2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

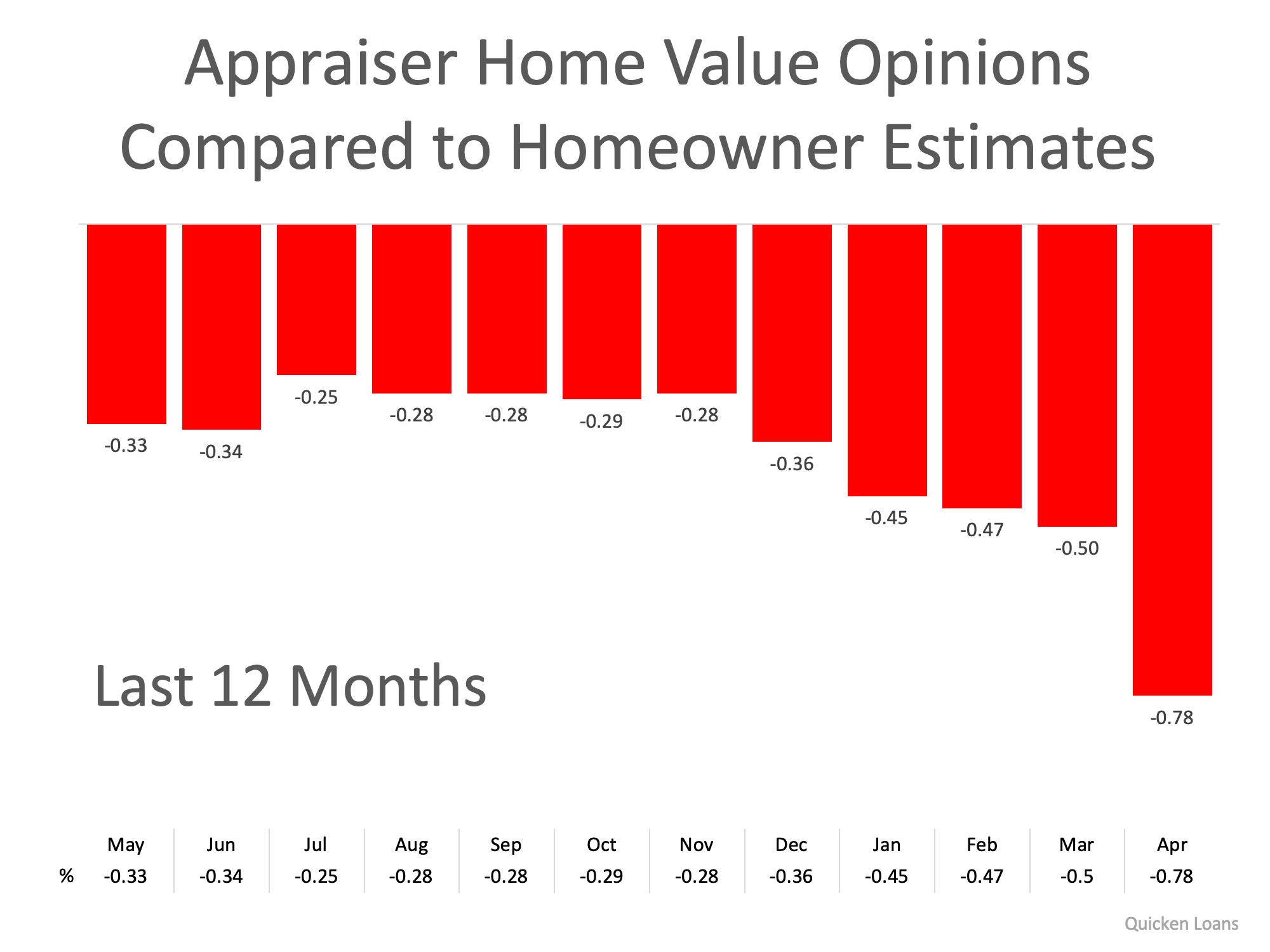

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Is Utah Real Estate Finally Cooling Down?

Utah Real Estate prices remain high, but the pace of growth has clearly slowed in recent months. Median monthly mortgage payments in Utah have dropped, improving affordability for first-time homebuyers. Listings are up across Utah, giving buyers more options and...

Utah 2025: Buyers Gain From Balance

Rising listings in Salt Lake suburbs support choice and negotiation. Family-oriented neighborhoods showing long-term value potential.

Where are the most new homes being built in the U.S.? In Utah?

Utah ranks 4th nationally for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah's median home price remains high at $535,217. The Salt Lake City-Murray area ranked...

Utah ranks No. 4 for most new homes being built in the US

Utah ranks fourth in the U.S. for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah maintains one of the highest median home prices at $535,217. The Salt Lake City-Murray...

Global Vacation Rental Market Grows 5% CAGR by 2033

Global vacation rental market to grow from $92.61B in 2025 to $136.83B by 2033. 5% CAGR driven by tech, personalization, remote work trends, and flexible travel preferences.

The price has reduced for this Listing, check it out Listing Address: 614 W ANDERSON Murray, UT 84123

New Carpet! 4 Bedroom 2 Bath updated Murray home. Granite counters, multiple gathering spaces, hardwood floors, and a large yard. Conveniently located, close to freeway access, IMC, shopping, schools, and canyons.

2025-27 Real Estate: Prices Rise 3.5% Yearly, Building Slows

US home prices are forecast to ↑ 3.5% annually through 2027, the slowest since 2011. Tariffs are expected to reduce construction of budget homes, with 90% of analysts predicting fewer builds

Could a Rate Cut Free Housing’s ‘Stuck Pig’?

Despite Fed rate cuts, 2025’s housing market remains a “stuck pig,” trapped by affordability and structural issues. Median home prices remain 4.2x median income; price gains forecast between 0.6% and 6.1% for 2025.

Utah 2025: Boomtowns Adjust to New Normal

Salt Lake City prices likely to flatten or dip as post-pandemic migration slows. New builds and resale listings ease supply crunch seen in boom years.

Essential Steps to Take for Financial Success Before Buying a Home

Buying a home is a significant milestone that requires careful financial preparation. Before starting the process, assess your financial situation, pay down high-interest debt, and establish an emergency fund. Check your credit score and get pre-approved for a...