The Benefits of Growing Equity in Your Home

Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is the positive impact they have on home equity. Let’s break down three ways this is a win for homeowners.

1. Move-Up Opportunity

With the rise in prices, homeowners naturally experience an increase in home equity. According to the Homeowner Equity Insights from CoreLogic,

“In the first quarter of 2019, the average homeowner gained approximately $6,400 in equity during the past year.”

This increase in profit means if homeowners decide to sell, they’ll be able to put their equity to work for them as they make plans to move up into their next home.

2. Gain in Seller’s Profit

ATTOM Data Solutions recently released their Q2 2019 Home Sales Report, indicating the seller’s profit jumped at one of the fastest rates since 2015. They said:

“A look at the national numbers showed that U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since the original purchase of $67,500…the average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of the original purchase price.”

Looking at the amount paid when they bought their homes, and then the amount they received after selling, we can see that some homeowners were able to walk away with a significant gain.

3. Out of a Negative Equity Situation

Negative equity occurs when there is a decline in home value, an increase in mortgage debt, or both. Many families experienced these challenges over the last decade. According to the same report from CoreLogic,

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $485.7 billion since the first quarter 2018, an increase of 5.6%, year over year.

In the first quarter of 2019, the total number of mortgaged residential properties with negative equity decreased…to 2.2 million homes, or 4.1% of all mortgaged properties.”

The good news is, many families have moved beyond a negative equity situation, and no longer owe more on their mortgage than the value of their home.

Bottom Line

If you’re a current homeowner, you may have more equity than you realize. Your equity can open the door to future opportunities, such as moving up to your dream home. Let’s get together to discuss your options and start to put your equity to work for you.

Tips To Reach Your Homebuying Goals in 2023

Tips To Reach Your Homebuying Goals in 2023 Some Highlights If you’re planning to buy a home in 2023, here are a few things to focus on. Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved,...

3 Best Practices for Selling Your House This Year

3 Best Practices for Selling Your House This Year A new year brings with it the opportunity for new experiences. If that resonates with you because you’re considering making a move, you’re likely juggling a mix of excitement over your next home and a sense of...

Avoid the Rental Trap in 2023

Avoid the Rental Trap in 2023 If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true...

Planning To Sell Your House? It’s Critical To Hire a Pro

Planning To Sell Your House? It’s Critical To Hire a Pro. With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has...

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do. While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may...

Financial Fundamentals for First-Time Homebuyers Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus...

Utah Realty Marty & Laurie Gale

Thank You for All of Your Support

What To Expect From the Housing Market in 2023

What To Expect From the Housing Market in 2023 The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it's put the market into a reset position. As the Federal Reserve (the Fed) made moves this year...

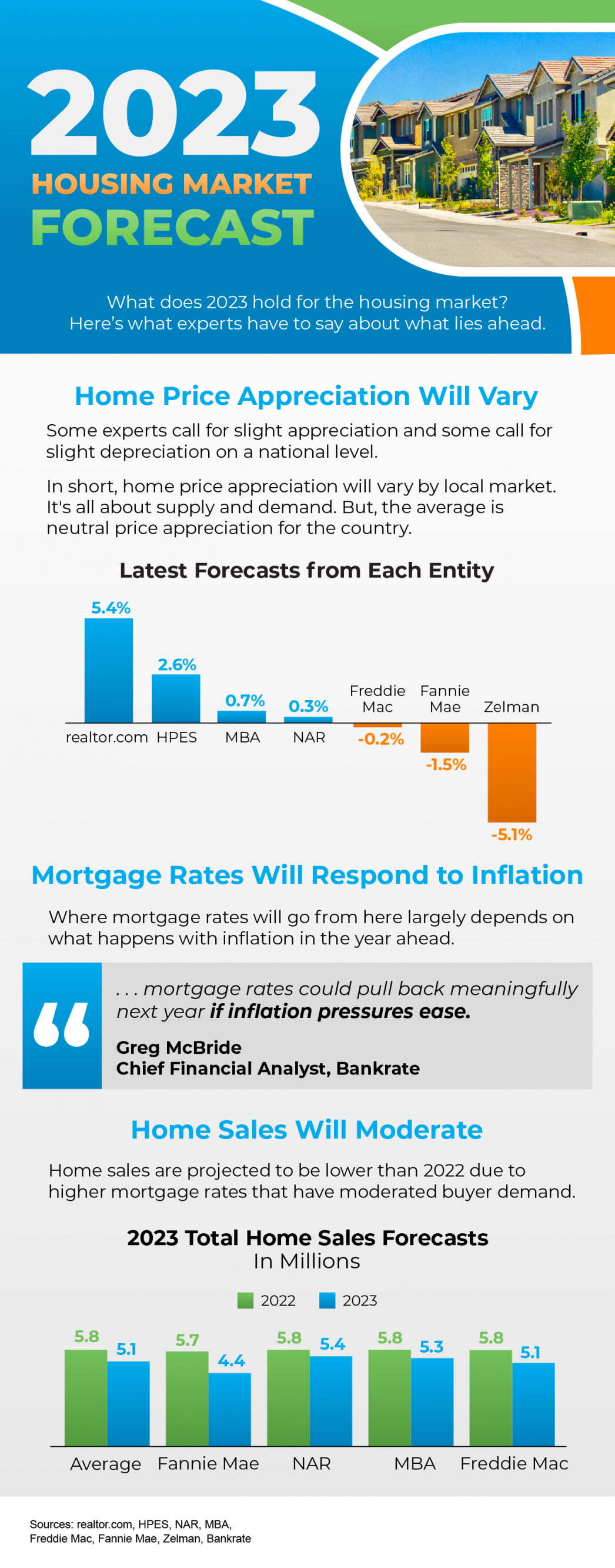

2023 Housing Market Forecast (National)

2023 Housing Market Forecast Some Highlights From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation. If you’re thinking of buying or selling a home this year, let’s connect so you...

Planning to Retire? It Could Be Time To Make a Move

Planning to Retire? It Could Be Time To Make a Move. If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs....