Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

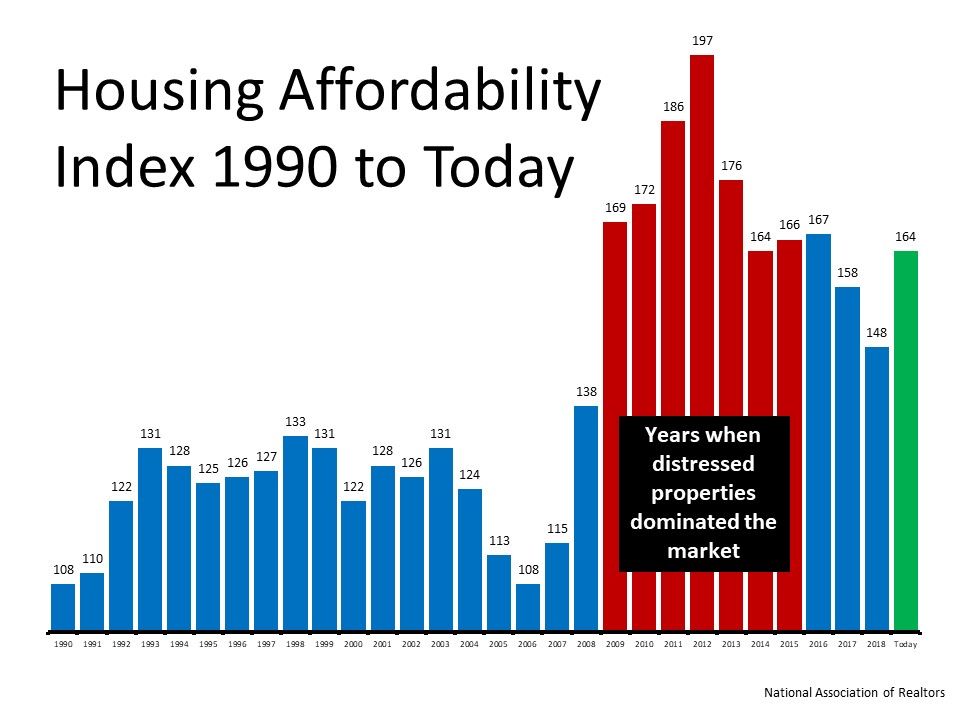

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

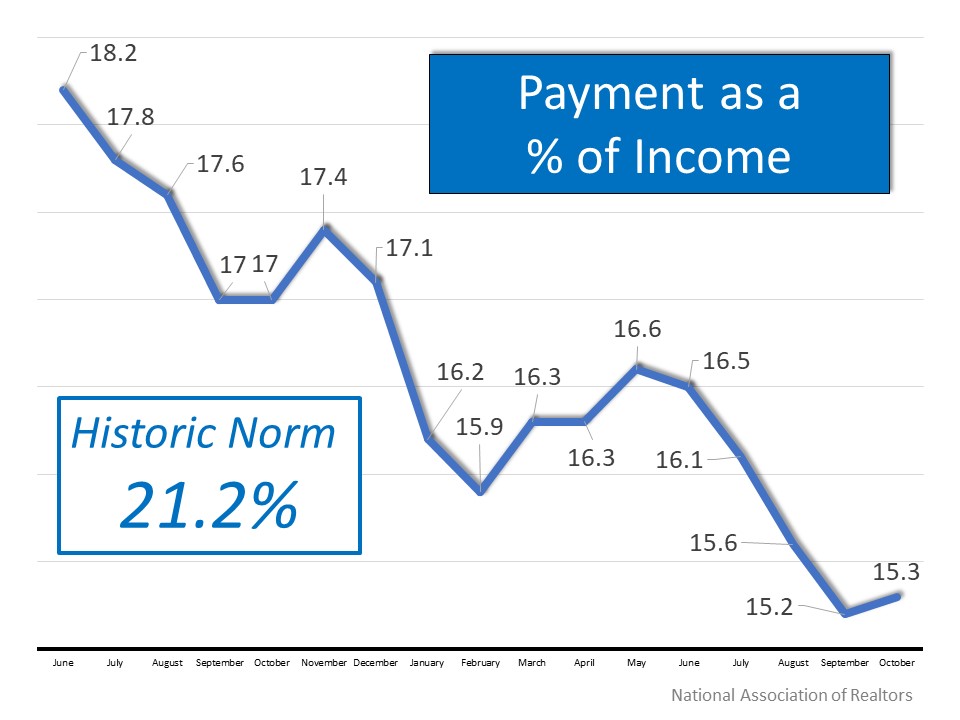

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

The Main Reason Mortgage Rates Are So High

The Main Reason Mortgage Rates Are So HighToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be...

The True Value of Homeownership

The True Value of Homeownership Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership...

Keys to Success for First-Time Homebuyers

Keys to Success for First-Time Homebuyers Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of...

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate....

Remember and Honor Those Who Gave All

Remember and Honor Those Who Gave All We remember and honor those who gave all. Some Highlights

The Benefits of Selling Now, According to Experts

The Benefits of Selling Now, According to Experts If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there...

Why Buyers Need an Expert Agent by Their Side

Why Buyers Need an Expert Agent by Their Side The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating...

What You Need To Know About Home Price News

What You Need To Know About Home Price News The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines....

Homeowners Have Incredible Equity To Leverage Right Now

Homeowners Have Incredible Equity To Leverage Right Now Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value...

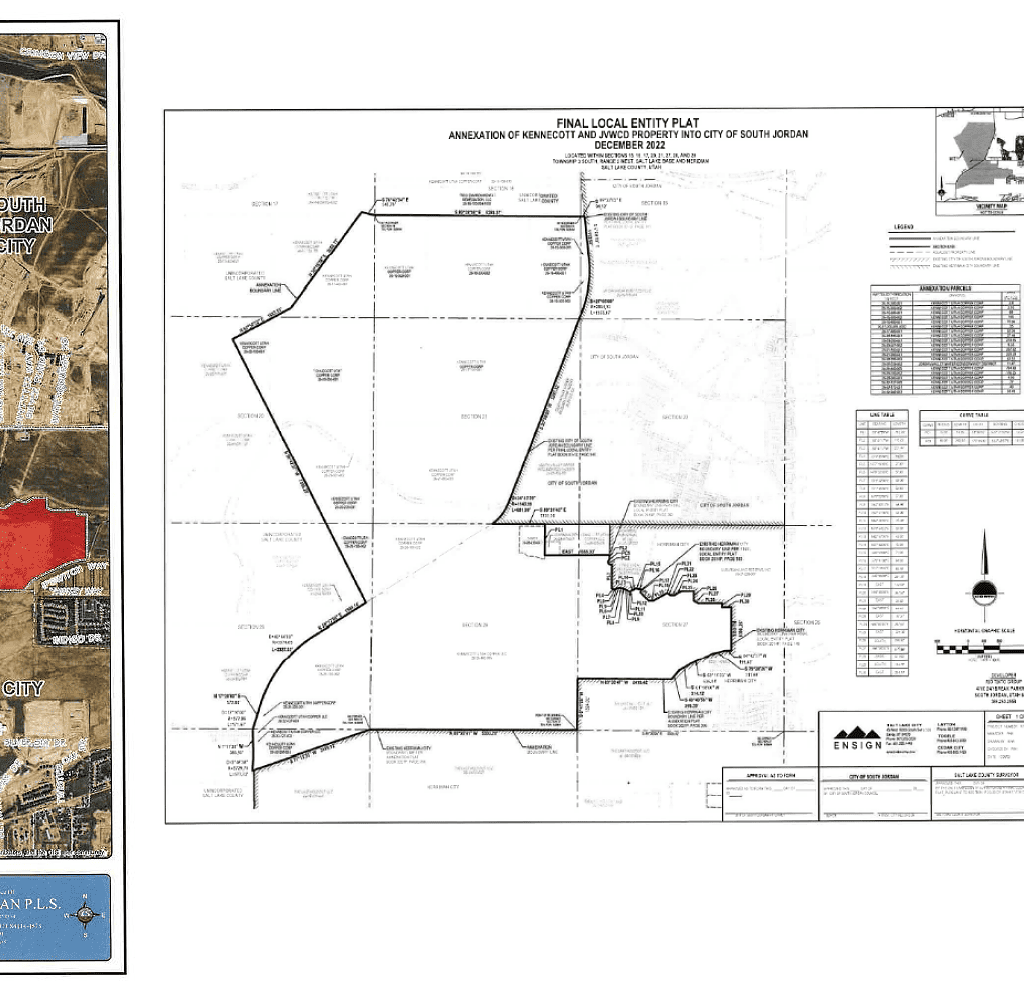

South Jordan City Council has recently announced the annexation of over 2,000 acres of land

South Jordan City Council has recently announced the annexation of over 2,000 acres of land. This move is expected to bring significant growth and development to the area. The annexed land is located in the western part of the city and includes several large parcels...