What is Important to Boomers when Selling their House?

If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. You may be ready to move into a home that better fits your current lifestyle. Many fellow boomers have already made the move you may be considering.

The National Association of Realtors recently released their 2019 Home Buyer and Seller Generational Report. The report revealed many interesting tidbits about both categories of baby boomers: younger boomers (ages 54 to 63) and older boomers (64 to72). Here are a few of the more interesting topics.

Percentage of Buyers who Looked Online First

- All Buyers: 44%

- Younger Boomers: 46%

- Older Boomers: 44%

Where Boomers Found the Home They Purchased

The two major ways buyers found the home they purchased:

- All buyers: 50% on the internet, 28% through a real estate agent

- Younger Boomers: 46% on the internet, 33% through a real estate agent

- Older Boomers: 36% on the internet, 35% through a real estate agent

Distance Seller Moved

The distance between the home they purchased and the home they recently sold was much greater for boomers than the average seller.

- All sellers: 20 miles

- Younger Boomers: 27 miles

- Older Boomers: 50 miles

Tenure in Previous Home of Seller

The percentage of older boomers who lived in their previous home for more than 20 years was almost twice the amount of the average seller.

- All sellers: 16%

- Younger Boomers: 20%

- Older Boomers: 31%

Primary Reason to Sell their Previous Home

- Want to move closer to friends or family

- Home too large

- Retirement

View of Homeownership as a Financial Investment

- 83% of Younger Boomers see homeownership as a good investment

- 82% of Older Boomers see homeownership as a good investment

Bottom Line

If you are a boomer and thinking about selling, now might be the time to contact an agent to help determine your options.

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since...

Salt Lake homebuyers, on average, paid $120,000 more than they did the same quarter last year

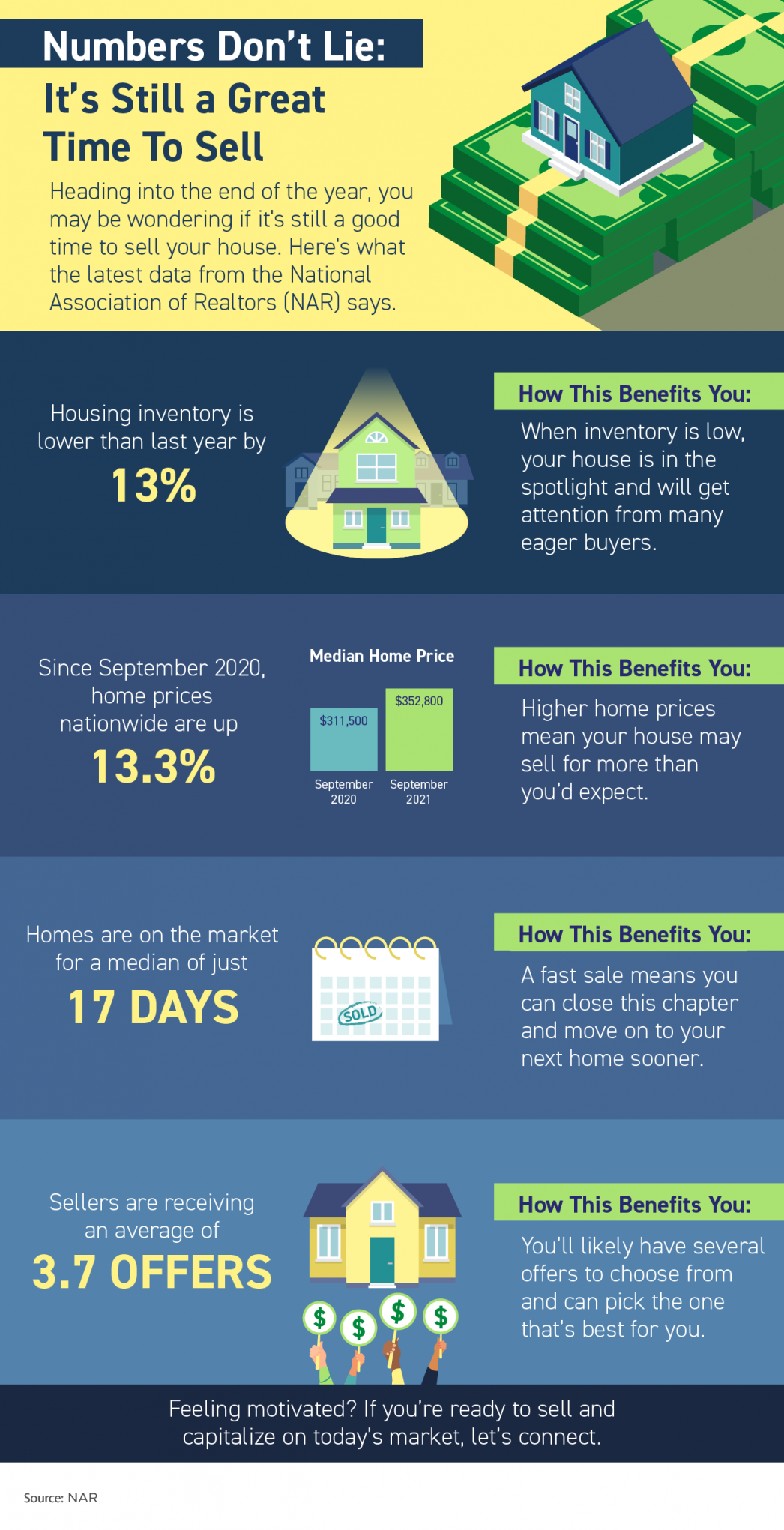

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...