Did you know?

Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/

| HomeAgain: | May include an owner occupied One-to-Two Unit Dwelling, such as a Duplex, mother in law apartment or Accessory Dwelling Unit (ADU) as defined by FHA. Follow FHA requirements when including any rental income to qualify. Rental income used to qualify the Borrower must be included in UHC qualifying income limits. |

| HomeAgain: | Non-Occupant Co-Borrowers are allowed. The Non-Occupant Co-Borrower debt ratio cannot exceed 45% |

| FirstHome: | The Non-Occupant Co-Signer’s debt ratio has increased from 41% to 45% |

| Insurance: | Addition of UHC Insurance requirements as currently listed in our Selling Supplement. |

https://utahhousingcorp.org/

How Buyers Can Win By Downsizing in 2020

Marty Gale SRESHow Buyers Can Win By Downsizing in 2020 Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as...

The 2 Surprising Things Homebuyers Really Want

The 2 Surprising Things Homebuyers Really Want In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though –...

2020 Expert Forecast in Numbers

The expert forecast is looking bright when it comes to the 2020 housing market. Let’s connect to talk about how these numbers can bring you one step closer to homeownership this year.

Homes Are More Affordable Today, Not Less Affordable

Homes Are More Affordable Today, Not Less Affordable There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several...

2020 Luxury Market Forecast

2020 Luxury Market Forecast By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger...

Buying a Home Early in Life Can Increase Future Wealth

Buying a Home Early Can Significantly Increase Future Wealth According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60. The good news is, our younger generations are strong believers in...

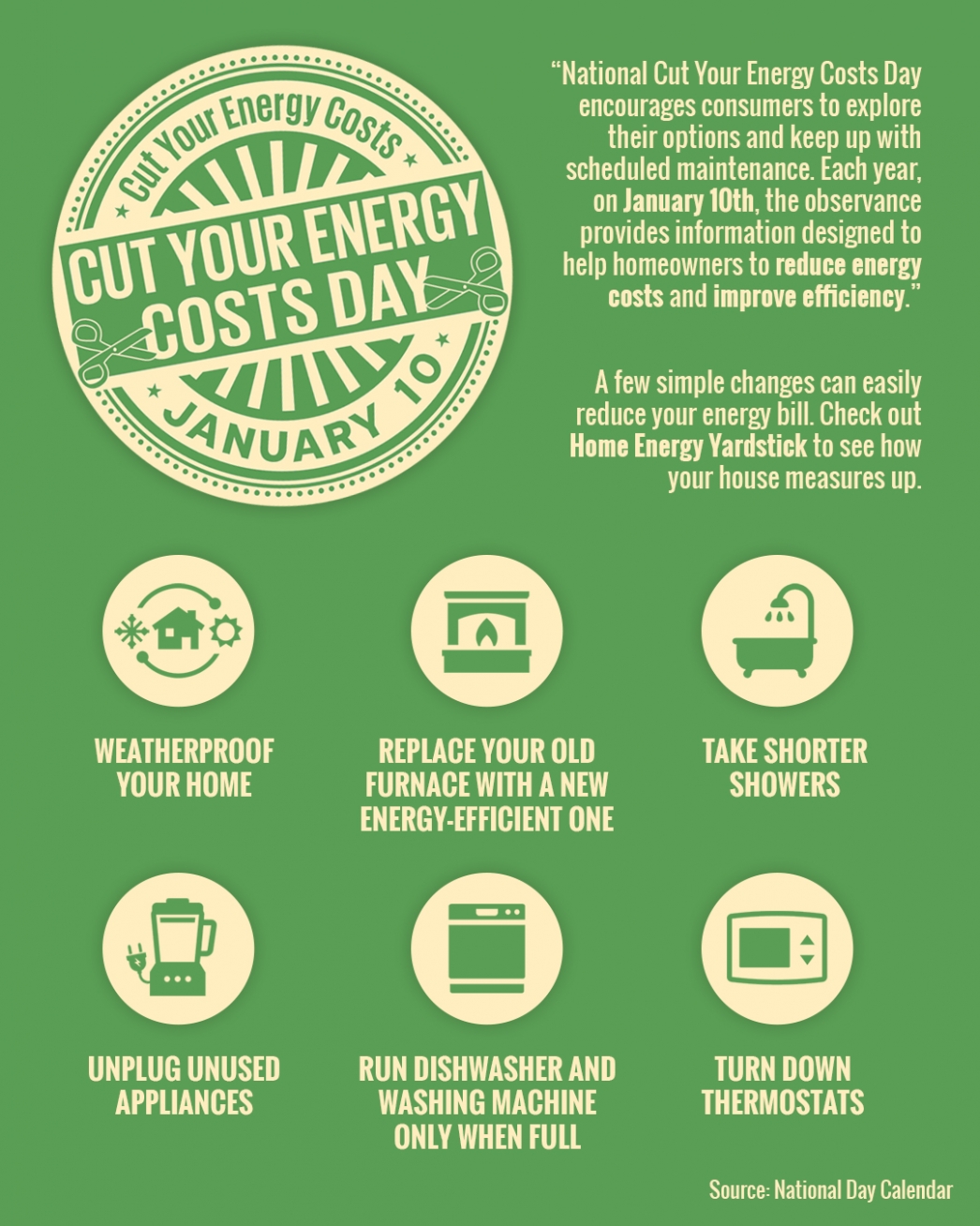

National Cut Your Energy Costs Day

National Cut Your Energy Costs Day | January 10 2020 Some Highlights: On January 10th of each year, “National Cut Your Energy Costs Day” encourages consumers to reduce their overall energy costs by improving home efficiency. According to Freddie Mac, a typical U.S....

There’s a Long Line of Buyers Waiting for Your House

There’s a Long Line of Buyers Waiting for Your House If you’re following what’s happening in the housing market right now, you know that many people believe the winter months aren’t a good time to sell a home. As realtor.com Senior Economist George Ratiu recently...

How can SRES Help You Plan for Your Future Housing Needs

How can SRES Help You Plan for Your Future Housing Needs? Most of us put time and effort into planning for retirement. That is, we plan for money related issues such as retirement funds. Secondly, people plan for long-term care and life insurance. Deciding on where...

Plus Fifty Today

Do you know where is your market is going? In 2020: More than one-third of the U.S. population reached age 50. 17 million baby boomers (20 percent) were age 60 or older. Generation X moved into middle age and began knocking on the door of age 58 Today demographic...