2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Top Markets for Office Development in the West

In 2024, the office sector saw significant changes with high vacancy rates and minimal increases in office utilization. Nationally, office space under construction decreased to 57.8 million square feet, down by 39 million from 2023. In the Western U.S., the office...

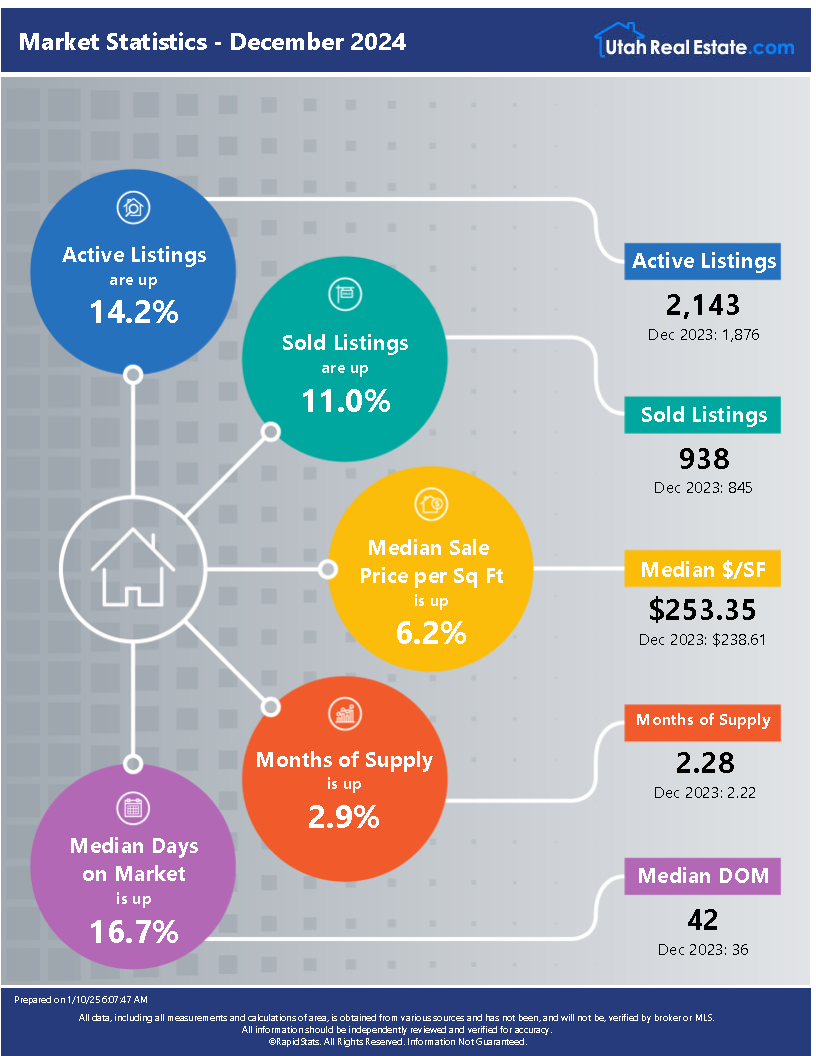

Utah Market Stats January 2025

Key Factors Influencing Utah Insurance Rates

The average annual homeowners insurance premium for a $200K home in Utah is $1,063. Utah’s insurance rates are influenced by low weather risks, local crime, and construction material costs.

Salt Lake City – A Top Pick for Millennial Homeowners

Salt Lake City: A Top Pick for Millennial Homeowners Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor...

2026 Interest Rate Forecast: Continued Adjustments

Federal funds rate projected to fall from 3.7% (Q1) to 3.1% (Q4), marking consistent quarterly reductions. Rate adjustments aim to stabilize the economy, setting the stage for long-term equilibrium.

2025 Housing Market Forecast for Buyers & Sellers

2025 housing market: moderate rise in home sales, stabilized mortgage rates, and slower price increases. All-cash buyers make up 26% of sales, driven by increased homeowner equity.

Home Prices Stay High, Buyers Wait for Relief

In October, the combination of rising mortgage rates and high home prices has slowed home sales to a 14-year low.New single-family home sales ↑ 4.1% MoM, signaling potential market recovery.

How To Use the 28/36 Rule To Determine How Much House You Can Afford

The 28/36 rule is a guideline for determining how much house you can afford. It states that your total housing costs should not exceed 28% of your gross income, and your total debt should not exceed 36%. This rule helps ensure that you don't take on too much...

Governors of Western states consider public lands for developing affordable housing

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Household debt in Utah rising at one of the fastest rates in the nation

A report reveals that Utah has one of the highest rates of household debt growth in the U.S., with residents adding over $1 billion in debt between the second and third quarters of 2024. The average household increased its debt by more than $1,000, ranking just behind...