With mortgage rates soaring to unprecedented heights, it’s crucial for homebuyers to understand the common misconceptions they may have about obtaining a mortgage. In particular, first-time homebuyers often find themselves treading in unfamiliar territory. Join us as we unveil the ten most common mistakes homebuyers make when it comes to securing a mortgage in the current market. Whether you’re feeling overwhelmed or simply seeking clarity, this article will serve as your trusty guide to navigating the turbulent waters of today’s home loan process.

Overlooking The Importance Of Credit Scores and Financial History

When it comes to securing a mortgage in the current real estate market, there are many factors that homebuyers need to consider. While rising mortgage rates certainly add an extra layer of complexity to the process, one crucial aspect that often gets overlooked is the importance of credit score and financial history.

Your credit score plays a significant role in determining your eligibility for a mortgage and the interest rate you will be offered. Lenders use this three-digit number as an indicator of your creditworthiness and ability to handle debt. Generally, the higher your credit score, the better your chances of getting approved for a mortgage and securing a favorable interest rate.

Unfortunately, many homebuyers underestimate the impact that their credit score can have on their mortgage application. Sometimes, they assume that their credit score is good enough without checking their credit report thoroughly. However, it’s essential to review your credit report regularly to ensure its accuracy and address any potential issues that may arise.

Before beginning the home loan process, it’s crucial to take proactive steps to improve your credit score. This might involve reducing your existing debt, making payments on time, and avoiding new credit applications that could negatively impact your score. By demonstrating responsible financial behavior, you can boost your creditworthiness and enhance your chances of securing a mortgage at a favorable rate.

Another aspect that homebuyers often overlook is their financial history. Lenders will carefully examine your financial records to assess your ability to handle mortgage repayments. They will scrutinize your income, employment stability, and overall financial health. If you have a stable employment history and a steady stream of income, it shows lenders that you have the means to afford a mortgage payment.

For first-time homebuyers, it’s crucial to have a clear understanding of your financial history and ensure that it is in good order before applying for a mortgage. This may involve gathering necessary documents such as tax returns, pay stubs, and bank statements, which lenders will scrutinize during the application process. By having these documents readily available and organized, you can streamline the application process and increase your chances of approval.

Moreover, it’s essential to be realistic about your financial situation and not overextend yourself. Some homebuyers make the mistake of aiming for a mortgage that is beyond their means, leading to financial stress or potential default. Instead, be honest about your budget and choose a mortgage that aligns with your income and expenses.

In today’s challenging mortgage environment, overlooking the importance of credit score and financial history can be a costly mistake for homebuyers. Taking proactive steps to improve your credit score, reviewing your credit report regularly, and ensuring your financial history is in order are essential elements of the home loan process.

By prioritizing these aspects and aligning them with your financial goals, you can increase your chances of securing a mortgage at a favorable rate and pave the way towards successful homeownership. Remember, a solid credit score and a strong financial history not only benefit you in securing a mortgage right now but also set a strong foundation for future financial endeavors.

Underestimating The Impact Of High Mortgage Rates On Affordability

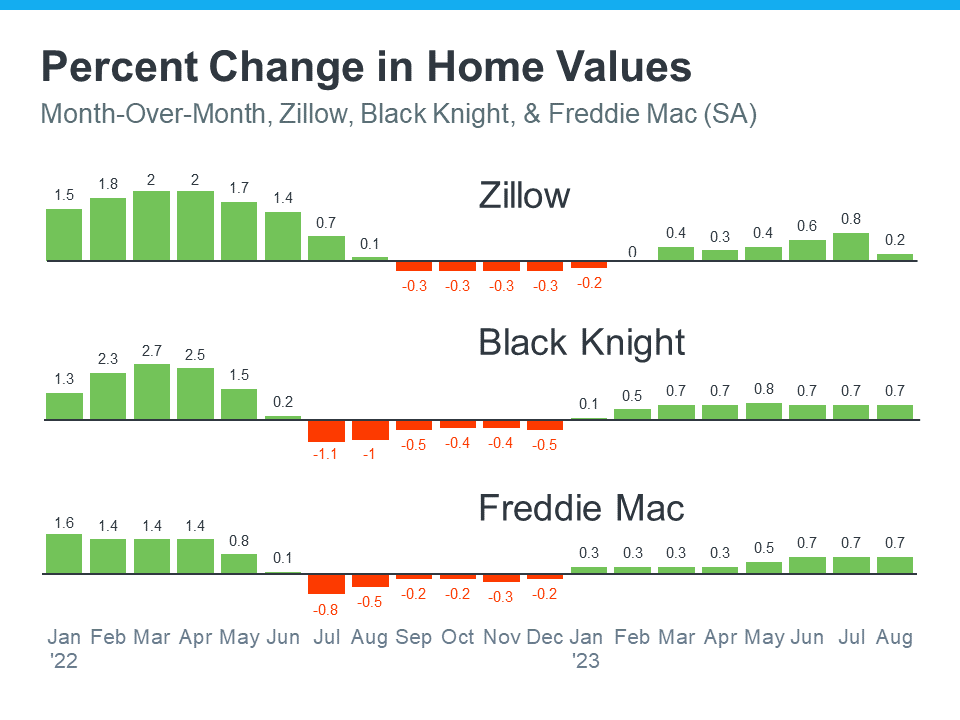

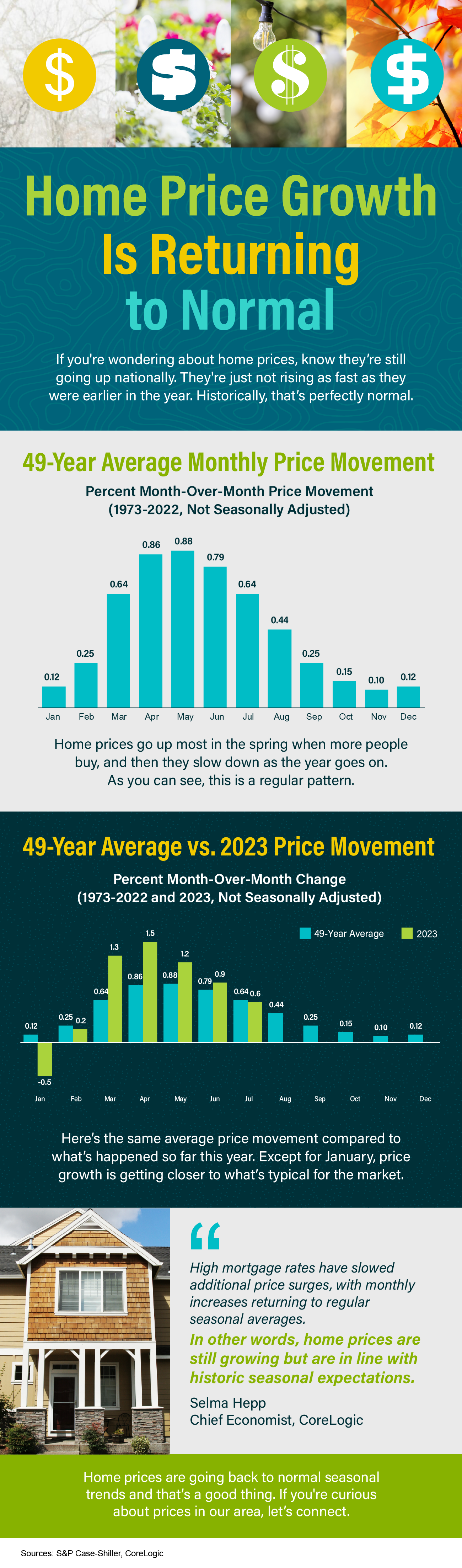

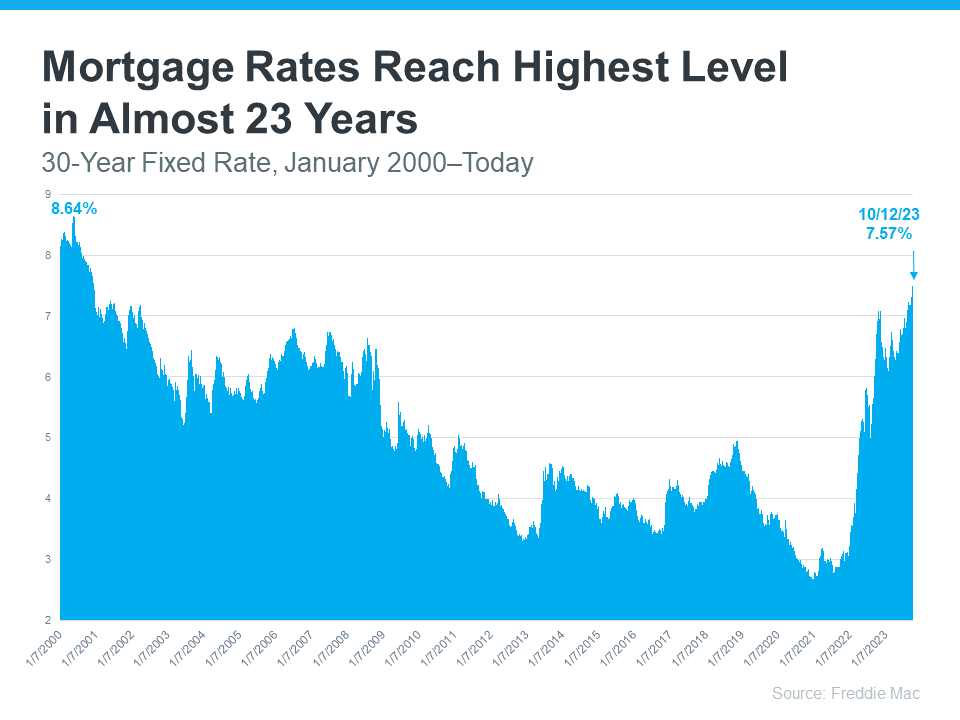

As homebuyers search for their dream homes in today’s real estate market, one significant factor that often gets underestimated is the impact of high mortgage rates on affordability. With interest rates on the rise, it’s crucial for homebuyers, particularly first-time buyers, to understand how these rates can affect their ability to purchase a home.

First and foremost, it’s essential to comprehend the relationship between mortgage rates and affordability. Mortgage rates directly impact the cost of borrowing money to purchase a home. When rates are high, the monthly mortgage payments increase, making it more difficult for buyers to afford the home they desire. This is particularly true for those who are already stretching their budget to purchase their first home.

Higher mortgage rates not only affect the affordability of a home purchase but also have a ripple effect on other aspects of the housing market. When rates rise, the overall cost of homeownership increases, leading to a potential decrease in housing demand. As a result, sellers may be forced to lower their asking prices or face a longer time on the market. This can create opportunities for buyers, but it also suggests a more competitive buying environment.

Additionally, high mortgage rates can impact the type of loan a homebuyer qualifies for. With higher rates, buyer’s purchasing power decreases, potentially limiting the loan amount they can secure. Some buyers may need to readjust their expectations or explore other financing options to make their homeownership dreams a reality.

Furthermore, it’s important to note that high mortgage rates can influence the overall affordability of homeownership, considering the additional costs that come with owning a home. While the monthly mortgage payment is a significant factor, it’s crucial to consider other expenses like property taxes, homeowner’s insurance, and ongoing maintenance and repairs. All these factors should be calculated into the budget to ensure that the home you find is within your financial means.

To navigate the impact of high mortgage rates on affordability, prospective homebuyers should take a proactive approach and educate themselves. Start by thoroughly researching current mortgage rates and trends in your area. Understanding the market and knowing what rates you qualify for can help you be realistic about your budget and make informed decisions during your home search.

Additionally, working with a reputable mortgage lender and pre-qualifying for a loan can provide you with a clearer picture of your buying power. By getting pre-approved for a mortgage, you’ll have a better understanding of the loan amount you qualify for and can confidently make offers within your budget.

Lastly, consider consulting with a trusted real estate agent who specializes in your target market. These professionals have their finger on the pulse of market conditions and can help you navigate the complexities associated with high mortgage rates and affordability. They can provide valuable insights, help you understand your options, and negotiate on your behalf to secure the best deal possible.

In conclusion, underestimating the impact of high mortgage rates on affordability is a common mistake made by many homebuyers, especially first-timers. By recognizing the relationship between rates and affordability, and taking proactive steps such as thorough research, pre-qualification, and expert guidance, homebuyers can successfully navigate the complexities of today’s sky-high mortgage rates. Don’t let this important factor catch you off guard – be prepared and equipped to make sound financial decisions on your journey to homeownership.

Ignoring The Benefits Of Pre-Approval In A Competitive Market

In today’s competitive housing market, where mortgage rates are at an all-time high, it is crucial for homebuyers to understand the importance of pre-approval. However, many first-time homebuyers often overlook or underestimate the benefits that come with obtaining a pre-approval before starting their house-hunting journey. Ignoring the advantages of pre-approval in a competitive market can be a costly mistake.

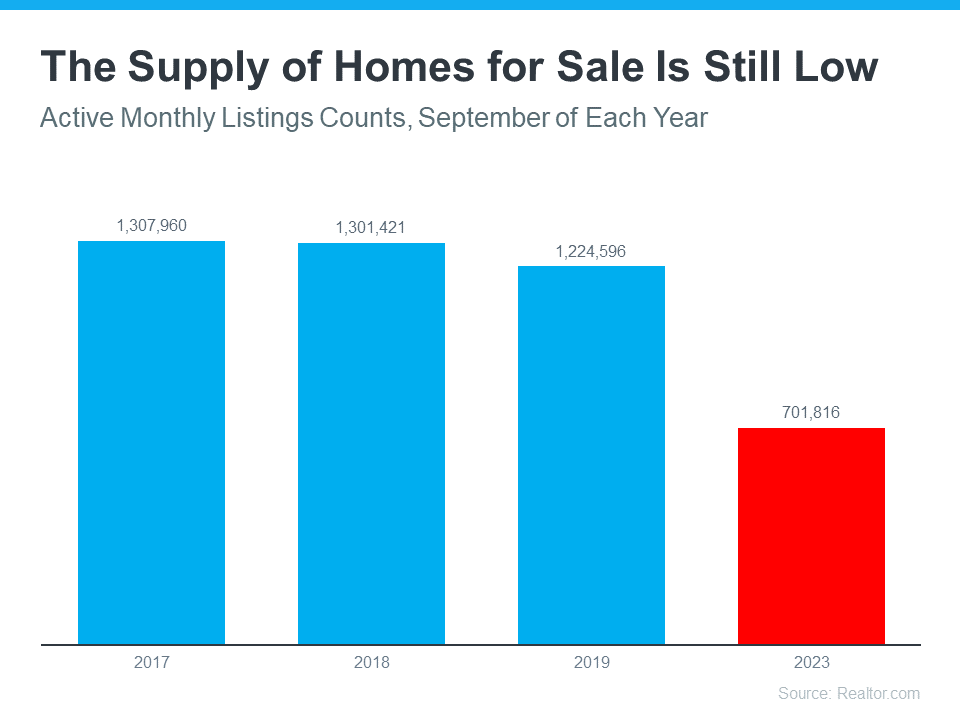

One of the biggest misconceptions regarding pre-approval is that it is unnecessary or can be done later in the home buying process. But in reality, pre-approval is an essential step that helps potential buyers stand out in a crowded market. With so many interested buyers vying for limited housing inventory, having a pre-approval letter in hand shows sellers that you are serious and financially capable of making an offer. It gives you a competitive edge and allows you to move quickly when the right property comes along.

Another common misconception is that pre-qualification and pre-approval are the same. While both involve assessing your financial situation, pre-approval carries more weight. Pre-qualification is a preliminary assessment of your financial fitness based on self-reported information. On the other hand, pre-approval involves a thorough examination of your financial standing by a lender who verifies your income, credit history, and debt-to-income ratio. It provides a stronger guarantee of your borrowing capacity and helps streamline the mortgage application process.

One of the key benefits of pre-approval is that it helps you set a realistic budget. By undergoing a thorough review of your financial documents, a lender can determine the maximum loan amount you qualify for. This knowledge allows you to focus your house hunt on properties within your price range, eliminating the frustration of falling in love with a home only to realize later that it is beyond your financial means.

Moreover, pre-approval can save you time and energy by narrowing down the properties you should consider. It helps you stay focused on homes that are within your budget and ensures you are not wasting time on properties that you cannot afford. This targeted approach improves your chances of finding a suitable home quickly.

Additionally, getting pre-approved allows you to shop for a mortgage with confidence. With a pre-approval letter, you have a clear understanding of the interest rate you qualify for, which gives you a better idea of your monthly mortgage payments. This information empowers you to make informed decisions and negotiate better terms with lenders.

Furthermore, in a competitive market, sellers often prioritize buyers who have already secured financing. By having a pre-approval letter, you position yourself as a serious buyer who is ready to move forward without hurdles. This can give you an advantage in multiple offer situations, as sellers are more likely to accept an offer from a buyer who has already secured financing over someone who has not.

Lastly, going through the pre-approval process gives you an opportunity to identify any potential red flags in your financial profile. If there are any issues that could impact your ability to secure a mortgage, such as errors in your credit report or high debt levels, pre-approval allows you to address them early on. This gives you time to rectify any discrepancies and improve your chances of securing a favorable loan.

Overall, ignoring the benefits of pre-approval in a competitive housing market is a mistake that can hinder your chances of successfully securing a mortgage. It is an important step that provides you with a clear understanding of your financial position and gives you the advantage of being a serious, prepared buyer. By integrating pre-approval into your homebuying strategy, you can navigate today’s complex mortgage landscape with confidence and increase your chances of finding your dream home.

Misjudging The Importance Of Down Payment Size In Mortgage Approval

One of the most common misconceptions that homebuyers tend to have when it comes to getting a mortgage right now is the misjudgment of the importance of down payment size in mortgage approval. Many first-time homebuyers, in particular, often underestimate the significance of the down payment in the home loan process, especially considering the current sky-high mortgage rates.

It is crucial for potential homebuyers to understand that the down payment plays a significant role in mortgage approval and can have a substantial impact on the terms and conditions of the loan. In the current market conditions, where interest rates are high, lenders are more cautious and stricter with their lending criteria. This means that having a larger down payment can greatly increase your chances of obtaining a mortgage and potentially securing more favorable terms.

One of the biggest advantages of a larger down payment is that it reduces the loan-to-value ratio (LTV), which is the percentage of the property’s value that you are financing through the mortgage. The lower the LTV, the less risky the loan is for the lender, and they may be more willing to offer a lower interest rate or waive certain fees. Additionally, a lower LTV can also help you avoid private mortgage insurance (PMI), which is typically required for borrowers with a down payment of less than 20%.

Another important point to consider is that a larger down payment demonstrates financial stability and commitment to the loan. Lenders often view borrowers with a substantial down payment as less likely to default on their mortgage payments. This gives them more confidence in approving the loan, even with the current high mortgage rates.

Furthermore, having a larger down payment can also positively impact your affordability and help you secure a more manageable monthly mortgage payment. A lower loan amount means lower monthly repayments, which can significantly reduce the financial strain of homeownership. This, in turn, can provide you with more flexibility and peace of mind in managing your household budget, despite the current mortgage rate environment.

It is essential for homebuyers to carefully consider their financial circumstances and goals when determining the appropriate down payment size. While it may be tempting to aim for the minimum required down payment, it is often advantageous to save up and strive for a higher percentage. Saving for a larger down payment may require discipline and patience, but the long-term benefits can be significant.

In conclusion, many homebuyers mistakenly underestimate the importance of down payment size when seeking a mortgage in today’s sky-high mortgage rate environment. A larger down payment can increase your chances of mortgage approval, secure more favorable terms, and potentially help you avoid additional costs such as private mortgage insurance. It also demonstrates financial stability and commitment to the loan, which can be reassuring to lenders. So, for those navigating the home loan process amid these complicated conditions, it is vital to recognize the significance of the down payment and make informed decisions to ensure a smoother homebuying journey.

Not considering first-time homebuyer programs

Not considering first-time homebuyer programs

When it comes to purchasing a home, many first-time buyers make the mistake of not exploring the various first-time homebuyer programs available to them. These programs are specifically designed to provide assistance and support to those who are looking to enter the housing market for the first time. By bypassing these programs, homebuyers may be missing out on valuable opportunities to secure favorable terms and financial assistance.

One of the main misconceptions surrounding first-time homebuyer programs is that they are only available to those with low income or poor credit. While these programs do prioritize individuals with certain financial limitations, there are often options available for individuals across a wide range of income brackets. Programs such as down payment assistance, grants, and low-interest loans can significantly alleviate the financial burden of purchasing a home.

One such program is the Federal Housing Administration (FHA) loan program. This government-backed initiative allows first-time homebuyers to secure a mortgage with a lower down payment requirement and more flexible credit standards compared to conventional loans. The FHA loans offer competitive interest rates and are usually more accessible for borrowers with limited savings or lower credit scores.

Another popular program is the Veterans Affairs (VA) loan program, which provides assistance to eligible military veterans, active-duty service members, and surviving spouses. VA loans offer advantageous terms, including no down payment requirements, no mortgage insurance, and competitive interest rates. Additionally, the U.S. Department of Agriculture (USDA) loan program provides home financing options for rural and suburban homebuyers, and it offers low or no down payment options.

First-time homebuyer programs are not merely limited to mortgage assistance. Some initiatives also offer educational resources and counseling, which can be invaluable for first-time buyers who may be unfamiliar with the home buying process. These resources can provide guidance on topics such as budgeting, credit improvement, and navigating the complex mortgage landscape.

It is important for potential homebuyers to thoroughly research and understand the first-time homebuyer programs available in their specific region. Local governments and organizations often provide additional assistance programs tailored to the needs of the community. By taking advantage of these programs, homebuyers can access a range of benefits, including lower down payment requirements, reduced closing costs, and even subsidies.

In today’s climate of sky-high mortgage rates, it has become increasingly crucial for first-time homebuyers to explore and take advantage of these programs. With rising home prices and tightening lending standards, the financial burden of purchasing a property can seem overwhelming. However, by utilizing first-time homebuyer programs, homebuyers can greatly improve their chances of successfully navigating the home loan process and realizing their dream of homeownership.

In conclusion, not considering first-time homebuyer programs is a common mistake made by homebuyers, which can potentially cost them valuable financial assistance and benefits. These programs are specifically designed to help first-time buyers overcome the challenges associated with purchasing a home, particularly in today’s environment of high mortgage rates. By exploring and utilizing these programs, homebuyers can obtain the necessary support to secure a mortgage and embark on their journey toward homeownership.

Picking the wrong type of loan

Picking the wrong type of loan

When it comes to obtaining a mortgage, one of the most crucial decisions homebuyers make is selecting the right type of loan. However, in today’s complex and ever-changing mortgage market, many homebuyers often make the mistake of picking the wrong type of loan, which can have significant consequences on their financial well-being in the long run.

One of the first things homebuyers need to understand is that not all mortgages are created equal. There are several different types of loans available, each with its own set of terms, interest rates, repayment schedules, and benefits. It’s important to thoroughly research and understand the options before making a decision.

For instance, one common mistake is assuming that a fixed-rate mortgage is always the best choice. While fixed-rate mortgages offer stability and predictability by locking in the interest rate for the entire loan term, they may not be ideal for everyone. If a homebuyer plans to move or sell the property within a few years, an adjustable-rate mortgage (ARM) with a lower initial interest rate might be a better fit. ARMs typically have an initial fixed-rate period followed by periodic adjustments based on an index. Understanding the features and risks associated with different loan types can help homebuyers make an informed decision that aligns with their specific circumstances and financial goals.

Another misconception that homebuyers often have is believing they need a large down payment to qualify for a mortgage. While a larger down payment can certainly have its advantages, such as reducing the overall loan amount and potentially avoiding private mortgage insurance (PMI), it is not always necessary or feasible for everyone. There are various loan programs, such as Federal Housing Administration (FHA) loans, that offer more flexible down payment requirements, often as low as 3.5%. Additionally, some lenders offer conventional loans with down payments as low as 3% through programs like Fannie Mae’s HomeReady or Freddie Mac’s Home Possible. By exploring different loan options and understanding the potential trade-offs, homebuyers can find a loan that fits their financial situation without getting trapped in the misconception that a huge down payment is always required.

Furthermore, homebuyers sometimes overlook the importance of shopping around for the best mortgage rate and terms. Comparing offers from multiple lenders is crucial for ensuring that homebuyers secure the most favorable loan terms possible. Many people mistakenly assume that all lenders offer the same rates and terms, but this is far from the truth. Rates and loan fees can vary significantly among lenders, and even a small difference in the interest rate can have a substantial impact on the total cost of the mortgage over time. Homebuyers should take advantage of online comparison tools, consult with mortgage brokers or loan officers, and thoroughly evaluate offers from different lenders to find the most advantageous deal for their individual circumstances.

Lastly, one mistake that first-time homebuyers often make is underestimating the importance of their credit score. Your credit score plays a vital role in determining the interest rate you will qualify for and the overall cost of your mortgage. Lenders consider credit scores as an indication of your ability to manage debt responsibly. The higher your credit score, the more likely you are to secure a lower interest rate, which can save you a significant amount of money over the life of the loan. It is important for homebuyers to regularly monitor their credit reports, work on improving their credit score if necessary, and maintain good credit habits to position themselves for the most favorable mortgage terms.

In conclusion, picking the wrong type of loan can have serious implications for homebuyers. It is crucial to thoroughly understand the different loan options available, research and compare rates and terms from multiple lenders, and pay attention to credit scores when navigating the home loan process. By avoiding common misconceptions and making informed decisions, homebuyers can secure the right mortgage that aligns with their financial situation, making the homebuying journey a more successful and rewarding experience.

Not shopping around for the right lender

Not shopping around for the right lender

When it comes to navigating the home loan process, one of the biggest mistakes that homebuyers make is not shopping around for the right lender. In today’s sky-high mortgage rate environment, finding the right lender can make a world of difference in terms of interest rates, loan terms, and overall affordability.

Many first-time homebuyers may feel overwhelmed by the mortgage process, which can lead them to simply choose the first lender that comes their way. However, this approach can be a costly mistake. Different lenders offer different rates and fees, so it’s crucial to do your homework and compare multiple options.

One of the main reasons why homebuyers fail to shop around is the misconception that all lenders offer the same rates and terms. This is far from the truth. Mortgage rates can vary significantly from lender to lender, and even a small difference in interest rates can have a substantial impact on your monthly mortgage payment and long-term financial goals.

By not shopping around for the right lender, homebuyers may end up paying thousands of dollars more in interest over the life of their loan. This can place a significant burden on their finances and limit their ability to achieve other financial goals, such as saving for retirement or funding their children’s education.

Moreover, not shopping around for the right lender means missing out on potential savings and incentives. Some lenders offer special programs or discounts for first-time homebuyers, veterans, or specific professional groups. By exploring different lenders, you increase your chances of finding a loan program that is tailored to your needs and offers additional benefits.

Another important aspect of shopping around for the right lender is finding one that is responsive and provides excellent customer service. The mortgage process can be complex and time-consuming, and having a lender who is easily accessible, transparent, and willing to answer your questions can make a world of difference in your overall experience.

To avoid falling into this common mistake, take the time to research and compare lenders. Start by gathering recommendations from friends, family, and real estate professionals. Additionally, use online resources, such as mortgage rate comparison websites, to get a better understanding of the current interest rate landscape and to compare different lenders.

Once you have a list of potential lenders, reach out to them directly to discuss your specific situation and loan needs. Take note of their responsiveness, level of knowledge, and willingness to address your concerns. Obtaining loan estimates from multiple lenders will also enable you to compare the total cost of each loan, including fees, closing costs, and interest rates.

Remember that finding the right lender is not solely about getting the lowest interest rate. It’s also important to consider the lender’s reputation, experience, and ability to provide tailored solutions for your unique circumstances.

In conclusion, not shopping around for the right lender is a common mistake that homebuyers make during the mortgage process. By taking the time to research and compare multiple lenders, you can potentially save thousands of dollars in interest, benefit from special programs or incentives, and ensure a smooth and positive experience. Don’t underestimate the importance of finding the right lender – it can make a world of difference in your home loan journey.