What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

How Buyers Can Win By Downsizing in 2020

Marty Gale SRESHow Buyers Can Win By Downsizing in 2020 Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as...

The 2 Surprising Things Homebuyers Really Want

The 2 Surprising Things Homebuyers Really Want In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though –...

2020 Expert Forecast in Numbers

The expert forecast is looking bright when it comes to the 2020 housing market. Let’s connect to talk about how these numbers can bring you one step closer to homeownership this year.

Homes Are More Affordable Today, Not Less Affordable

Homes Are More Affordable Today, Not Less Affordable There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several...

2020 Luxury Market Forecast

2020 Luxury Market Forecast By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger...

Buying a Home Early in Life Can Increase Future Wealth

Buying a Home Early Can Significantly Increase Future Wealth According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60. The good news is, our younger generations are strong believers in...

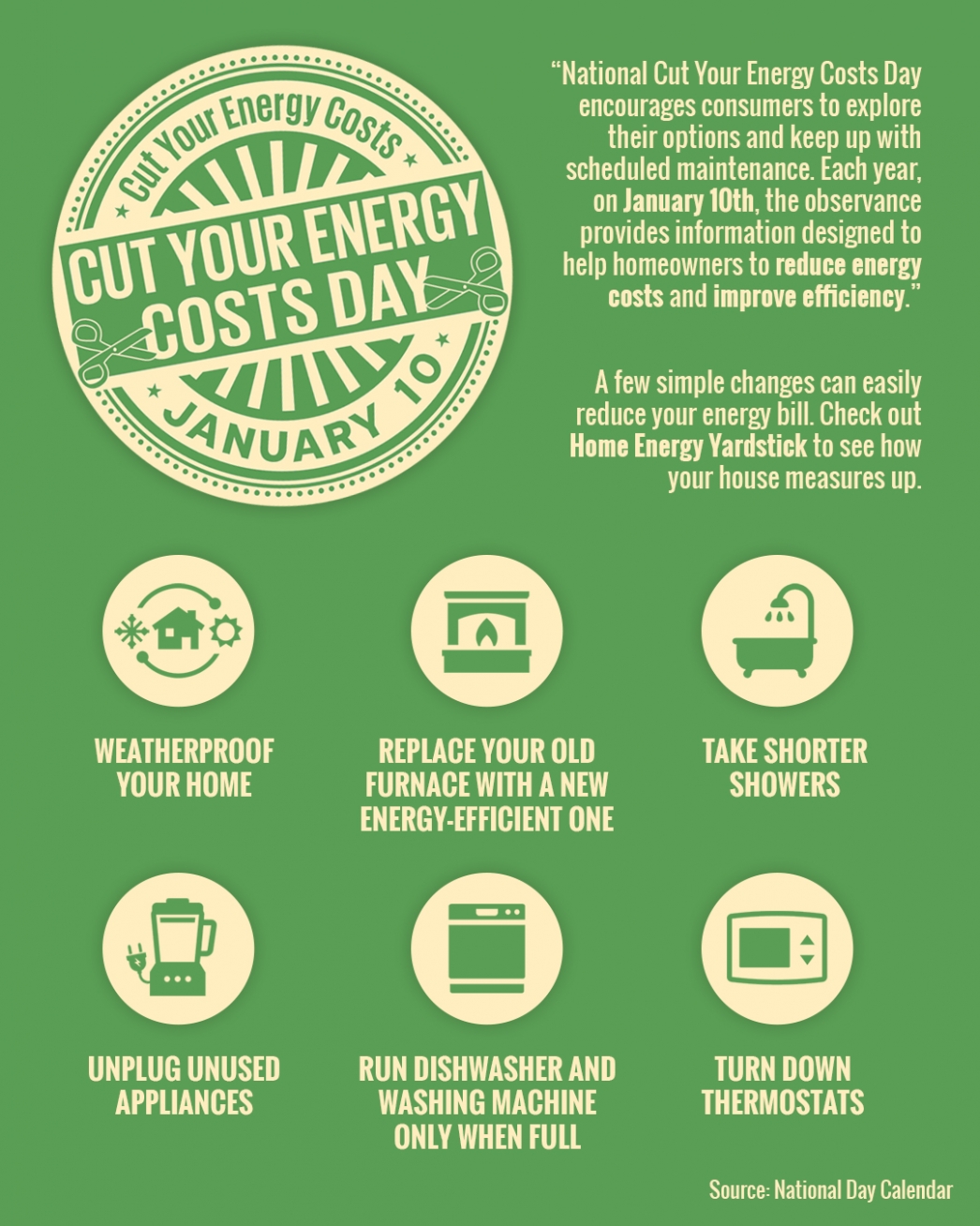

National Cut Your Energy Costs Day

National Cut Your Energy Costs Day | January 10 2020 Some Highlights: On January 10th of each year, “National Cut Your Energy Costs Day” encourages consumers to reduce their overall energy costs by improving home efficiency. According to Freddie Mac, a typical U.S....

There’s a Long Line of Buyers Waiting for Your House

There’s a Long Line of Buyers Waiting for Your House If you’re following what’s happening in the housing market right now, you know that many people believe the winter months aren’t a good time to sell a home. As realtor.com Senior Economist George Ratiu recently...

How can SRES Help You Plan for Your Future Housing Needs

How can SRES Help You Plan for Your Future Housing Needs? Most of us put time and effort into planning for retirement. That is, we plan for money related issues such as retirement funds. Secondly, people plan for long-term care and life insurance. Deciding on where...

Plus Fifty Today

Do you know where is your market is going? In 2020: More than one-third of the U.S. population reached age 50. 17 million baby boomers (20 percent) were age 60 or older. Generation X moved into middle age and began knocking on the door of age 58 Today demographic...