The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

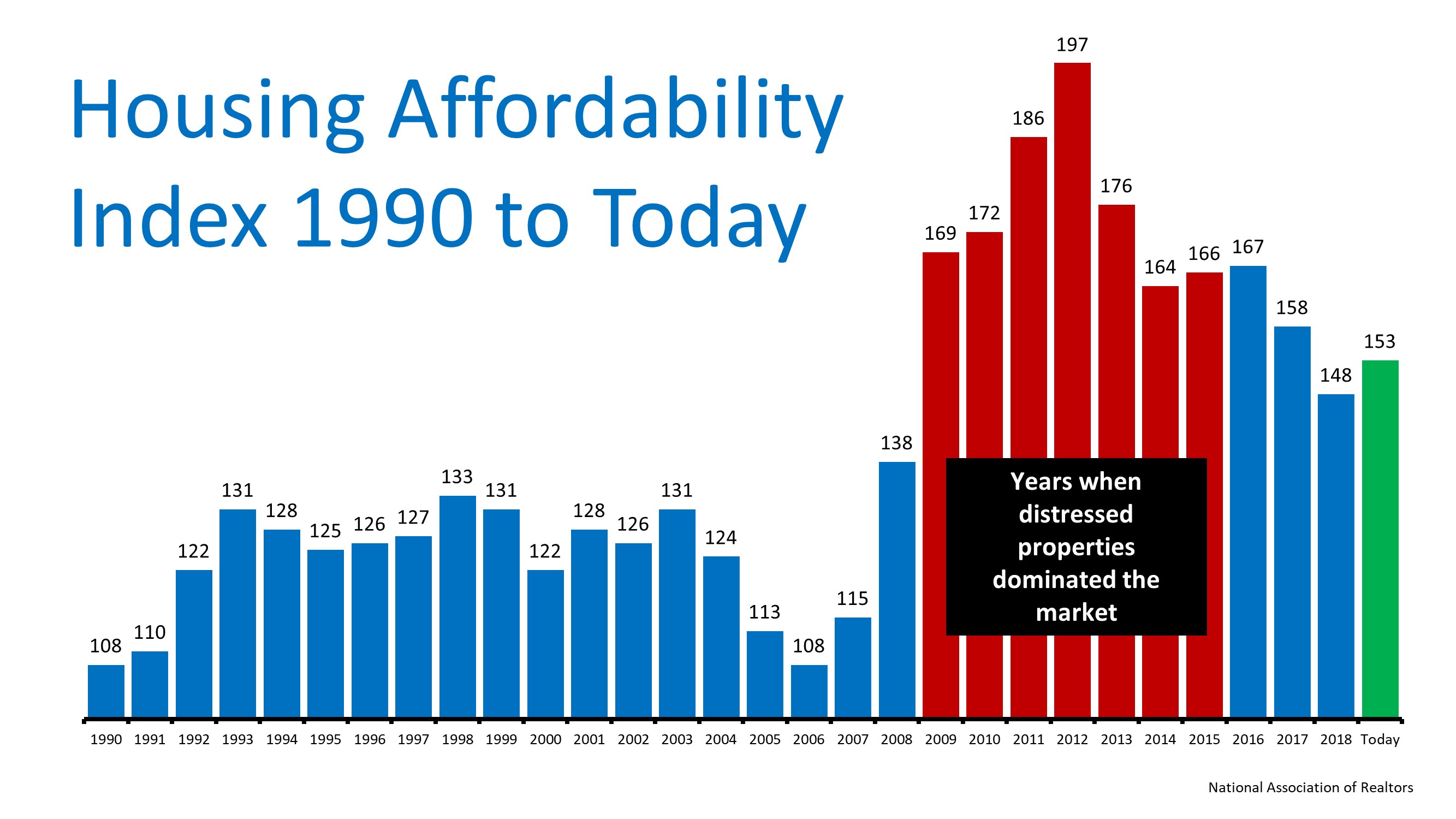

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Honoring the Significance of Indigenous Day

Indigenous Peoples’ Day celebrates, recognizes, and honors the beautiful traditions and cultures of the Indigenous People We take a stand for and support the indigenous people on this day. We should also offer our support to those who invest and uplift the indigenous...

Avoid Mortgage Mistakes Buyers Make: Expert Tips

Key mortgage mistakes to avoid include not getting pre-approved, overlooking credit scores, and failing to compare mortgage options. Buyers should budget for total homeownership costs, including property taxes and maintenance. Skipping home inspections and neglecting...

Top Strategies to Sell Your Home Fast in 2025

Price your home right from day one to attract more offers and avoid sitting on the market too long. Boost curb appeal with simple upgrades—fresh paint, landscaping, and clean entryways make a strong first impression. Use professional photos and staging to showcase...

5 Smart Tips to Save Money on Home Closing Costs

Closing costs can add up to more than $10,000, but buyers have strategies to reduce them. Local banks may offer grants, credits, or fee waivers that cut costs without repayment obligations. Conventional loans with larger down payments often reduce costs compared to...

5 Key Takeaways: How to Negotiate to Cut Costs When Closing on a Home

Homebuyers can save money by negotiating key aspects of the purchase, including repairs found during inspections, closing costs, and the closing date. Buyers may also negotiate for home contents like appliances and furniture to be included, as well as for sellers to...

Chasing 4%: The Future of Mortgage Rates

Mortgage rates are expected to gradually ease over the coming years, though a return to 4% remains a longer-term possibility. Past 4% levels were achieved during periods of strong monetary support, showing rates can fall when economic conditions shift significantly. A...

Will 2029’s Home Prices Surpass Pre-Bubble Levels?

National home prices expected to rise by 19.8% through 2029, averaging 3.7% annual growth. Price Growth 2025 (+3.4%) 2026 (+6.8%) 2027 (+10.8%) 2028 (+15.2%) 2029 (+19.8%)

8 Tips for First-Time Home Buyers

First-time homebuyers should save for a down payment, typically 20%, and budget for additional costs like fees, moving, and furniture. Choose a neighborhood that fits long-term needs, prioritize must-haves, and get a home inspection to avoid surprises. Use a mortgage...

5 Reasons Enticing Me to Buy a Home Before 2025 Ends

Slide 1 Mortgage rates dropped to around 6%, down from the 7.79% peak in 2023. Slide 2 Housing supply rose 15.7% in 2025, giving buyers 1.55 million homes to choose from. Slide 3 Home prices are still high but rising slower, with just 2.9% annual growth mid-2025....

22 Real Estate Investment Strategies

Real estate investing offers strategies for wealth building, passive income, and portfolio diversification, including buy-and-hold, fix-and-flip, REITs, and rental property diversification. REITs have shown stability and often outperform stocks over time, while...