Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

What Homeowners Want To Know About Selling in Today’s Market

What Homeowners Want To Know About Selling in Today’s Market If you’re thinking about selling your house, you’re likely hearing about the cooling housing market and wondering what that means for you. While it's not the peak intensity we saw during the pandemic, we’re...

Should You Update Your House Before You Sell? Ask a Real Estate Professional

Should You Update Your House Before You Sell? Ask a Real Estate Professional Some Highlights You may be wondering what needs to be renovated before you sell your house. In today’s shifting market, making your house appealing is more important than ever. That’s why...

Home Equity: A Source of Strength for Homeowners Today

Home Equity: A Source of Strength for Homeowners Today Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says: “. . . don’t...

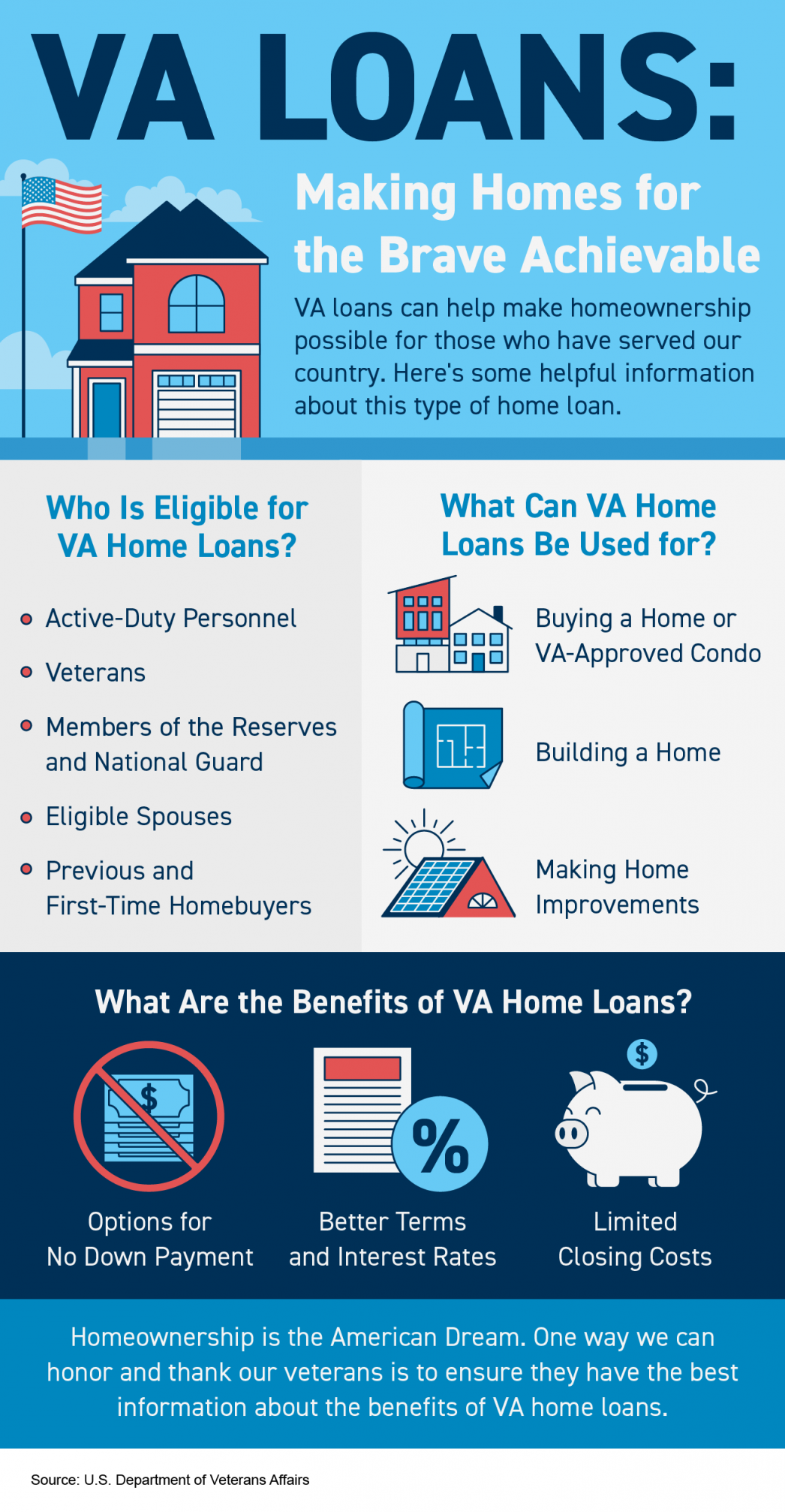

VA Loans: Making Homes for the Brave Achievable

VA Loans: Making Homes for the Brave Achievable Some Highlights VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a...

VA Loans Can Help Veterans Achieve Their Dream of Homeownership

VA Loans Can Help Veterans Achieve Their Dream of Homeownership For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand...

What’s Ahead for Mortgage Rates and Home Prices?

Utah Realty Blog & News The Latest news for Real Estate both local and National. Buyers Sellers SeniorsWhat’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next...

The Majority of Americans Still View Homeownership as the American Dream

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view...

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s...

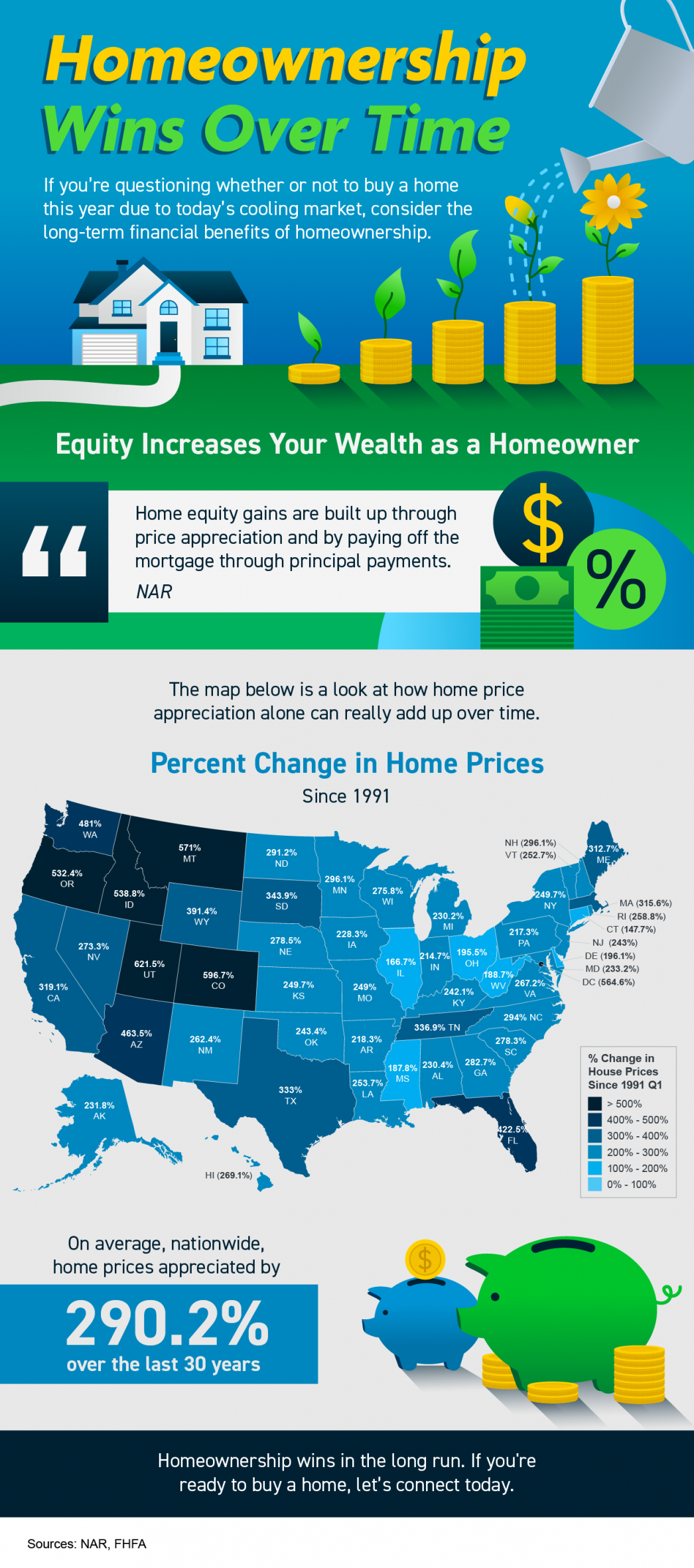

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...