[dflip id=”110394″][/dflip]

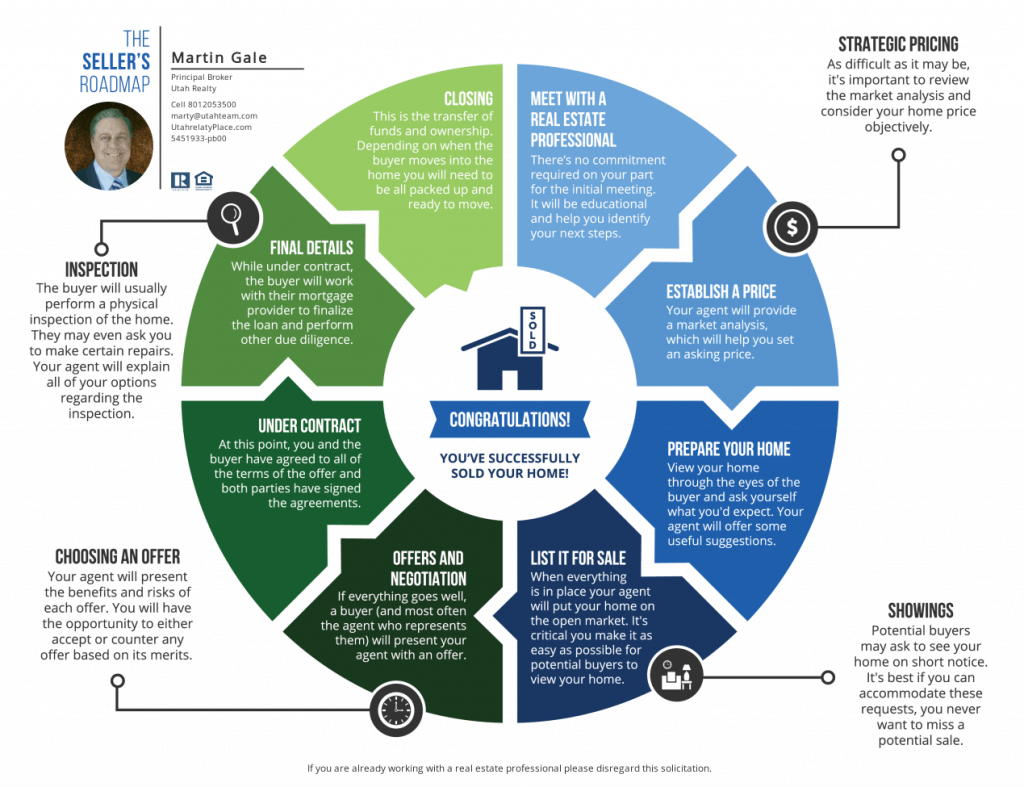

Selling your Home in the Greater Wasatch Front

When you make the decision to sell your home, you, as a seller, find that their are three basic choices: FSBO or For sale by owner. You may find or hear of a friend/neighbor/relative to possibly list with. Or, Better yet hire a thirty year proven real estate veteran team. The Gale Team are highly rated, top producing Realtors®. We specialize in representing sellers. I would hope you would give our team a close look. “As a native Utahan I know about the Greater Wasatch Front market, areas, schools, and recreation”

Why Hire Us?

Representing Sellers is what we do best at Utah Realty. Our past clients return to us because of our exceptional service. Should you choose to list your home with us, you are guaranteed to have a professional exceptional experience. You can count of us to get the job done! Here is what you can come to expect on when we represent you in the sale of your home.

WE CAN RECOGNIZE THE MARKET

WE UNDERSTAND the complexities of real estate transactions

WE NEGOTIATE as if each deal were our own home

WE CARE about our clients.

WE MARKET your property like nobody else

WE KNOW your home is your one of your most valuable assets, and it deserves to be treated as such.

ACTIVITIES WE DO FROM START TO FINISH WHEN LISTING YOUR HOME

PRE-LISTING ITEMS

- Contact property owner(s) and make appointment with seller(s) for listing presentation.

- Send seller(s) confirmation of listing appointment and call to confirm.

- Review pre-appointment questions.

- Research appropriate sampling of currently listed comparable properties (i.e., appropriate by property type, price range, and location).

- Research trends and sales activity for an appropriate period (past three to six months is recommended) from MLS and public records databases.

- Research “average days on market” for the property type, price range, and location.

- Download and review property tax roll information.

- Research property’s public record information for ownership and deed type.

- Research property’s public record information for lot size and dimensions.

- Research and verify legal description.

- Research property’s land use coding and deed restrictions.

- Research property’s current use and zoning.

- Ascertain need for lead-based paint disclosure.

- Prepare market analysis to establish broker opinion of value.

- Prepare listing-presentation package with above materials.

- Perform exterior “curb-appeal assessment” of subject property.

- Verify public-school zoning and discuss with the seller(s) the impact of school districts on market value determination.

- Review listing-appointment checklist to verify that all steps and actions have been completed.

LISTING APPOINTMENT ITEMS

- Review broker’s and company’s credentials and accomplishments in the market with seller(s).

- Present company’s profile and position of “niche” in the marketplace.

- Give seller(s) an overview and projections of current market conditions.

- Present market analysis results to seller(s), including sold comparables, current listings, and expired.

- Offer pricing strategy based on professional judgment and interpretation of current market conditions.

- Discuss goals with seller(s) to market effectively.

- Explain marketing power and benefits of the MLS.

- Explain the different marketing options and their effectiveness.

- Explain work the brokerage does “behind the scenes” and the broker’s availability on weekends.

- Explain brokerages role in taking calls to screen for qualified buyers and to protect seller(s) from curiosity seekers.

- Present and discuss strategic master marketing plan.

- Review results of curb-appeal assessment with seller(s) and provide suggestions to improve sale-ability.

- Research and verify city sewer/septic tank systems. Verify when property’s septic system was last pumped or inspected.

- Well water: Confirm well status, depth, and output from third-party well report.

- Natural gas: Research/verify the availability of natural gas and supplier’s name and phone number.

- Verify security system, current term of service, and determine if it’s owned or leased.

- Verify if seller(s) has transferable termite bond – obtain a copy of the terms and conditions of bond that may be available to buyer(s).

- Discuss home-warranty program with homeowner.

- Verify if property has rental units involved.

- Make copies of all leases for retention in listing file.

- Verify all rents and all deposits.

- Assess interior décor and suggest changes.

- Prepare net sheet for seller(s).

- Review accuracy of current title information with sellers. (If possible, obtain copies of seller(s)’ deed, owner’s title insurance policy, and most-recent survey.)

- Verify names of owner(s) as they appear in county’s public property records.

- Verify with seller(s) if there are any outstanding or expired construction permits or if any changes have been made to the property since the seller(s) purchased the property.

- Obtain copy of current Title Insurance Policy.

- Complete listing contract and addenda (using names of seller(s) as they appear on deed or title policy). Obtain seller(s)’ signature(s) on the listing agreement and return a signed copy of the listing contract to the seller(s). (If property is jointly owned, all owners should sign listing agreement.)

- Review with seller(s) the standard closing costs and pro-rations typical to the HUD statements.

- Obtain seller(s)’ permission to use a lock box.

- Measure interior room sizes.

- Confirm lot size via owner’s copy of certified survey, if available.

- Note any and all unrecorded property lines, agreements, and easements that are known to the seller if they are not otherwise noted.

- Obtain house plans, if applicable and available.

- Review house plans and make a copy.

AFTER THE LISTING

- Obtain copy of subdivision plat/complex layout.

- Verify with seller(s) if there are any outstanding or expired construction permits or if any changes have been made to the property since the seller(s) purchased the property.

- Obtain copy of current title insurance policy.

- Provide seller(s) with a copy of a blank sales contract to review in preparation of their receipt of an offer.

- Inform tenants of listing and discuss how showings will be handled.

- Arrange for installation of yard sign.

- Have seller(s) complete the seller(s)’ disclosure form.

WHILE THE PROPERTY IS LISTED

- Order plat map for retention in property’s listing file.

- Prepare showing instructions for buyer(s)’ broker and agree on showing-time window with seller(s).

- Install electronic lock box and program the lock box with agreed-upon showing-time windows.

- Obtain current mortgage loan(s) information: companies and loan account numbers.

- Verify current loan information with lender(s).

- Identify homeowner association manager, if applicable.

- Verify homeowner association fees and pending or unpaid assessments with homeowner association manager.

- Research electricity availability and supplier’s name and phone number.

- Prepare detailed list of property amenities and assess market impact.

- Prepare detailed list of property’s “inclusions and conveyances with sale.”

- Compile list of completed repairs and maintenance items.

- Explain benefits of homeowner warranty to seller(s).

- Assist sellers with completion and submission of homeowner-warranty application.

- Place homeowner warranty in property file for conveyance at time of sale.

- Make extra key for lockbox.

- Place a copy of the seller(s)’ completed disclosure form in the property file.

- Arrange for interior and exterior photos to be taken for MLS listing.

- Arrange for creation of a virtual tour if one will be used in marketing the property.

- Complete a new-listing checklist.

- Enter listing into office records and/or create listing file.

MARKETING AND SHOWING ACTIVITIES

- Create print and Internet ads with seller(s)’ input and approval.

- Provide “special feature” cards for marketing, if applicable.

- Submit ads to company’s participating Internet real estate sites.

- Reprint/supply brochures promptly as needed.

- Create QR codes.

- Prepare mailing and contact list.

- Generate mail-merge letters to contact list.

- Order “just listed” labels and reports.

- Prepare flyers.

- Prepare property marketing brochure for seller(s)’ review.

- Order an appropriate quantity of marketing brochures or flyers.

- E-mail marketing material to brokers and agents with marketing material.

- Upload listing to company and broker’s Internet site, if applicable.

- Mail out “just listed” notice to all neighborhood residents.

- Inform Network Referral Program of listing.

- Coordinate showings with owners, tenants, and other REALTORS®. Return all calls promptly (weekends included).

- Provide showing time comments and feedback to seller(s) and recommend changes according to potential buyer comments.

- Review comparable MLS listings and new trends regularly to verify property remains competitive in price, terms, conditions, and availability.

- Provide marketing data to buyers coming through international relocation networks.

- Provide marketing data to buyers coming from referral network.

- Convey price changes promptly to all Internet groups.

- Request feedback from buyers’ brokers after showings.

- Review weekly market study reports.

- Discuss feedback from showing sales associates with seller(s) to determine if changes will accelerate the sale.

- Call seller(s) weekly to discuss marketing and pricing.

- Promptly enter price changes in MLS listing database.

OFFER AND CONTRACT ACTIVITIES

- Verify proper licensure of buyer’s broker and salesperson.

- Obtain a signed and dated verification that escrow deposit was delivered to escrow agency.

- Receive and review all offer to purchase contracts submitted by buyers or buyers’ brokers.

- Evaluate offer(s) and prepare a “net sheet” on each offer, for the seller(s) to make comparisons.

- Review offers with seller(s) and review merits and weaknesses of each component of each offer.

- Contact buyers’ broker to review buyer(s)’ qualifications and discuss offer.

- Provide seller(s)’ disclosure to buyer(s)’ broker or buyer upon request (prior to offer if possible).

- Confirm buyer(s) is pre-approved by contacting lender.

- Obtain a copy of the buyer(s)’ pre-approval letter from lender.

- Negotiate all offers and counteroffers on seller(s)’ behalf.

- Prepare and convey any counteroffers, acceptance, or amendments to buyer(s)’ broker.

- When offer to purchase is accepted and signed by seller(s) (“contract”), deliver contract to selling/buyer(s)’ broker or if none, to buyer(s).

- Verify contract is signed by all parties.

- Provide copies of the contract and all addenda to closing attorney and the title company.

- Record and promptly deposit buyer(s)’ earnest money with escrow agent.

- Disseminate “under-contract showing restrictions” as seller(s) requests.

- Deliver copies of signed contract to seller(s).

- Provide copies of contract to lender.

- Inform seller(s) how to handle additional offers to purchase submitted between effective date of contract and closing.

- Change status in MLS to “sale pending”.

- Update listing file to show “sale pending”.

APPRAISAL ACTIVITIES

- Make arrangements for appraiser to enter property.

- Follow-up on appraisal.

- Enter appraisal completion into listing file.

- Discuss appraisal report with seller(s) and suggest options, if necessary.

CLOSING

- Distribute signed contracts to all involved parties (buyer, seller(s), title company, lender, seller(s)/buyer(s) broker, closing agent) and provide contact information as needed.

- Coordinate closing process with buyer(s)’ broker and lender.

- Update closing forms and files.

- Confirm location, date, and time where closing will be held and notify all parties.

- Confirm with closing agent that all title problems have been resolved.

- Confirm that the seller has the proper Power of Attorney or trust documents, as required.

- Work with buyer(s)’ broker in scheduling and conducting buyer(s)’ final walk-through prior to closing.

- Confirm with closing agent that all tax, HOA, utility, and other applicable pro-rations have been resolved.

- Request final closing figures from closing agent.

- Review closing figures on HUD statement with seller(s) to verify accuracy of preparation.

- Forward verified closing figures to buyer(s)’ broker and confirm buyer(s)’ broker has received and reviewed closing figures.

- Confirm buyer(s) and Buyer(s)’ broker has received title insurance commitment.

- Provide homeowners warranty for availability at closing.

- Recommend courtesy closing agent for absentee seller(s), as needed.

- Review closing documents with seller(s) and their counsel.

- Provide earnest money deposit check from escrow account to closing agent. If closing agent is holding escrow funds make sure it appears on the final HUD.

- Coordinate this closing with seller(s)’ next purchase and resolve any timing problems, if applicable.

- Confirm seller(s)’ net proceeds check at closing.

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....