2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

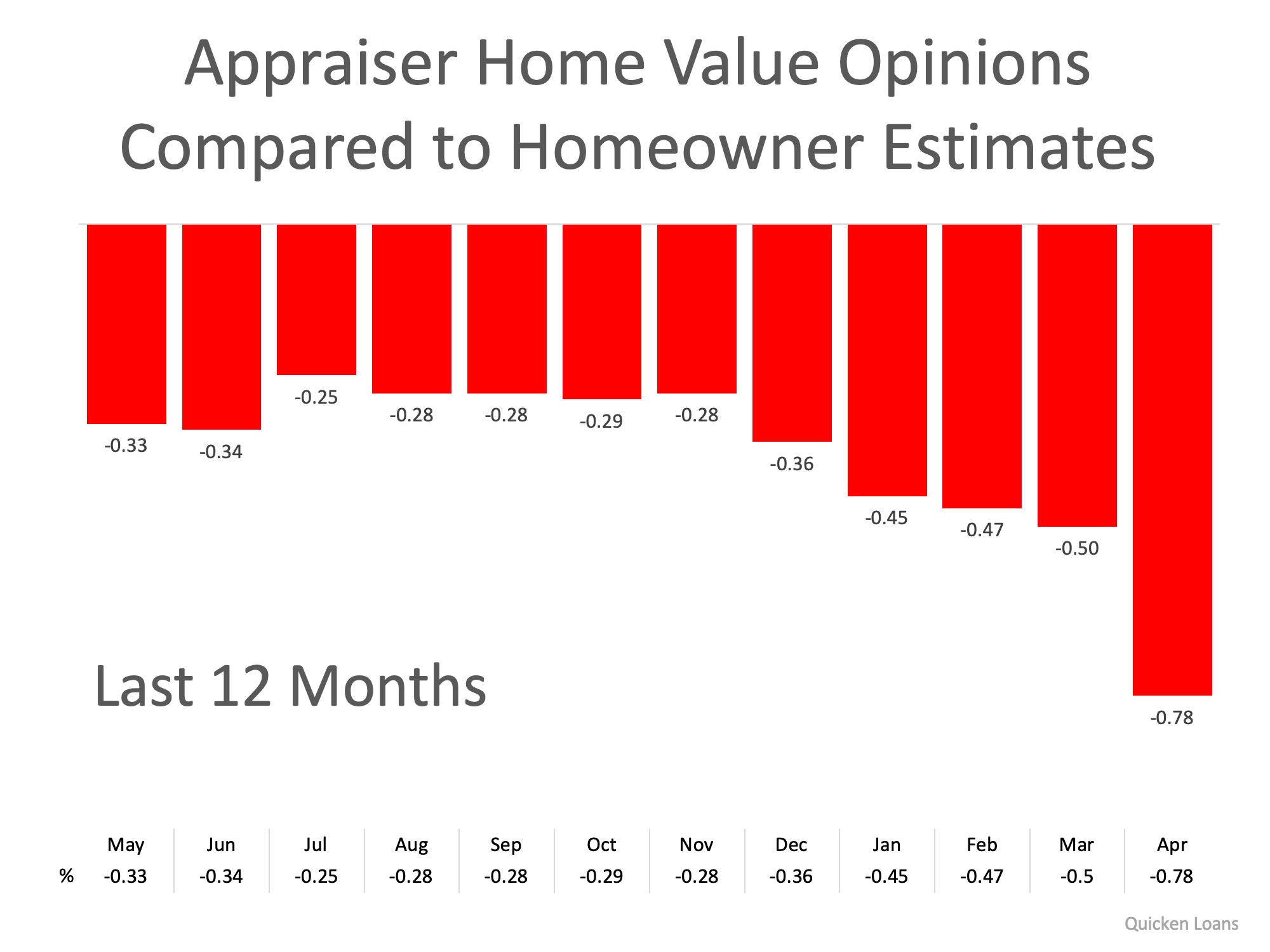

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

It’s Not Too Late To Apply For Forbearance

It’s Not Too Late To Apply For Forbearance Over the past year, the pandemic made it challenging for some homeowners to make their mortgage payments. Thankfully, the government initiated a forbearance program to provide much-needed support. Unless they’re extended once...

Americans Have Their Hearts Set on Homeownership

801-205-3500

Are Interest Rates Expected to Rise Over the Next Year?

Are Interest Rates Expected to Rise Over the Next Year?So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into...

Single Family Inventory on The Rise for May

It’s a Great Time for Your House to Shine

It's a Great Time for Your House to Shine April 30, 2021 Today's housing market makes it easy to win as a seller. Let's connect if you're ready to make a move this year.

Utah Housing This Isn’t a Bubble. It’s Simply Lack of Supply

This Isn’t a Bubble. It’s Simply Lack of Supply. [INFOGRAPHIC] Some Highlights In a recent article, Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), discussed the state of today’s housing market. When addressing whether or not today’s high...

Endless Utah Real Estate Possibilities

Top 4 Reasons to Own a Home

Top 4 Reasons to Own a Home Owning a home can have an incredible impact on your quality of life. Let's connect if you're ready to make your dream of homeownership a reality.

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to Foreclosure

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to ForeclosureThere has been a lot of discussion as to what will happen once the 2.3 million households currently in forbearance no longer have the protection of the program. Some assume there could...

Don’t Sell on Your Own Just Because It’s a Sellers’ Market

Don’t Sell on Your Own Just Because It’s a Sellers’ MarketIn a sellers’ market, some homeowners might be tempted to try to sell their house on their own (known as For Sale By Owner, or FSBO) instead of working with a trusted real estate professional. When the...