A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

Homeownership can be yours

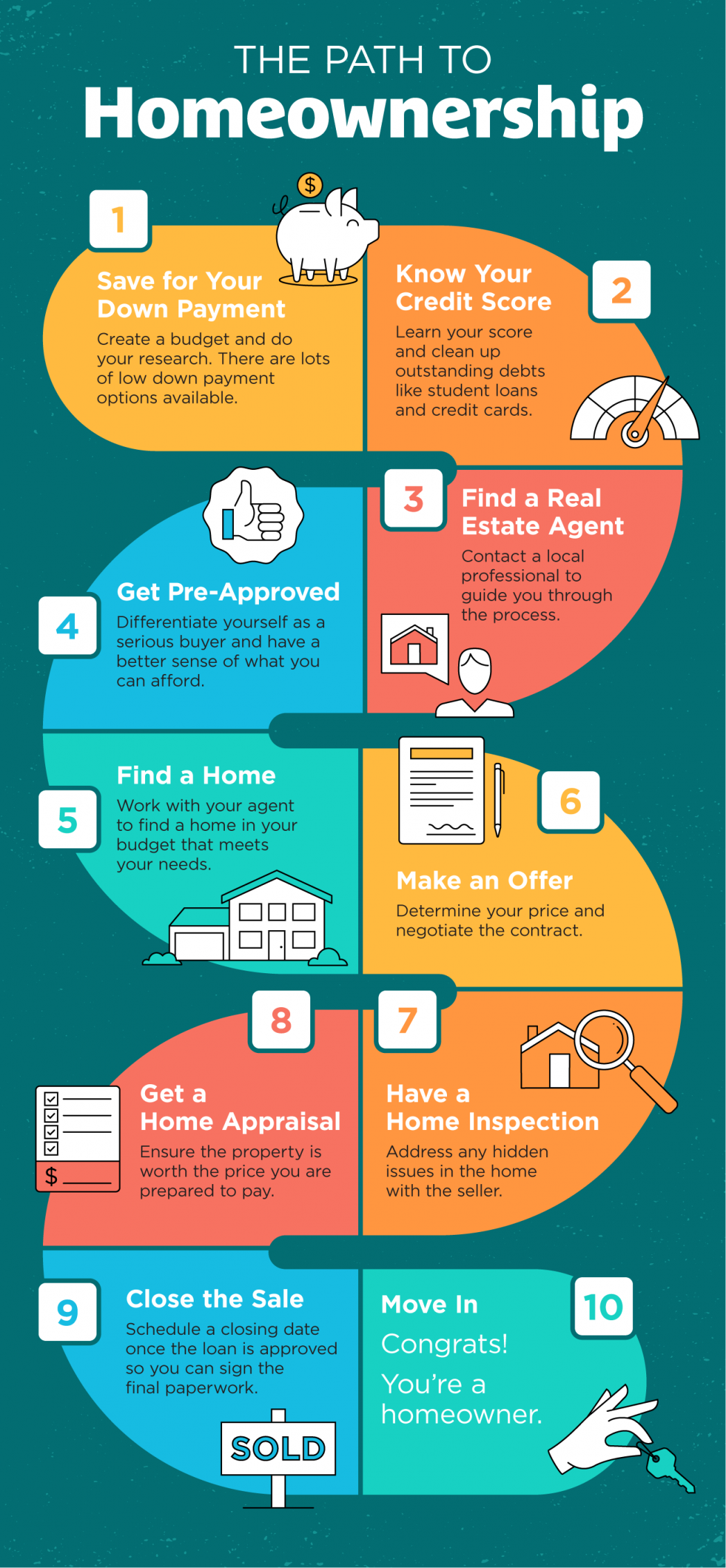

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...

Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual WorldIn a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we...

Thank You

Thank You for Your Support!

It Pays to Sell with a Real Estate Agent

It Pays to Sell with a Real Estate Agent Some HighlightsToday, it’s more important than ever to have an expert you trust to guide you as you sell your house.From your safety throughout the process to the complexity of negotiating...

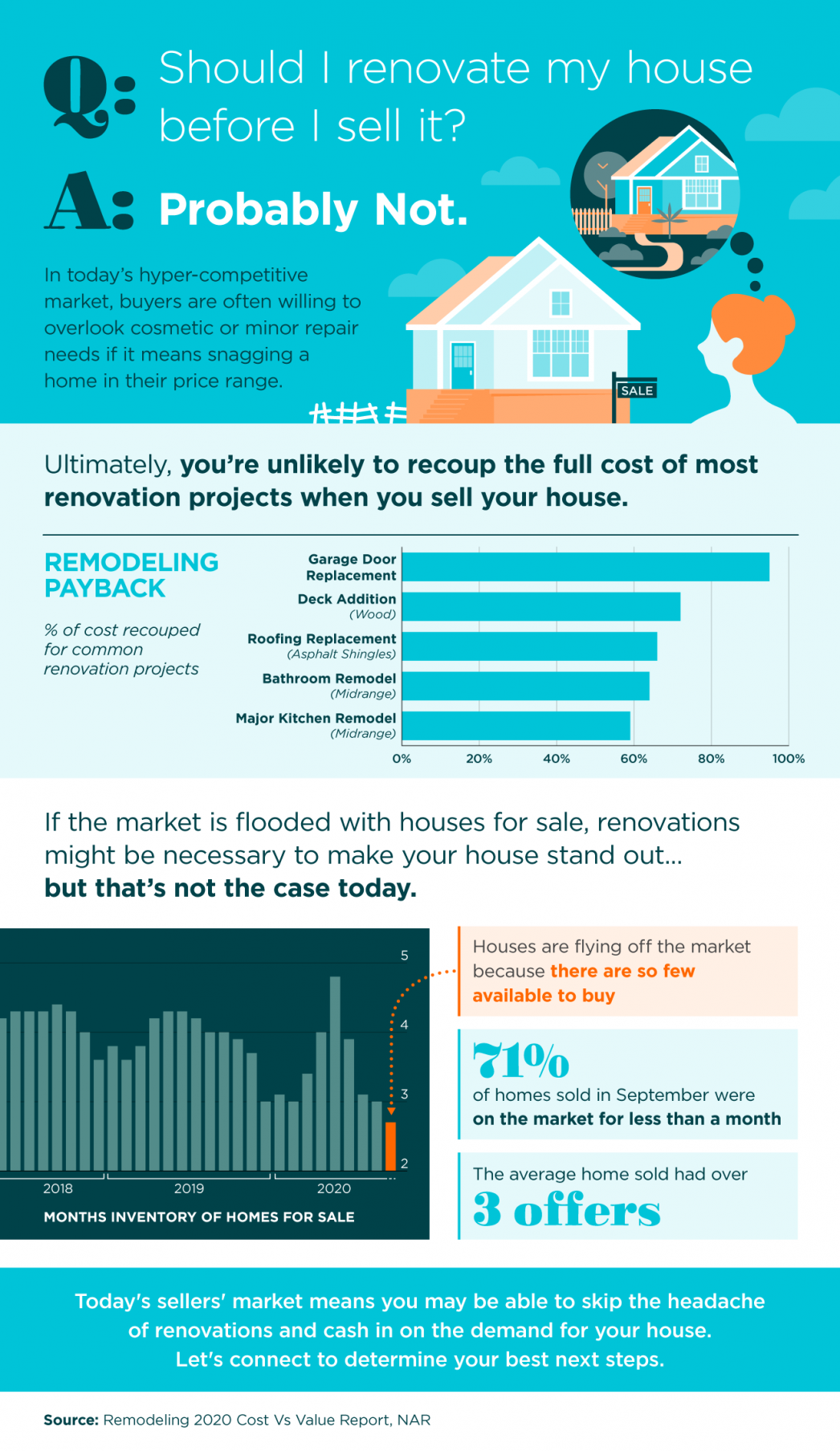

Should I Renovate My House Before I Sell It?

Should I Renovate My House Before I Sell It? Some HighlightsIn today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.With so few houses available for sale today, you may...

Don’t Fear the Real Estate Market

Don't Fear the Real Estate Market October 29, 2020 Fear should never be a factor when navigating the housing market. Whether you're buying or selling a home this fall, let's connect to make sure you're empowered to take the safest path.

Why Selling Your House Before Next Spring Is Key

Why Selling Your House Before Next Spring Is Key Today's housing market is empowering homeowners with the control they want when selling their house, but as home inventory begins to rise, this fair weather won't last forever. Let's connect to start the process of...

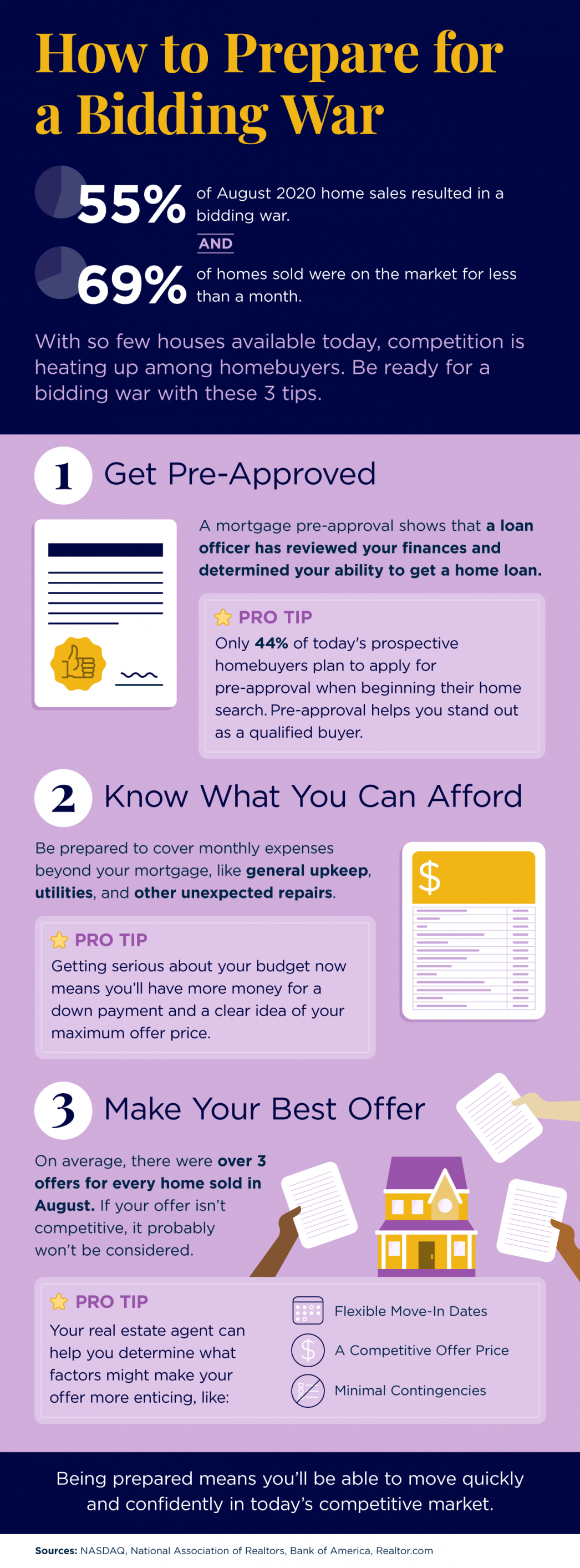

How to Prepare for a Bidding War

How to Prepare for a Bidding War Some HighlightsWith so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.From pre-approval to making your best offer, here are three tips to make sure you can act quickly...

2020 Housing Market on Track to Beat Last Year’s Success

Housing Market on Track to Beat Last Year’s SuccessBack in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions....

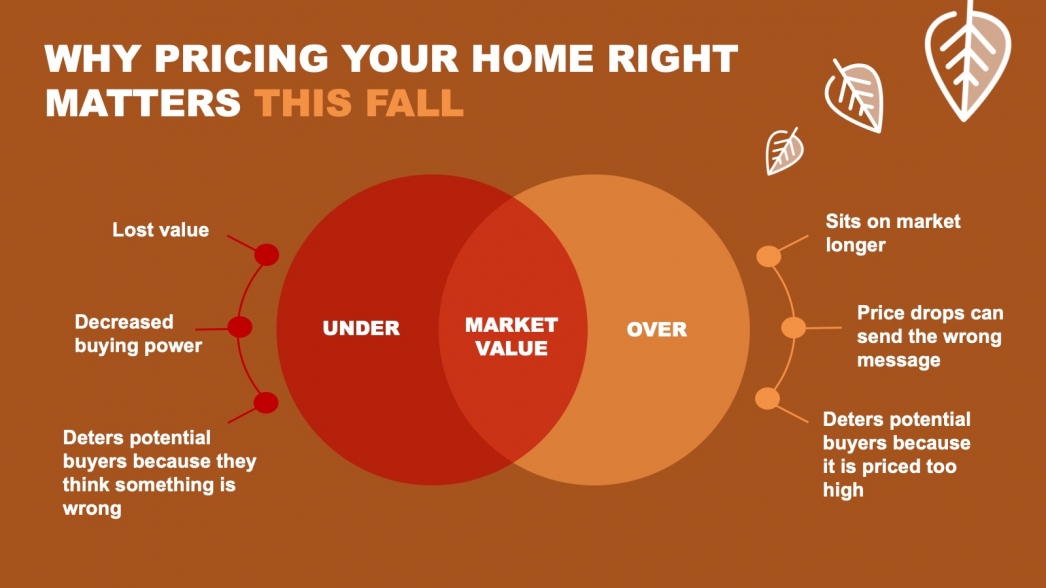

Why Pricing Your Home Right Matters This Fall

Why Pricing Your Home Right Matters This Fall Some HighlightsAs a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.To sell your home quickly and for the best possible price, you...