A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

Auto DraftTime Is Money When It Comes to Your Home

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today's low mortgage rates. Let's connect to make sure you don't miss out.

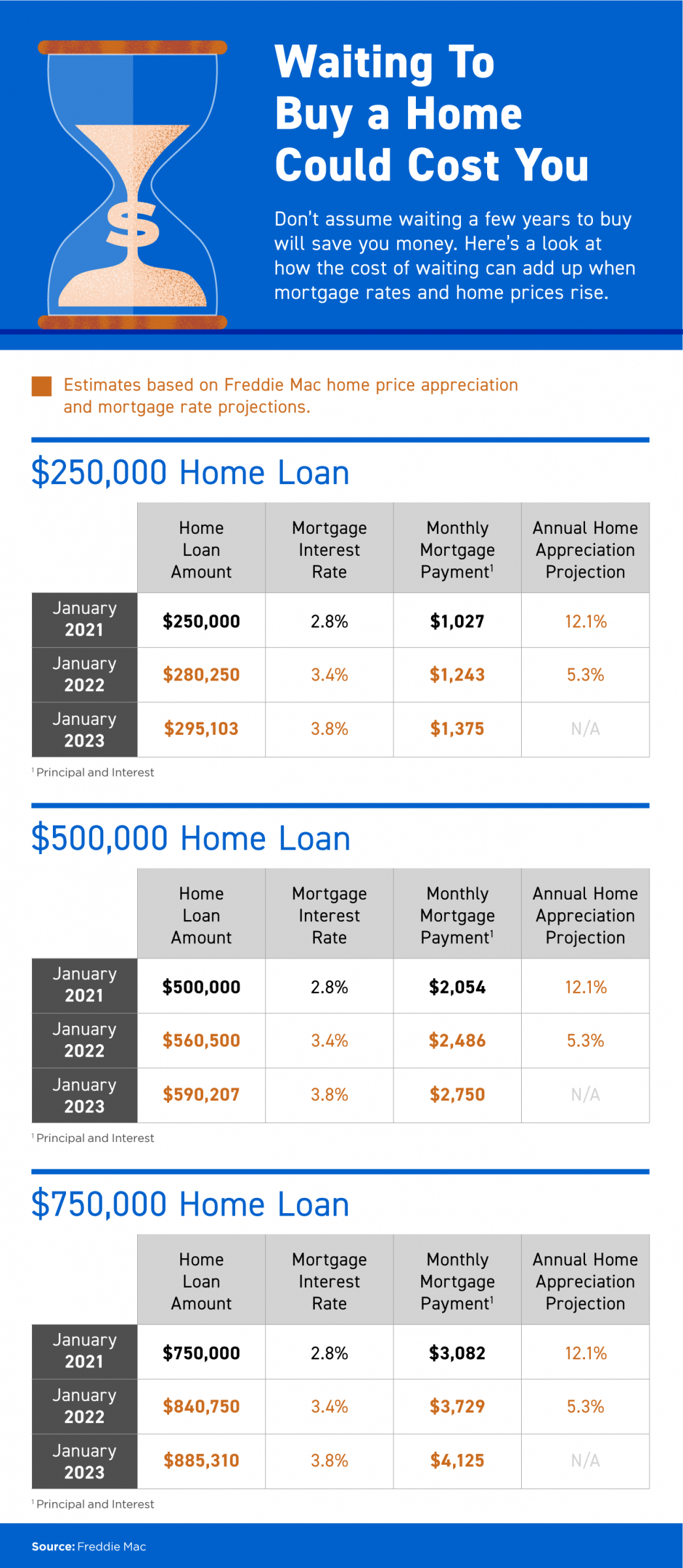

Important News! Buying a Home Could Cost You!

Waiting To Buy a Home Could Cost You Some Highlights If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again. The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise....

A Look at Home Price Appreciation Through 2025

A Look at Home Price Appreciation Through 2025 Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s...

Happy Independence Day

Happy Independence Day!Wishing you a happy and safe Independence Day.

What Do Experts See on the Horizon for the Second Half of the Year 2021?

What Do Experts See on the Horizon for the Second Half of the Year?As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off...

What To Expect as Appraisal Gaps Grow

What To Expect as Appraisal Gaps GrowIn today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association...

Save Time and Effort by Selling with the Right Agent

Save Time and Effort by Selling with the Right AgentSelling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations,...

Tips for Today’s Sellers

Tips for Today's Sellers Even in today's ultimate sellers' market, it's key to have an expert guide when you sell your house. Let's connect to optimize your home sale this summer.

Don’t Wait To Sell Your House

Don’t Wait To Sell Your HouseWe’re in the ultimate sellers’ market right now. If you’re a homeowner thinking about selling, you have a huge advantage in today’s housing market. High buyer demand paired with very few houses for sale makes this the optimal time to sell...

Today’s mortgage rates are still incredibly low compared to the historical norm. Let’s connect so you can strike while the iron is hot.

There's Still Time To Take Advantage of Historically Low Mortgage RatesToday's...