3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

The Overlooked Financial Advantages of Homeownership

The Overlooked Financial Advantages of Homeownership There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can...

Why the Electoral College Is So Important

Why The Electoral College Is So Important?

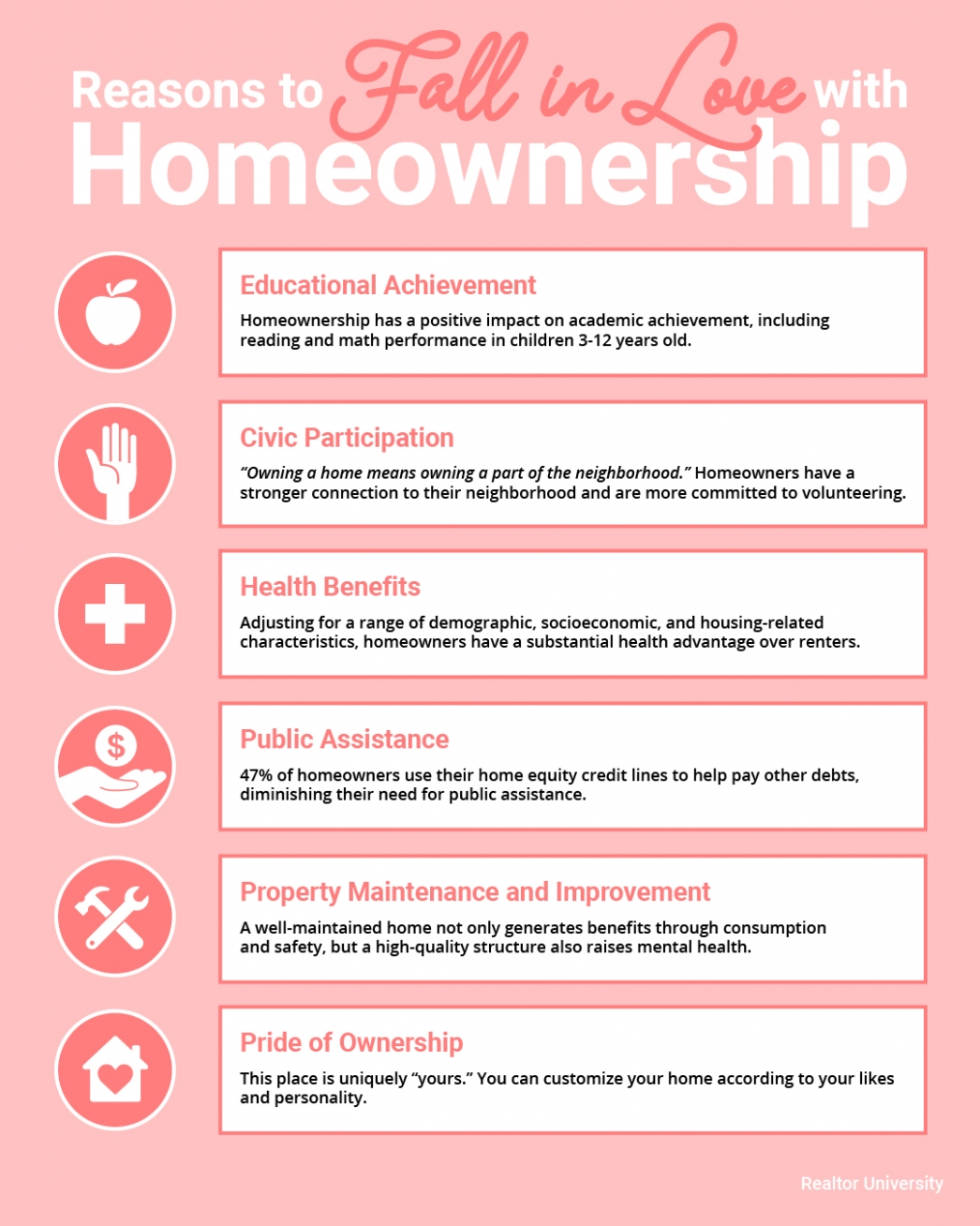

Reasons to Fall in Love with Homeownership

Reasons to Fall in Love with Homeownership Some Highlights: There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these...

Home Prices Are on the Rise This Year and to 2024

Home prices are appreciating, and they're forecasted to continue doing so through the next few years. Let's connect to see if now is a great time to make your next move.

How the Housing Market Benefits with Uncertainty in the World

How the Housing Market Benefits with Uncertainty in the World It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have...

The #1 Reason to List Your House Right Now

The #1 Reason to List Your House Right Now The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that...

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Underwater with Two Mortgages? Here are 5 Ways to Refinance Having a second mortgage or home equity line can make refinancing an underwater mortgage nearly impossible, but one of these five strategies might bail out your refinance. The mortgage market is awash in...

Homeownership Rate on the Rise to a 6-Year High

Homeownership Rate on the Rise to a 6-Year High Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing...

How Pricing Your Home Right Makes a Big Difference

How Pricing Your Home Right Makes a Big Difference Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is...

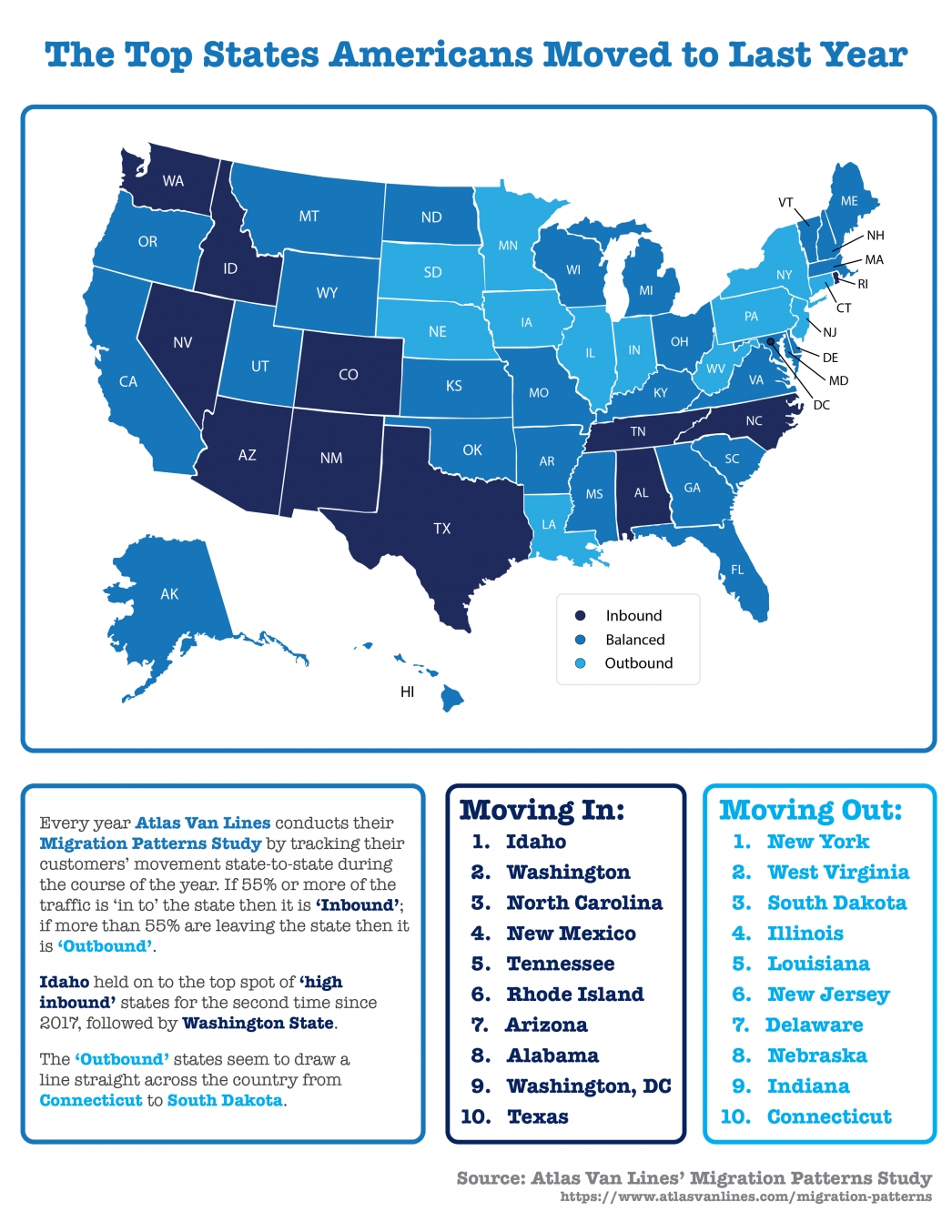

The Top States Americans Moved to Last Year

The Top States Americans Moved to Last Year Some Highlights: Americans are on the move, and the most recent Atlas Van Lines Migration Patterns Survey tracked the 2019 traffic flow from state-to-state. Idaho held on to the top spot of ‘high inbound’ states for the...