The Benefits of Growing Equity in Your Home

Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is the positive impact they have on home equity. Let’s break down three ways this is a win for homeowners.

1. Move-Up Opportunity

With the rise in prices, homeowners naturally experience an increase in home equity. According to the Homeowner Equity Insights from CoreLogic,

“In the first quarter of 2019, the average homeowner gained approximately $6,400 in equity during the past year.”

This increase in profit means if homeowners decide to sell, they’ll be able to put their equity to work for them as they make plans to move up into their next home.

2. Gain in Seller’s Profit

ATTOM Data Solutions recently released their Q2 2019 Home Sales Report, indicating the seller’s profit jumped at one of the fastest rates since 2015. They said:

“A look at the national numbers showed that U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since the original purchase of $67,500…the average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of the original purchase price.”

Looking at the amount paid when they bought their homes, and then the amount they received after selling, we can see that some homeowners were able to walk away with a significant gain.

3. Out of a Negative Equity Situation

Negative equity occurs when there is a decline in home value, an increase in mortgage debt, or both. Many families experienced these challenges over the last decade. According to the same report from CoreLogic,

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $485.7 billion since the first quarter 2018, an increase of 5.6%, year over year.

In the first quarter of 2019, the total number of mortgaged residential properties with negative equity decreased…to 2.2 million homes, or 4.1% of all mortgaged properties.”

The good news is, many families have moved beyond a negative equity situation, and no longer owe more on their mortgage than the value of their home.

Bottom Line

If you’re a current homeowner, you may have more equity than you realize. Your equity can open the door to future opportunities, such as moving up to your dream home. Let’s get together to discuss your options and start to put your equity to work for you.

Buyers Want To Know: Why Is Housing Supply Still So Low?

Buyers Want To Know: Why Is Housing Supply Still So Low? One key question that’s top of mind for homebuyers this year is: why is it so hard to find a house to buy? The truth is, we’re in the ultimate sellers’ market, so real estate is ultra-competitive for buyers...

What Are the Best Tips if You’re Planning To Sell Your House?

Utah Housing Market Stats for December 2021

Utah Housing Market State for December 2021

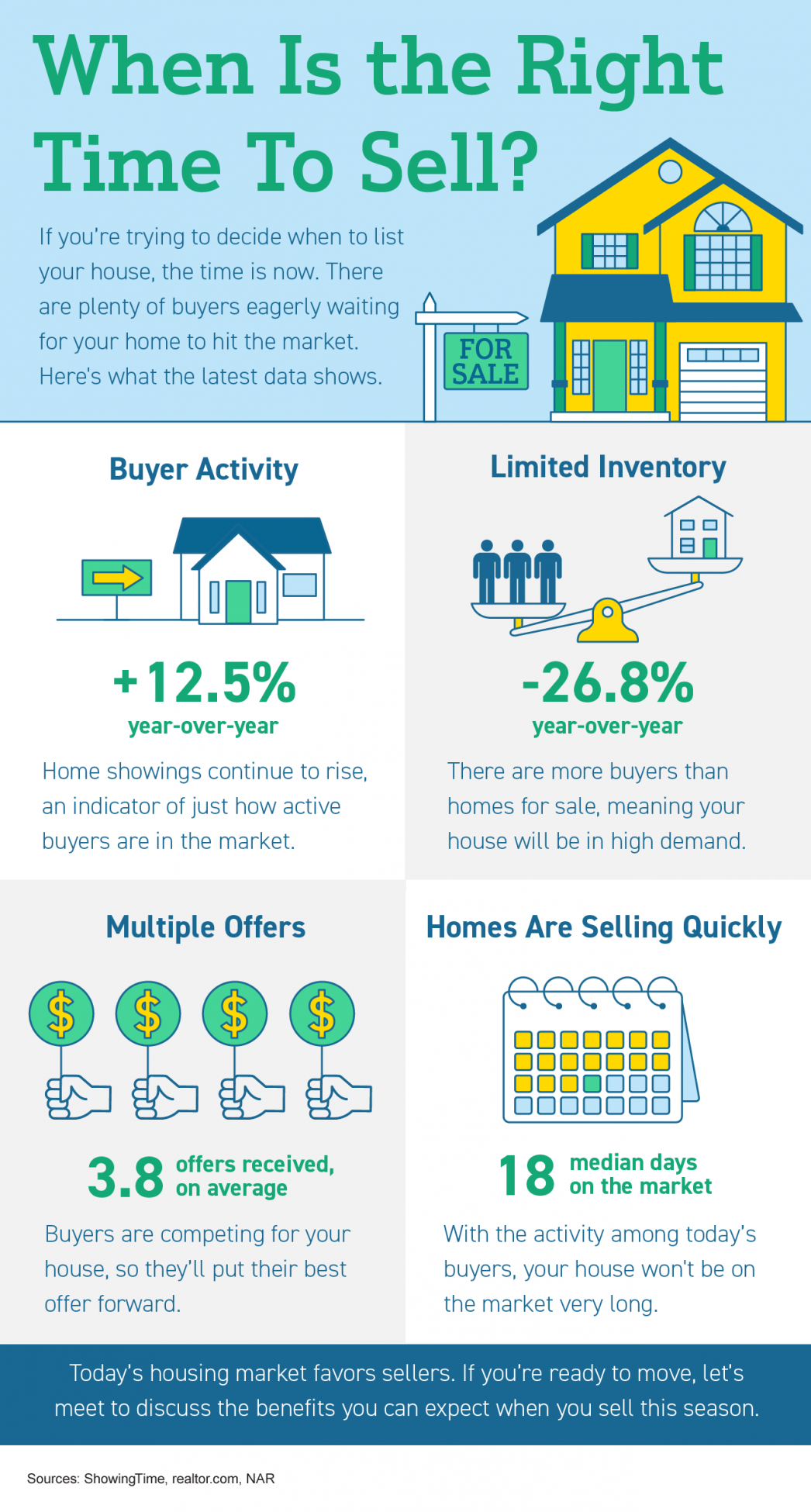

When Is the Right Time To Sell ?

When Is the Right Time To Sell Some Highlights If you’re trying to decide when to list your house, the time is now. There are plenty of buyers eagerly waiting for your home to hit the market. The latest data indicates home...

Why You Shouldn’t Sell Your House on Your Own

Why You Shouldn't Sell Your House on Your Own There's more to selling your house than putting up a For Sale sign....

Expert Insights on the 2022 Housing Market Utah Realty™

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we...

Your Best Offer

5 Tips for Making Your Best Offer on a Home As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1....

Merry Christmas! Happy New Year! Thank You for All of Your Support

Merry Christmas! Happy New Year! Thank You for All of Your Support

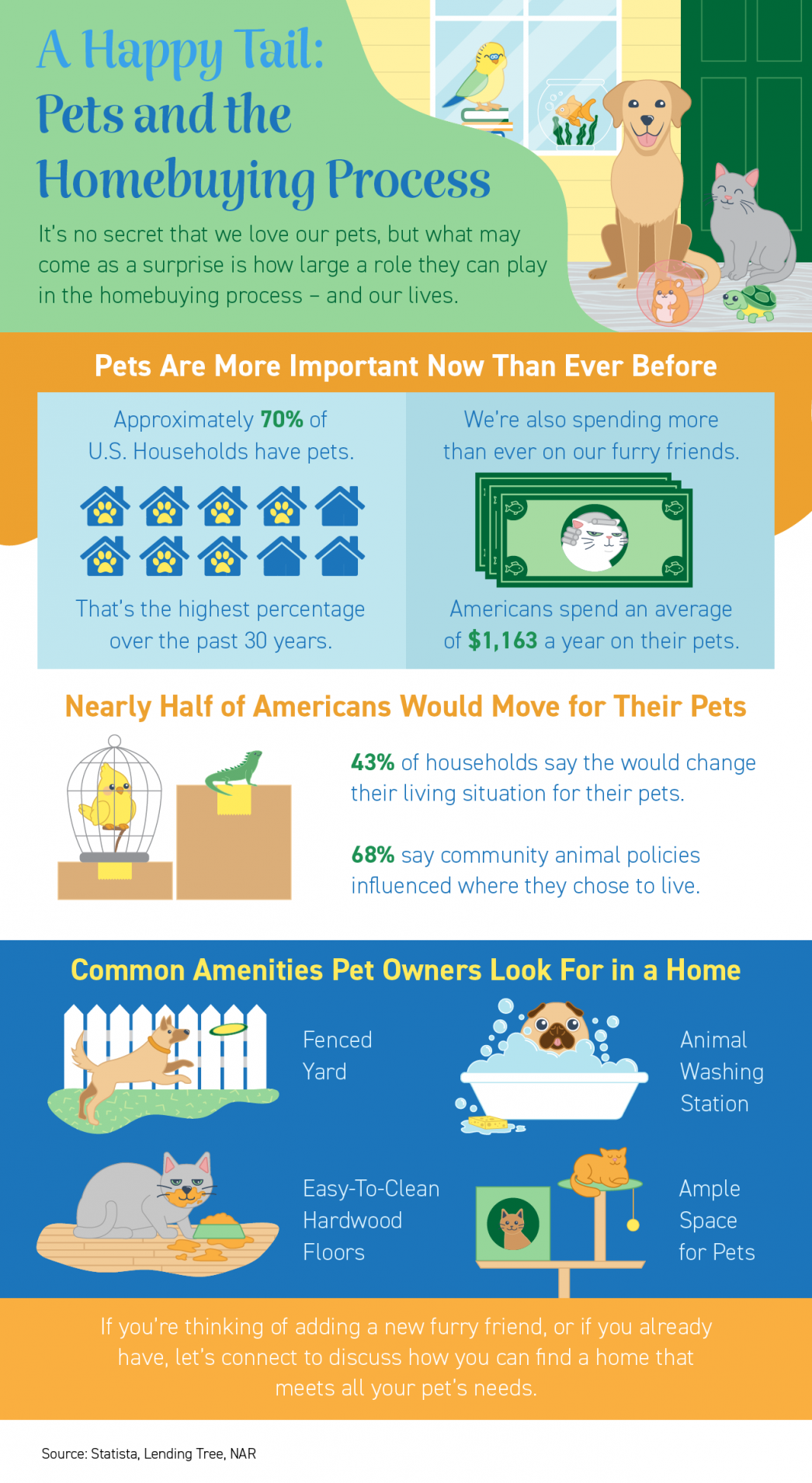

A Happy Tail: Pets and the Homebuying Process

A Happy Tail: Pets and the Homebuying Process Some Highlights It’s no secret that we love our furry friends - about 70% of U.S. households have pets. What may come as a surprise is how large a role they play in the homebuying process. Americans spend $1,163 a year on...

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market...