7 Reasons to List Your House This Holiday Season

Around this time each year, many homeowners decide to wait until after the holidays to list their houses. Similarly, others who already have their homes on the market remove their listings until the spring. Let’s unpack the top reasons why listing your house now or keeping it on the market this winter may be the best choice you can make.

Here are seven great reasons not to wait:

- Relocation buyers are out there now. Many companies are still hiring throughout the holidays, and they need their new employees to start as soon as possible.

- Purchasers who are looking for homes during the holidays are serious buyers and are ready to buy now.

- You can restrict the showings on your home to days and times that are most convenient for you. You will remain in control.

- Homes show better when decorated for the holidays.

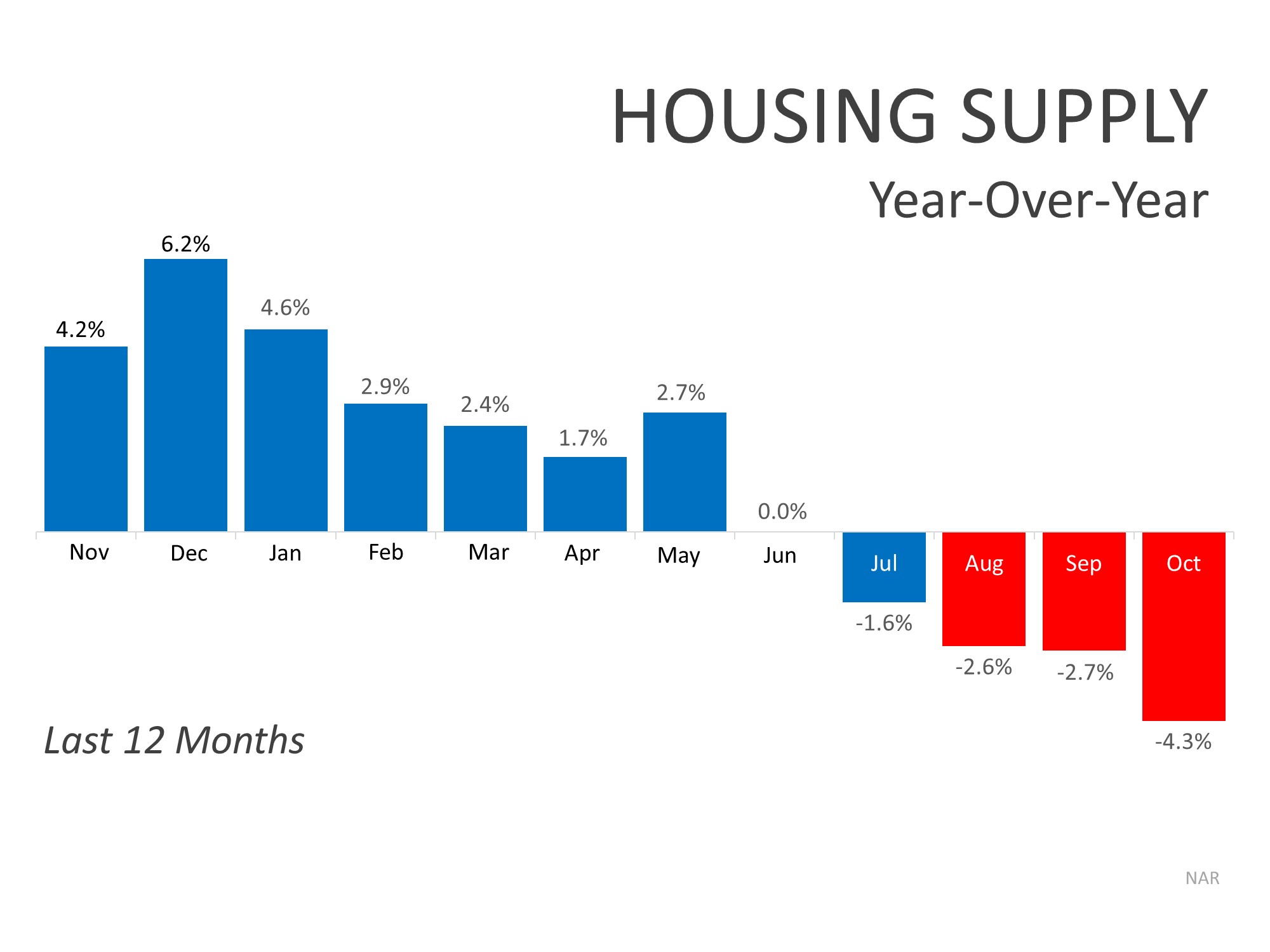

- There is minimal competition for you as a seller right now. Over the past few months we’ve seen the supply of homes for sale decreasing year-over-year, as shown in the graph below:

- The desire to own a home doesn’t stop during the holidays. Buyers who were unable to find their dream homes during the busy spring and summer months are still searching, and your home may be the answer.

- Late fall and early winter make up the “sweet spot” for sellers. The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge and reach new heights in 2020, which will lessen the demand for your house next year.

Bottom Line

It may make the most sense to list your home this holiday season. Let’s get together to determine if selling now is your best move.

Do New Roofs Save Money and Energy?

Impact-resistant shingles and metal roofs extend roof life while safeguarding against costly storm damage. Solar-compatible roofs allow easier renewable energy adoption, even for homeowners not installing panels yet. Cool roofing systems lower household cooling bills...

Smart Steps to Buy Your First Home

Start with patience, flexibility, and assembling a trustworthy Real Estate team from day one. Work with a reliable realtor to avoid rushed or financially risky buying decisions. Compare lenders to find strong pre-approval options, like a pre-underwritten mortgage....

Steps to Take Between Mortgage Closing and Moving Day

After closing on your mortgage, follow this checklist to prepare for moving into your new home. Change your address with the Post Office and update utilities. Review your inspection report for necessary repairs and create a maintenance schedule. Deep clean your new...

Guide for First-Time Homebuyers

Buying your first house can be both exciting and overwhelming. Resources are available to empower you with the knowledge needed for homeownership. You can save up to $1,250, and if you find lower costs elsewhere, there are incentives. Local experts are available to...

Housing Market Predictions 2025

In 2025, the housing market shows slow stabilization with mortgage rates declining from near 7%, boosting buyer interest. Home sales remain sluggish but may rise 6% by year-end, while prices continue modest growth due to limited supply. Inventory has increased,...

What Mortgage Rate Will Get Buyers Moving?

A 6% mortgage rate could make homes affordable for 5.5 million more households, potentially unlocking major buying activity across key U.S. metro areas. NAR forecasts rates falling to 6% by 2026, possibly increasing home sales 14%. Current high rates and inventory...

Homeowner Equity Grows Even as Home Prices Dip

After 3 quarters of slipping, equity-rich homes finally ticked up in Q2 2025. ~50% of U.S. homes with mortgages are now equity-rich. Equity-rich = owing less than 50% of your home’s value. In just one quarter, equity-rich homes jumped from 46.2% to 47.4% nationwide....

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...