3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

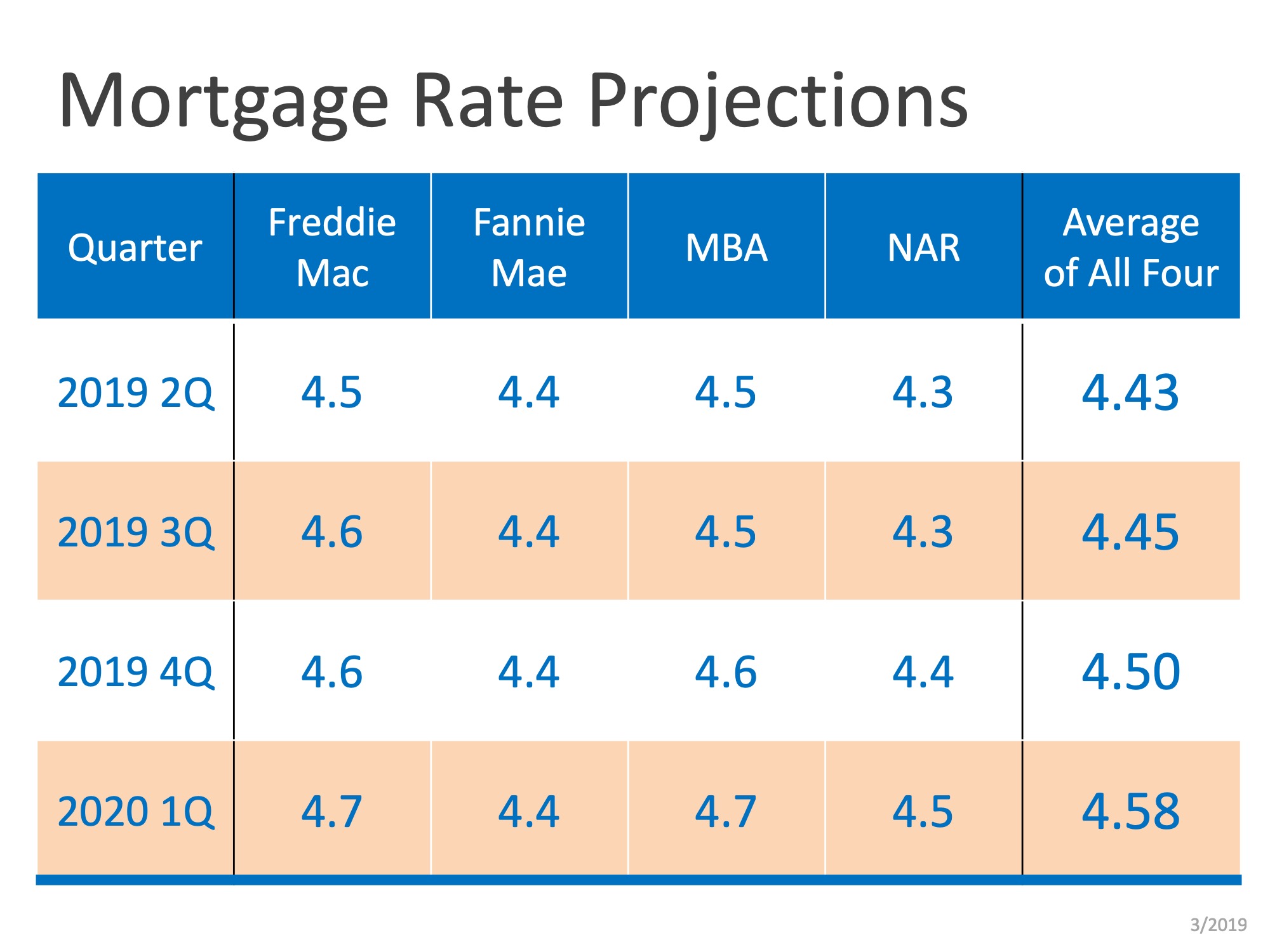

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

Forget Tariffs! There’s a New Crisis Impacting Rate Cuts

The Fed held rates at 4.25–4.5%, ignoring Trump’s calls for aggressive cuts. Trump imposed steep tariffs, triggering fears of price hikes on goods and vehicles.

How to Know if a Home Fits Your Lifestyle?

Research local schools even if you don’t have kids — they influence home values. Consider internet availability and speed, especially for remote work or streaming needs.

Are Buyers Really Optimistic About Housing?

Over half of U.S. buyers feel the market is better than last year, showing cautious optimism. Seventy-five percent of buyers are waiting for lower prices and interest rates before purchasing homes.

Why You Should Move to Utah

Suburbs of Salt Lake City are booming with new homes. Low unemployment and tech sector growth fuel migration. Affordable pricing compared to West Coast states. Access to skiing, hiking, and national parks. Ideal for families seeking active, balanced lifestyles.

Is Utah Real Estate Finally Cooling Down?

Utah Real Estate prices remain high, but the pace of growth has clearly slowed in recent months. Median monthly mortgage payments in Utah have dropped, improving affordability for first-time homebuyers. Listings are up across Utah, giving buyers more options and...

Utah 2025: Buyers Gain From Balance

Rising listings in Salt Lake suburbs support choice and negotiation. Family-oriented neighborhoods showing long-term value potential.

Where are the most new homes being built in the U.S.? In Utah?

Utah ranks 4th nationally for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah's median home price remains high at $535,217. The Salt Lake City-Murray area ranked...

Utah ranks No. 4 for most new homes being built in the US

Utah ranks fourth in the U.S. for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah maintains one of the highest median home prices at $535,217. The Salt Lake City-Murray...

Global Vacation Rental Market Grows 5% CAGR by 2033

Global vacation rental market to grow from $92.61B in 2025 to $136.83B by 2033. 5% CAGR driven by tech, personalization, remote work trends, and flexible travel preferences.

The price has reduced for this Listing, check it out Listing Address: 614 W ANDERSON Murray, UT 84123

New Carpet! 4 Bedroom 2 Bath updated Murray home. Granite counters, multiple gathering spaces, hardwood floors, and a large yard. Conveniently located, close to freeway access, IMC, shopping, schools, and canyons.