The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

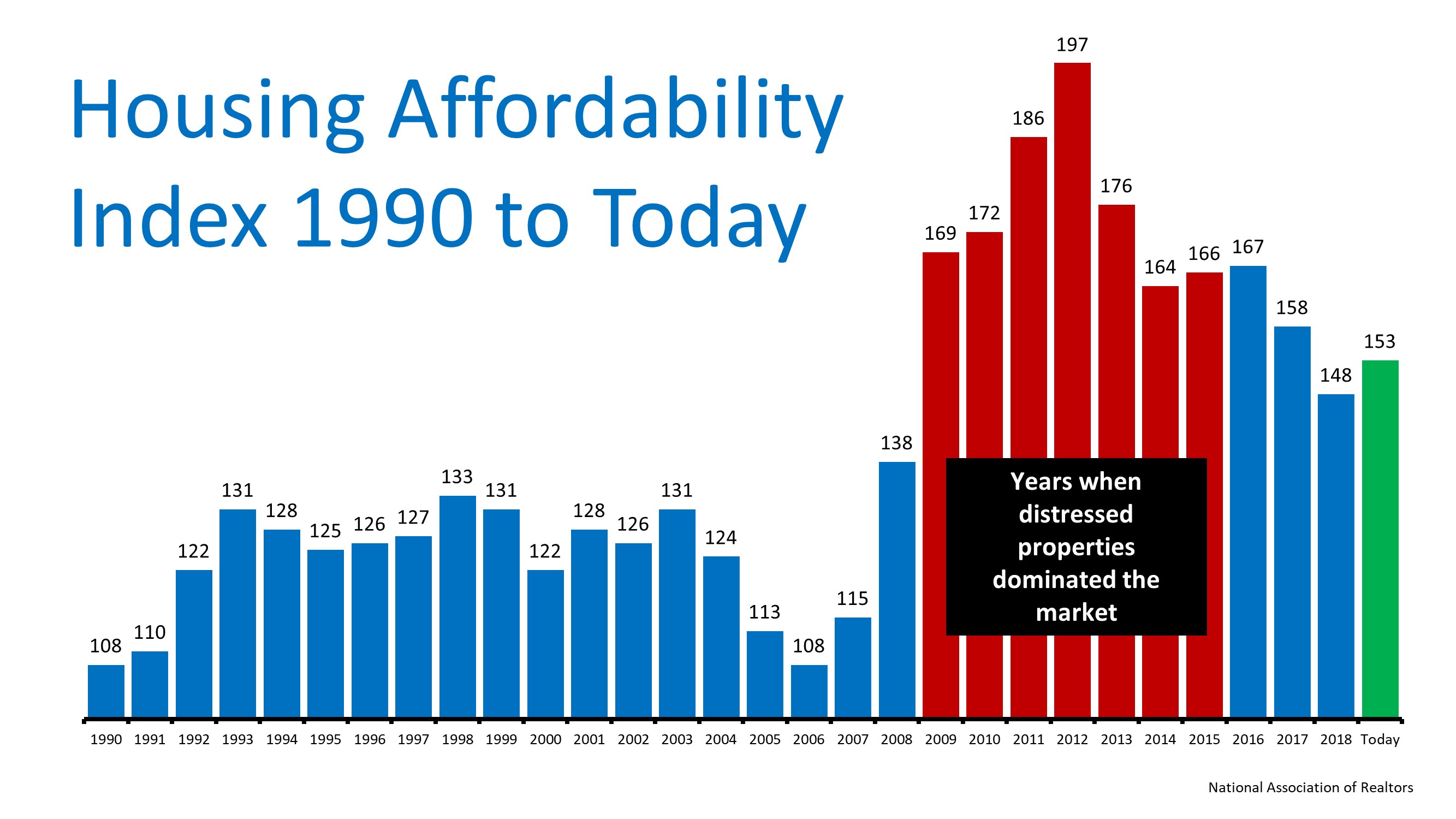

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Why Pre-Approval Is Even More Important This Year

Why Pre-Approval Is Even More Important This Year On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024. What Pre-Approval Is...

There’s No Foreclosure Wave in Sight

There’s No Foreclosure Wave in Sight Some Highlights Headlines saying foreclosures are rising might make you feel uneasy. But the truth is, there’s no need to worry. If you look at the latest numbers, they’re still below pre-pandemic norms and way below what happened...

Don’t Wait Until Spring To Sell Your House

Don’t Wait Until Spring To Sell Your House As you think about the year ahead, one of your big goals may be moving. But, how do you know when to make your move? While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell....

Blockchain technology and its integration with real estate transactions

Blockchain technology and its integration with real estate transactions. Blockchain has been making waves in various industries, revolutionizing the way we store and transfer data securely. And with the ever-evolving real estate market, it comes as no surprise that...

2 of the Factors That Impact Mortgage Rates

2 of the Factors That Impact Mortgage Rates If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?...

Trends in Senior Housing

Trends in Senior Housing In this article, we dive into the fascinating realm of senior purchasing habits when it comes to housing. With the aging population, the needs and preferences of seniors have transformed, leading to new trends and demands in the housing...

Will a Silver Tsunami Change the 2024 Housing Market?

Will a Silver Tsunami Change the 2024 Housing Market? Have you ever heard the term “Silver Tsunami” and wondered what it's all about? If so, that might be because there’s been lot of talk about it online recently. Let's dive into what it is and why it won't...

Why It’s More Affordable To Buy a Home This Year

Why It’s More Affordable To Buy a Home This Year Some Highlights Home affordability depends on three factors: mortgage rates, home prices, and wages. Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are...

Experts Project Home Prices Will Increase in 2024

Experts Project Home Prices Will Increase in 2024 Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the...

3 Must-Do’s When Selling Your House in 2024

3 Must-Do’s When Selling Your House in 2024 If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to...