Why It Makes No Sense to Wait for Spring to Sell

The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

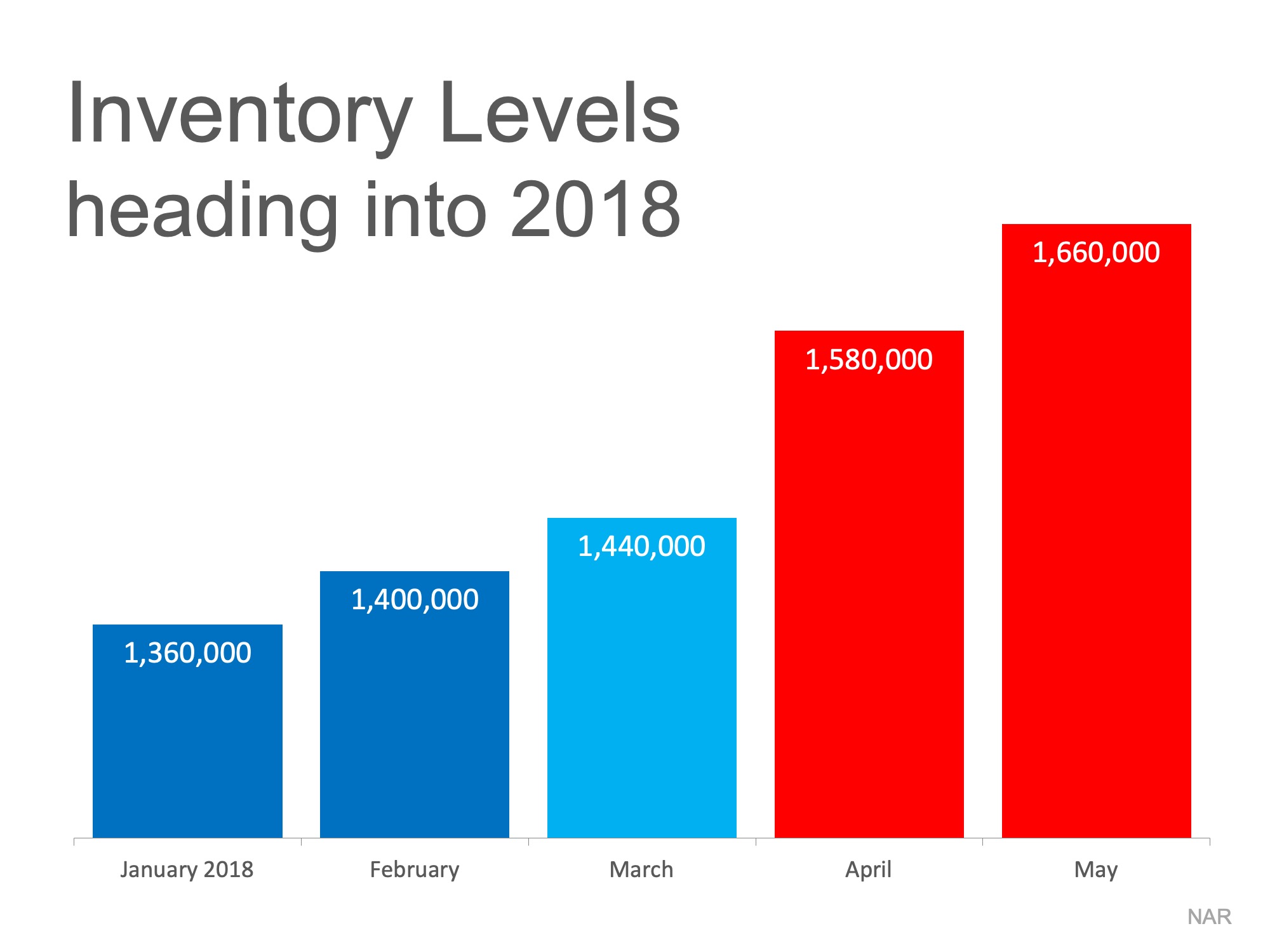

The supply of homes for sale dramatically increases every spring, according to the National Association of Realtors (NAR). As an example, here is what happened to housing inventory at the beginning of 2018:

Putting your home on the market now, rather than waiting for increased competition in the spring, might make a lot of sense.

Bottom Line

Buyers in the market during the winter are truly motivated purchasers and they want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Why Buyers Need an Expert Agent by Their Side

Why Buyers Need an Expert Agent by Their Side The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating...

What You Need To Know About Home Price News

What You Need To Know About Home Price News The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines....

Homeowners Have Incredible Equity To Leverage Right Now

Homeowners Have Incredible Equity To Leverage Right Now Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value...

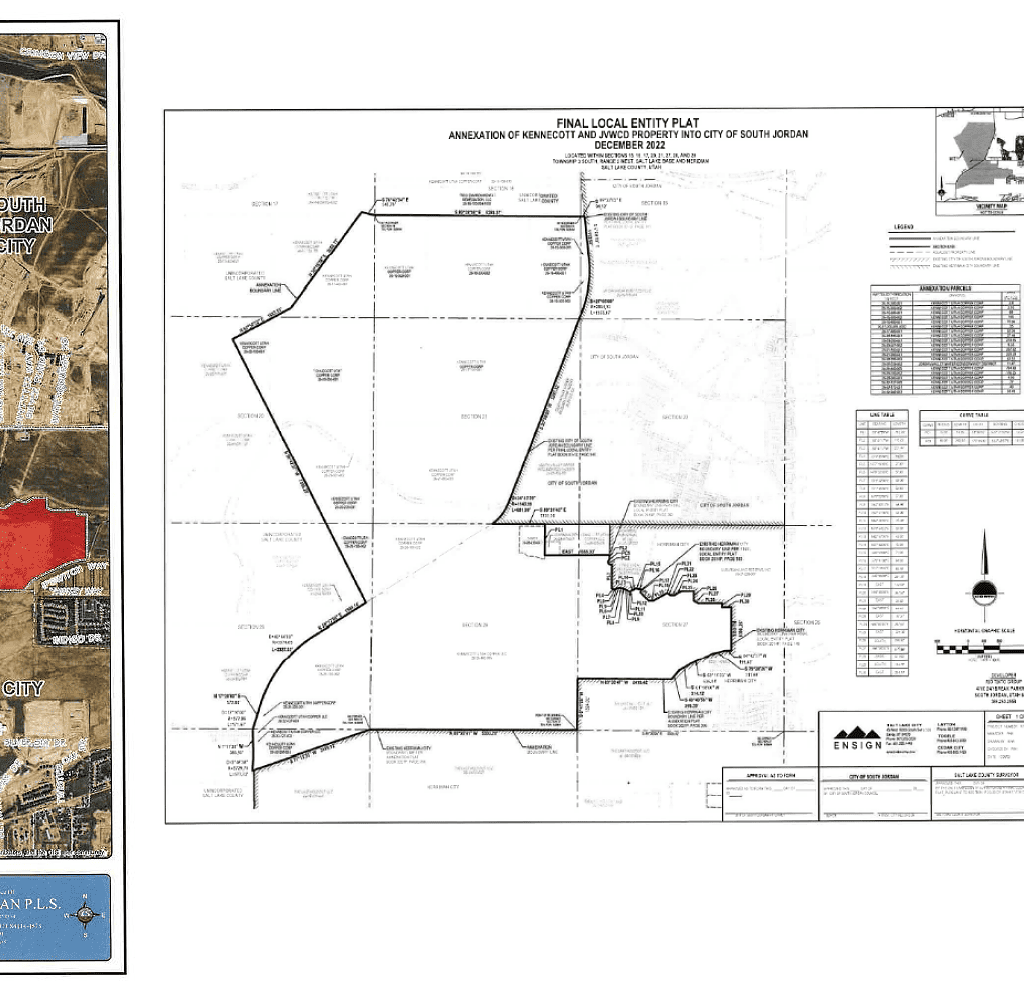

South Jordan City Council has recently announced the annexation of over 2,000 acres of land

South Jordan City Council has recently announced the annexation of over 2,000 acres of land. This move is expected to bring significant growth and development to the area. The annexed land is located in the western part of the city and includes several large parcels...

Is Now a Good Time to Buy in Utah

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor 2000 (in-active) e-pro (advanced digital marketing)...

Why Today’s Housing Market Is Not About To Crash

Why Today’s Housing Market Is Not About To Crash There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to...

Cinco de Mayo -Mexican Independence Day!

Today is Cinco de Mayo May 5th Happy Cinco de Mayo! Cinco de Mayo is a holiday that is celebrated in the United States every year on May 5th. While many people associate the holiday with Mexican Independence Day, which is actually celebrated on September 16th, Cinco...

How Homeowners Win When They Downsize

How Homeowners Win When They Downsize Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer...

What’s in store for the Housing Market for the rest of 2023, and beyond?

What’s in store for the Housing Market for the rest of 2023, and beyond? According to industry experts, the housing market is expected to remain strong in the coming years, with steady demand and limited supply driving up prices. This trend is likely to continue into...

Ways To Overcome Affordability Challenges in Today’s Housing Market

Ways To Overcome Affordability Challenges in Today’s Housing Market Some Highlights With so few homes on the market right now, widening the scope of your search to include nearby areas could help you find more options in your budget. You can also work with a trusted...