The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

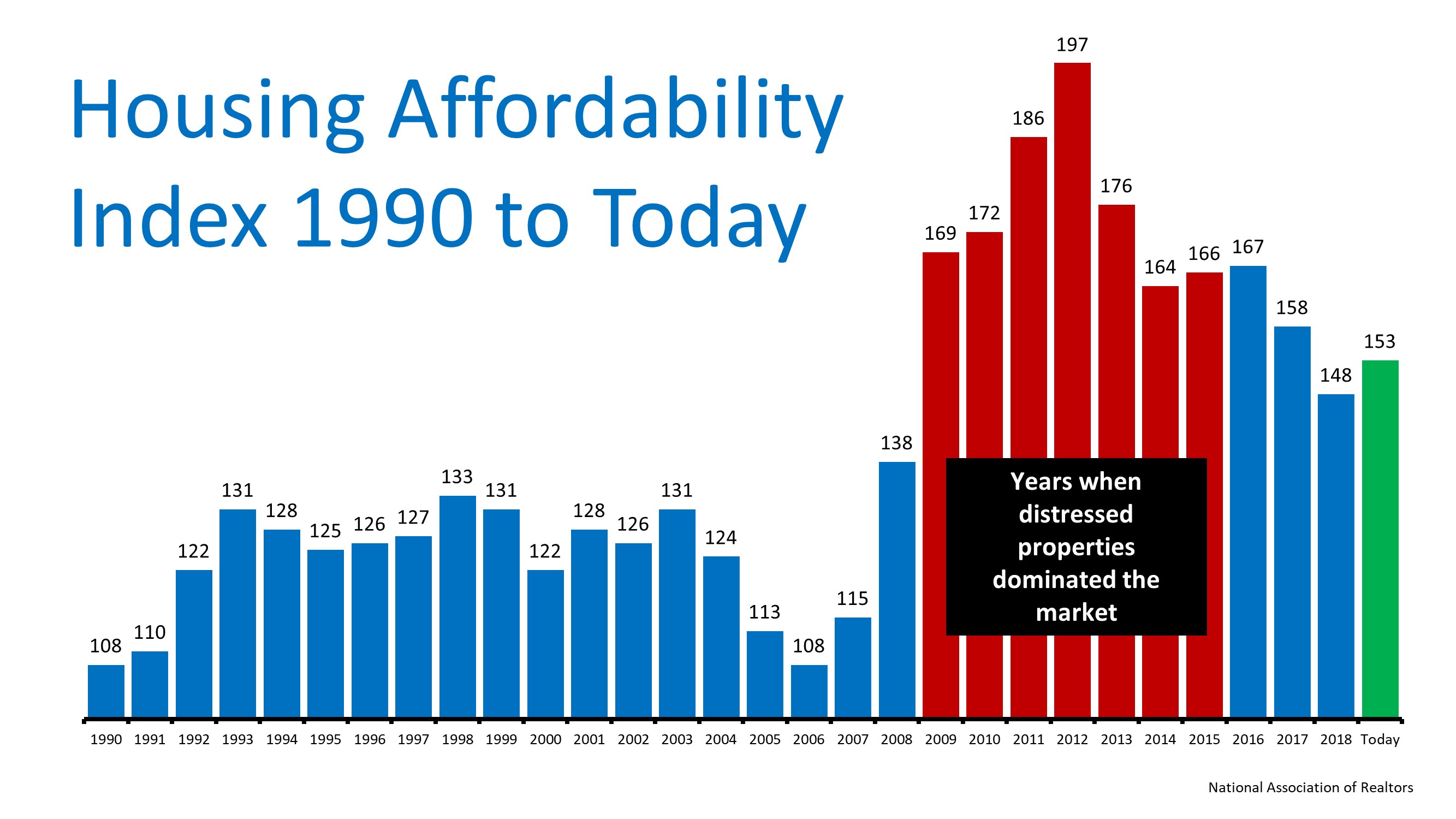

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

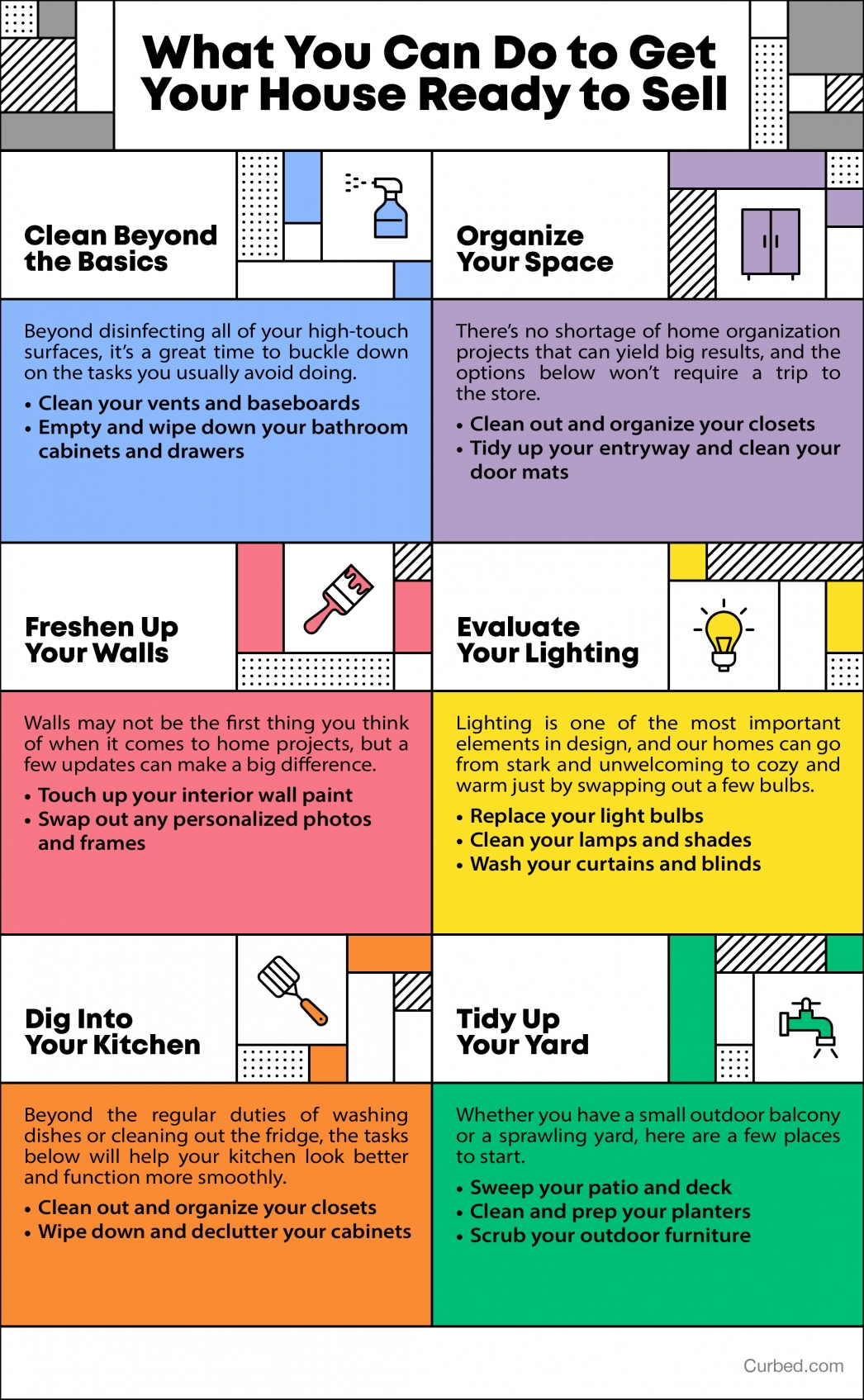

What You Can Do to Get Your House Ready to Sell

What You Can Do to Get Your House Ready to Sell Some Highlights: Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store. Your real estate plans don’t have to be completely on hold even while we’ve hit the...

Why Home Office Space Is More Desirable Than Ever

Why Home Office Space Is More Desirable Than EverFor years, we’ve all heard about the most desirable home features buyers are looking for, from upgraded kitchens to remodeled bathrooms, master suites, and more. The latest on the hotlist, however, might surprise...

Will Surging Unemployment Crush Home Sales?

Will Surging Unemployment Crush Home Sales?Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many...

Auto DraftWhy Pre Approval Is a Great Step to Take Today

Why Pre Approval Is a Great Step to Take Today If you’re in the position to buy a home this year, pre-approval is something you can still do right now to get ahead in the homebuying process. Let’s connect to talk about your goals for 2020.

The Housing Market Is Positioned to Help the Economy Recover

The Housing Market Is Positioned to Help the Economy RecoverSome HighlightsExpert insights are painting a bright future for housing when the economy bounces back – and it will.We may be facing challenging economic times today, but the housing market is poised to help...

Looking to the Future: What the Experts Are Saying

Looking to the Future: What the Experts Are SayingAs our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human...

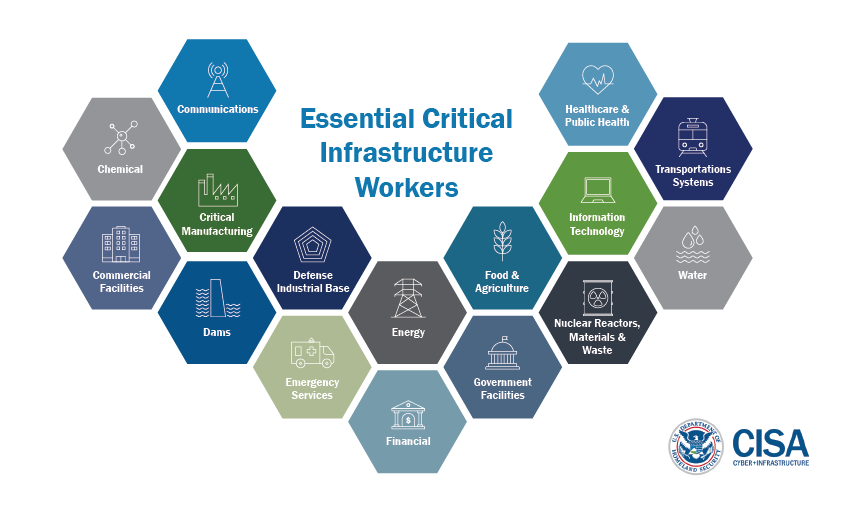

Real Estate Is an Essential Service According to U.S. Government

According to CISA (Cybersecurity and Infrastructure Security Agency)This list is advisory in nature. It is not, nor should it be considered, a federal directive or standard. Additionally, this advisory list is not intended to be the exclusive list of critical...

The Best Advice Does Not Mean Perfect Advice

The Best Advice Does Not Mean Perfect AdviceThe angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol...

What You Can Do to Keep Your Dream of Homeownership Moving Forward

What You Can Do to Keep Your Dream of Homeownership Moving ForwardSome Highlights:Don’t put your homeownership plans on hold just because you’re stuck inside.There are several things you can do right now to keep your home search moving forward.Connect with an agent,...

With so much changing in today’s market