Time for Your Dream Home, Gen X!

During the housing market crash, Gen X homeowners lost more wealth than other generations. However, things are changing now! A strong economy, increasing home prices, and the recovery of the housing market are helping this generation to regain their lost wealth.

According to Pew Research Center,

“Their fortunes have rebounded more than those of other generations during the post-recession economic expansion and as home and stock prices have risen. Since 2010, the median net worth of Gen X households has risen 115%. In fact, in 2016, the most recent year with available data, the net worth of a typical Gen X household had surpassed what it was in 2007 ($84,200 vs. $63,400)”.

The same report also mentioned,

“15% of Gen X’s homeowners were ‘underwater’ on their homes in 2010 (meaning they owed more than they owned). By 2016 only 3% were underwater.”

As a result of homes regaining market value and their increasing net worth, many Gen Xers are presented with the opportunity of selling their current home in order to move up to the house they always dreamed of!

According to the 2019 Home Buyers and Sellers Generational Trends Report by the National Associations of Realtors, in 2018 Gen Xers made up the second largest share of home buyers by generation at 24%.

The report also provided some highlights about their purchase:

- Greatest share that purchased a multi-generational home (16%).

- Largest share that purchased a detached single-family home (88%).

- Highest median household income ($111,100).

- Bought the most expensive homes of all the generations.

- Job-related relocation was identified as the primary reason to buy.

But this generation is not only buying- they are selling too!

- Largest share of home sellers (25%).

- Highest median household income among sellers ($123,600).

- Tenure in the previous home was a median of 9 years.

- House too small was indicated as the primary reason to sell.

- 91% sold the home using a real estate professional.

Bottom Line

If you are a Gen Xer who would like to know exactly how much your house is worth today so you can move up to the home of your dreams, let’s get together to analyze your current circumstances.

The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election

Strength of the Economy Is Surprising the Experts We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by...

The top 10 highest Utah median prices in the fourth quarter by ZIP code

The median single-family home price in Salt Lake County in the fourth quarter increased to $378,000, up 8 percent compared to a median price of $350,000 in 2018's fourth quarter. Strong demand for homes is being driven by net in-migration and population increase. In...

First-Time Buyers Are Searching for Existing Homes This Year

First-Time Buyers Are Searching for Existing Homes This Year In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all...

American Dream Grant

Homeownership matters. That is why the Salt Lake Board of Realtors® this year is giving away down payment housing grants. This is just one way for us to help our community. The next grant is for single parents. The deadline to apply for this grant is March 20.

Utah Real Estate Market Stats for December

An Exceptional Year for Salt Lake’sHousing Market | 2019 Was One of theBest Years in Overall Residential Sales

Attention Utah Home Buyers

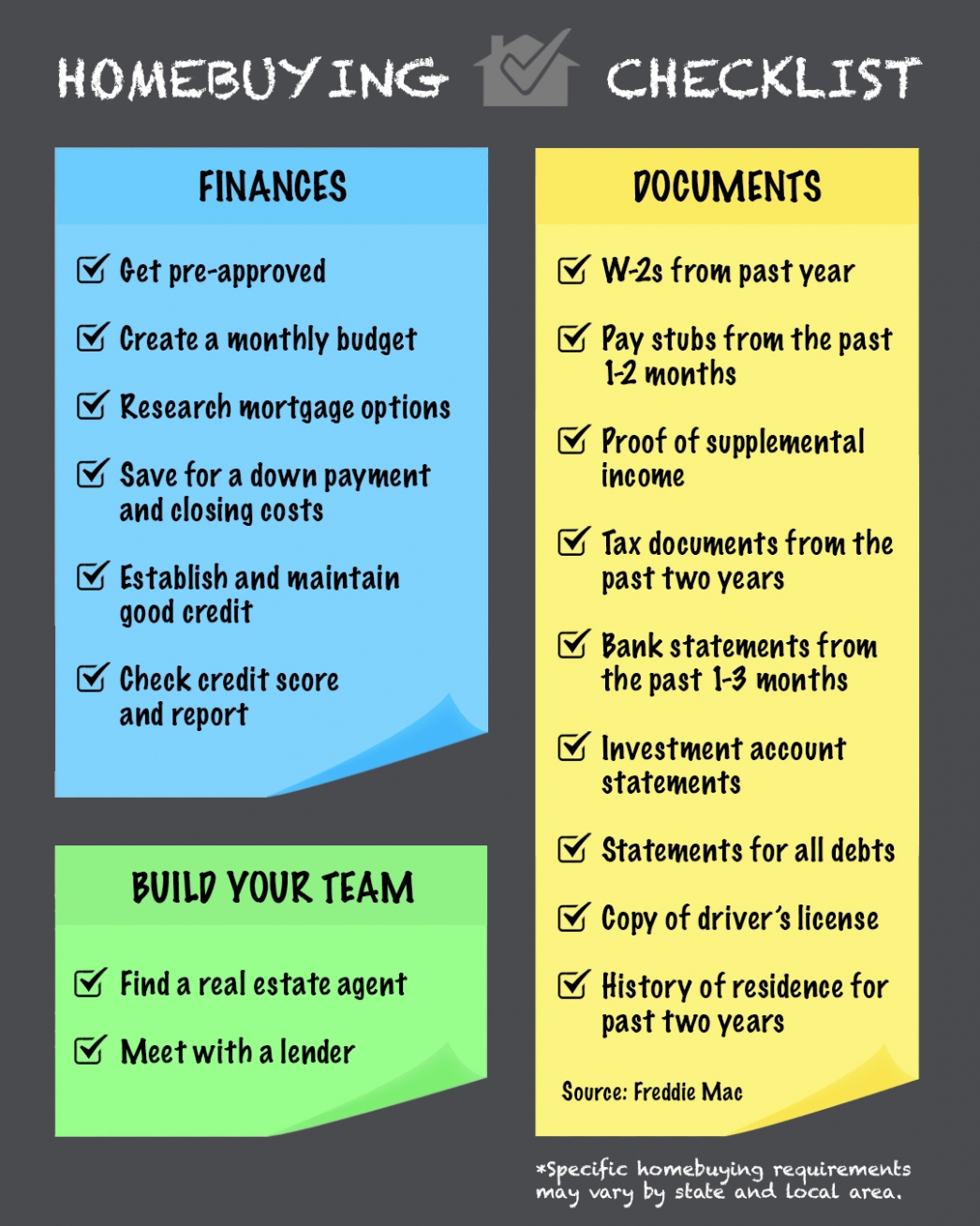

2020 Homebuying Checklist Some Highlights: If you’re thinking of buying a home, plan ahead and stay on the right track, starting with pre-approval. Being proactive about the homebuying process will help set you up for success in each step. Make sure to work with a...

How Buyers Can Win By Downsizing in 2020

Marty Gale SRESHow Buyers Can Win By Downsizing in 2020 Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as...

The 2 Surprising Things Homebuyers Really Want

The 2 Surprising Things Homebuyers Really Want In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though –...

2020 Expert Forecast in Numbers

The expert forecast is looking bright when it comes to the 2020 housing market. Let’s connect to talk about how these numbers can bring you one step closer to homeownership this year.

Homes Are More Affordable Today, Not Less Affordable

Homes Are More Affordable Today, Not Less Affordable There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several...