<iframe sandbox="allow-scripts" src="https://www.simplifyingthemarket.com/en/videos/embed/405191-bf9ce7799899cf839e0bf0e261497d3e/59deec78" frameborder="0" allowfullscreen width="560" height="315"></iframe>

Top Markets for Office Development in the West

In 2024, the office sector saw significant changes with high vacancy rates and minimal increases in office utilization. Nationally, office space under construction decreased to 57.8 million square feet, down by 39 million from 2023. In the Western U.S., the office...

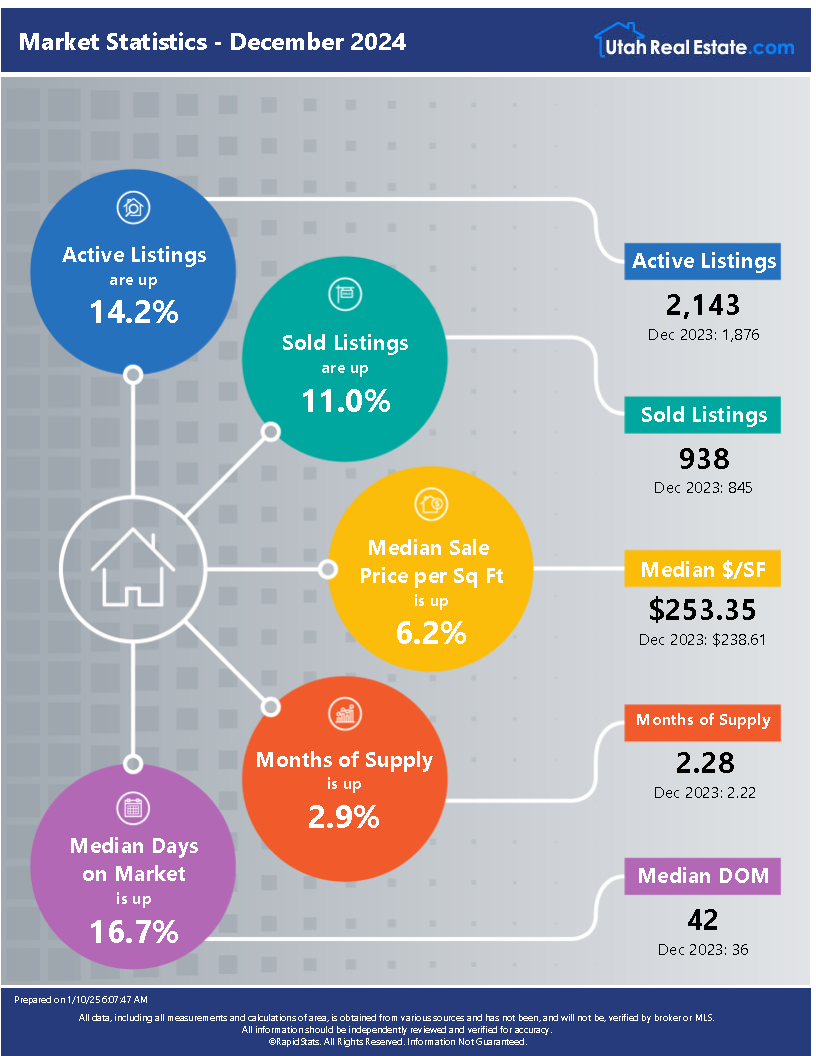

Utah Market Stats January 2025

Key Factors Influencing Utah Insurance Rates

The average annual homeowners insurance premium for a $200K home in Utah is $1,063. Utah’s insurance rates are influenced by low weather risks, local crime, and construction material costs.