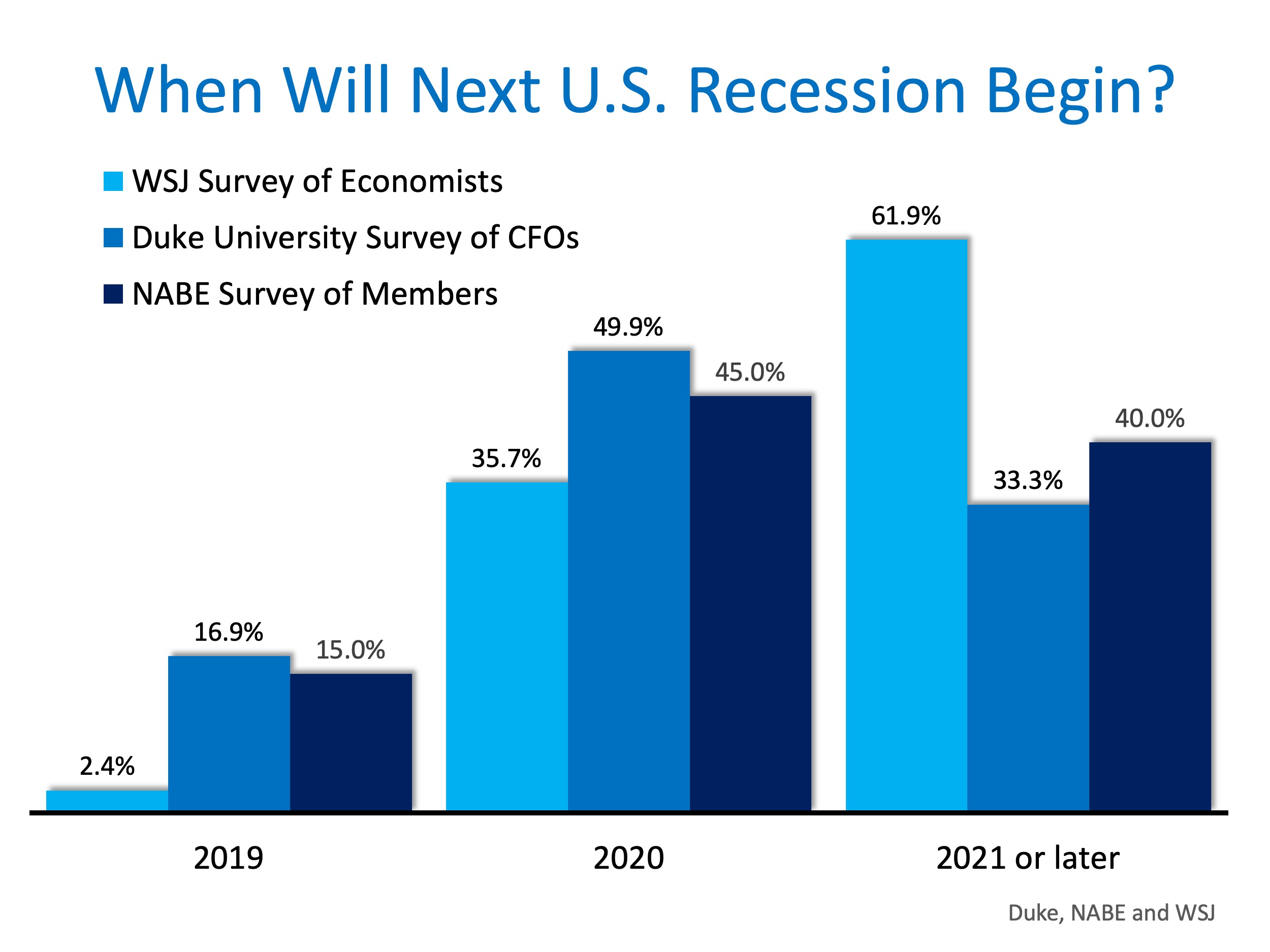

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Reasons You Should Consider Selling This Fall

Reasons You Should Consider Selling This Fall If you're trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers' market we're in today won't last forever. If you’re thinking of making a move, here are four...

5 Reasons Today’s Housing Market Is Anything but Normal

5 Reasons Today’s Housing Market Is Anything but Normal There are many headlines out there that claim we’re reverting to a more normal real estate market. That would indicate the housing market is returning to the pre-pandemic numbers we saw from 2015-2019. But that’s...

smart home and what it means for homeowners today

Compared to this time last year, selling your house is twice as nice. Let’s connect so we can strike while the iron’s hot.

Compared to this time last year, selling your house is twice as nice. Let's connect so we can strike while the iron's hot.

Free Checklist to Get Ready to Sell Your Home

Your Checklist To Get Ready To Sell Some Highlights When it comes to selling your house, you want it to look its best inside and out. It’s important to focus on tasks that can make it inviting, show it’s cared for, and boost your curb appeal for prospective buyers....

Why 2021 Is Still the Year To Sell Your House

Why 2021 Is Still the Year To Sell Your House If you’re trying to decide whether or not to sell your house, this is the time to think seriously about making a move. Fannie Mae’s recent Home Purchase Sentiment Index (HPSI) reveals the number of respondents who say it’s...

What To Do with Your Vacation Home as Summer Ends

What To Do with Your Vacation Home as Summer Ends As summer comes to a close, is it time to think about selling your vacation home? Based on recent data and expert opinions, it’s something you may want to consider. According to research from the National Association...

Utah Real Estate Housing Stats

Expert News on Mortgage Rates

What Do Experts Say About Today’s Mortgage Rates? Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison.Generally speaking, when rates are...

Auto DraftTime Is Money When It Comes to Your Home

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today's low mortgage rates. Let's connect to make sure you don't miss out.