Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

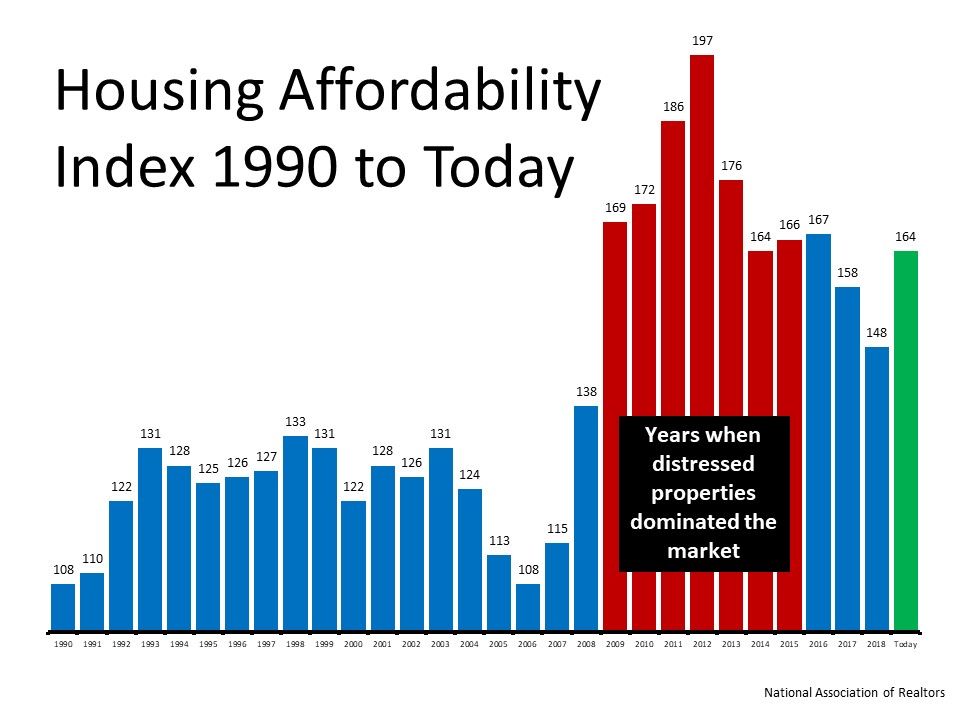

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

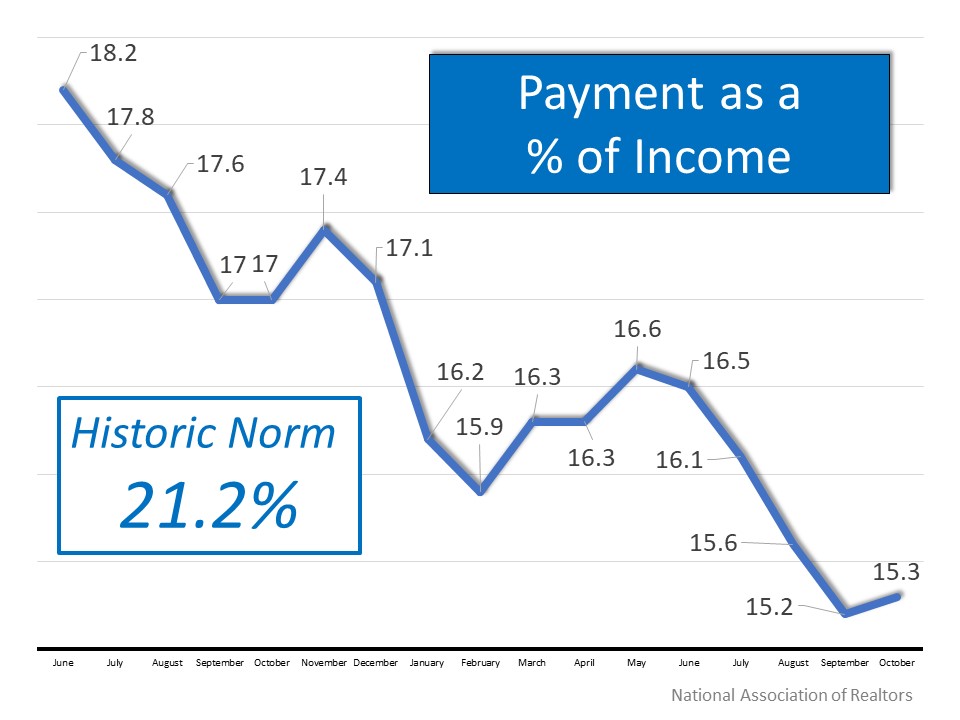

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Expert Home Price Forecasts for 2024 Revised Up

Expert Home Price Forecasts for 2024 Revised Up Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall. So, let’s see exactly how experts’...

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last...

Strategic Tips for Buying Your First Home

Strategic Tips for Buying Your First Home Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it's a dream you can make come true, but there are some hurdles you'll need to overcome...

It’s Time To Prepare Your House for a Spring Listing

It’s Time To Prepare Your House for a Spring Listing If you're thinking of selling your house this spring, now is the perfect time to start getting it ready. With the market gearing up for its busiest time of year, it'll be important to make sure your house shines...

Don’t Let the Latest Home Price Headlines Confuse You

Don’t Let the Latest Home Price Headlines Confuse You Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for...

Maximizing The Benefits Of Home Equity When Downsizing

Maximizing The Benefits Of Home Equity When Downsizing When it comes to downsizing, homeowners often view it as a way to simplify their lives, reduce maintenance costs, or even relocate to a more desirable location. But what many don't realize is that downsizing can...

Why Pre-Approval Is Even More Important This Year

Why Pre-Approval Is Even More Important This Year On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024. What Pre-Approval Is...

There’s No Foreclosure Wave in Sight

There’s No Foreclosure Wave in Sight Some Highlights Headlines saying foreclosures are rising might make you feel uneasy. But the truth is, there’s no need to worry. If you look at the latest numbers, they’re still below pre-pandemic norms and way below what happened...

Don’t Wait Until Spring To Sell Your House

Don’t Wait Until Spring To Sell Your House As you think about the year ahead, one of your big goals may be moving. But, how do you know when to make your move? While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell....

Blockchain technology and its integration with real estate transactions

Blockchain technology and its integration with real estate transactions. Blockchain has been making waves in various industries, revolutionizing the way we store and transfer data securely. And with the ever-evolving real estate market, it comes as no surprise that...