Starting the Search for Your Dream Home? Here Are 5 Tips!

In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared.

In a realtor.com article entitled, “How to Find Your Dream Home—Without Losing Your Mind,” the author highlights some steps that first-time homebuyers can take to help carry their excitement of buying a home throughout the whole process.

1. Get Pre-Approved for a Mortgage Before You Start Your Search

One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach.

This step will also help you narrow your search based on your budget and won’t leave you disappointed if the home you tour, and love, ends up being outside your budget!

2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

Before you start your search, list all the features of a home you would like and then qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help keep you focused on what’s most important.

3. Research and Choose a Neighborhood You Want to Live In

Every neighborhood has its own charm. Before you commit to a home based solely on the house itself, the article suggests test-driving the area. Make sure that the area meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

4. Pick a House Style You Love and Stick to It

Evaluate your family’s needs and settle on a style of home that would best serve those needs. Just because you’ve narrowed your search to a zip code, doesn’t mean that you need to tour every listing in that zip code.

An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

5. Document Your Home Visits

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy to document what you love and don’t love about each property you visit.

Making notes on the listing sheet as you tour the property will also help you remember what the photos mean, or what you were feeling while touring the home.

Bottom Line

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home.

Winter Savings Tips for 2025 Homebuyers

Track your spending this winter to identify areas for cost-cutting before buying a home in 2025. Winter-proof your home to reduce energy bills and save money during the colder months.

Western state governors eye public lands for affordable housing development

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Utah’s Fall Housing Market Shows Growth Despite Higher Prices

Utah's fall housing market in 2024 experienced a 1.6% increase in home prices and a 12.5% rise in sales compared to the previous year, with a median home price of $553,000. In Salt Lake City, prices rose by 7.3% to an average of $550,000, although sales decreased...

What Makes Your Home Sell Faster?

Pricing slightly below market value attracts multiple offers and encourages faster sales across regions. Well-maintained exteriors and appealing landscapes boost property attractiveness in any climate.

Thanksgiving The True Meaning

Thanksgiving Day, celebrated predominantly in the United States, is often symbolized by the quintessential turkey dinner and indulgent pies, marking a period of feasting and familial gatherings. However, the essence of this holiday transcends beyond the mere...

Should you have your home pre-appraised before placing it on the Market?

In the complex and often unpredictable journey of selling a home, understanding the value of your property through a pre-listing appraisal emerges as a critical step that can significantly impact the outcome of your sale. This introduction to pre-listing appraisals...

State of Utah Market Update – Residential Homes

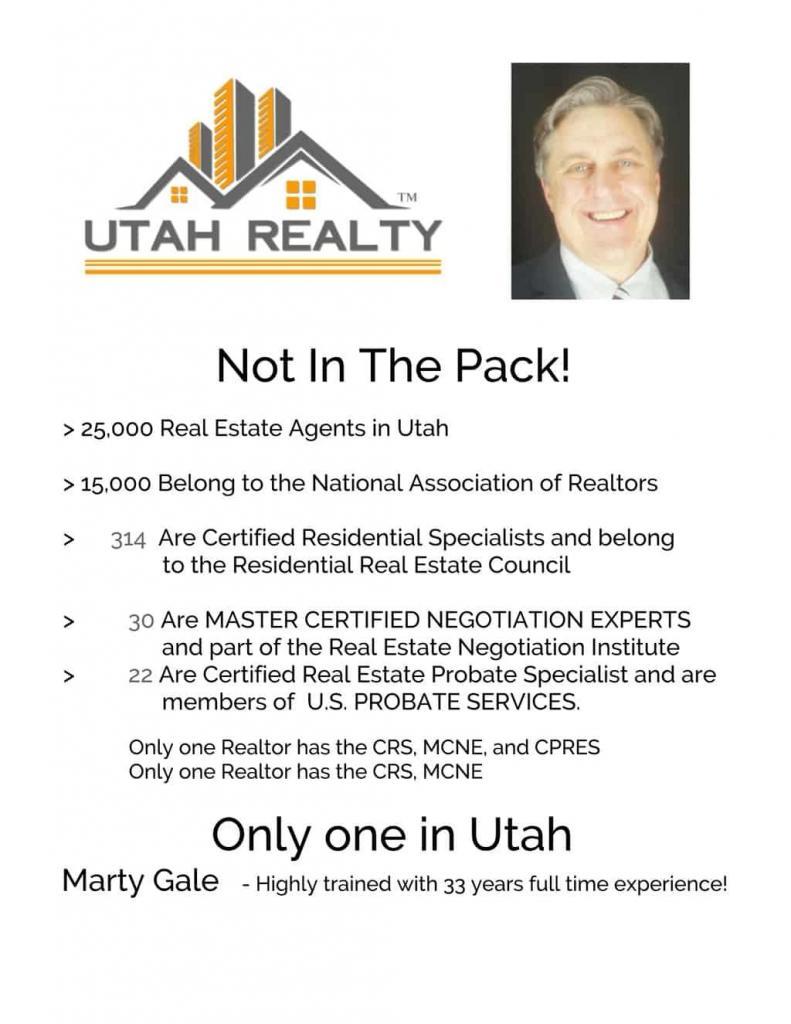

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING...

6 Must-Haves for a 2025 Home Sale

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor 2000 (in-active) e-pro (advanced digital marketing)...

Top 8 most asked questions from Home Buyers and Sellers.

Top 8 most asked questions Home Buyers and Sellers ask From Home Buyers 1. **What is the current market condition?** Buyers want to know whether it’s a buyer’s or seller’s market to gauge competition and pricing. 2. **What are the property taxes and homeowners...

Navigating Complex Transactions: The Broker Benefit over using a Real Estate Agent

Navigating Complex Transactions: The Broker Benefit In the intricate world of real estate transactions, the distinction between opting for a broker over an agent plays a pivotal role in not just simplifying the process, but in elevating the entire experience....