Expert Insights on the 2020 Housing Market

When closing out another year, it’s normal to wonder what’s ahead for the housing market. Though there will be future inventory issues, we expect interest rates to stay low and appreciation to continue.

Here’s what three experts are saying we’ll likely see in 2020:

Danielle Hale, Chief Economist at realtor.com

“I think the biggest surprise from the forecast is how long the market is staying in this low inventory environment, especially as Millennials are in a major home-buying phase…sellers will contend with flattening price growth and slowing activity with existing home sales down 1.8%. Nationwide you can look to flat home prices with an increase of less than 1%.”

Mike Fratantoni, Chief Economist at Mortgage Banker Association (MBA)

“Interest rates will, on average, remain lower…These lower rates will in turn support both purchase and refinance origination volume in 2020.”

Skylar Olsen, Director of Economic Research at Zillow

“If current trends hold, then slower means healthier and smaller means more affordable. Yes, we expect a slower market than we’ve become accustomed to the last few years…consumers will continue to absorb available inventory and the market will remain competitive in much of the country.”

As we can see, we’re still going to have a healthy market. It is forecasted to be a more moderate (or normal) market than the last few years, but strong enough for Americans to continue to believe in homeownership and to capitalize on the opportunities that come with low interest rates.

Bottom Line

If you’re wondering what’s happening in our local market, let’s get together today.

![Interest Rates Over Time [INFOGRAPHIC]](https://files.mykcm.com/2020/02/20093247/20200221-MEM-1046x837.jpg)

Interest Rates Over Time [INFOGRAPHIC]

Interest Rates Over Time [INFOGRAPHIC] Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently...

You May Have More Home Equity Than You Think

You May Have More Home Equity Than You Think With home values appreciating, there's a good chance you have more home equity than you think. Let's connect to explore how you can use your equity in your next move.

The #1 Misconception in the Homebuying Process

The #1 Misconception in the Homebuying Process After over a year of moderating home prices, it appears home value appreciation is about to reaccelerate. Skylar Olsen, Director of Economic Research at Zillow, explained in a recent article: “A year ago, a combination...

The Many Benefits of Aging in a Community

The Many Benefits of Aging in a Community There’s comfort in being around people who share common interests, goals, and challenges. That comfort in a community doesn’t wane with age – it actually deepens. Whether it’s proudly talking about grandchildren or lamenting...

Ways to Declutter Before Listing the Family Home

Ways to Declutter Before Listing the Family Home 1. Toss the Trash We often become “clutter blind” to things that collect in our homes. If you have mail waiting to be sorted, handled, and discarded, magazines and newspapers you intended toread (but probably won’t),...

Adapting Your Home

Adapting with Age Most of us would prefer to age in our current home. But as health and aging issues make more areas of the home hard to access or pose a greater risk of injury, doing so can be difficult. We can begin to feel trapped and that selling our home is the...

Trusted Professionals Make Homebuying Easier

How Trusted Professionals Make Homebuying Easier to Understand In the spring, many excited buyers get ready to enter the housing market. Others continue dreaming about the homes they’d like to buy. The truth is, many potential buyers continue to dream longer than they...

The Overlooked Financial Advantages of Homeownership

The Overlooked Financial Advantages of Homeownership There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can...

Why the Electoral College Is So Important

Why The Electoral College Is So Important?

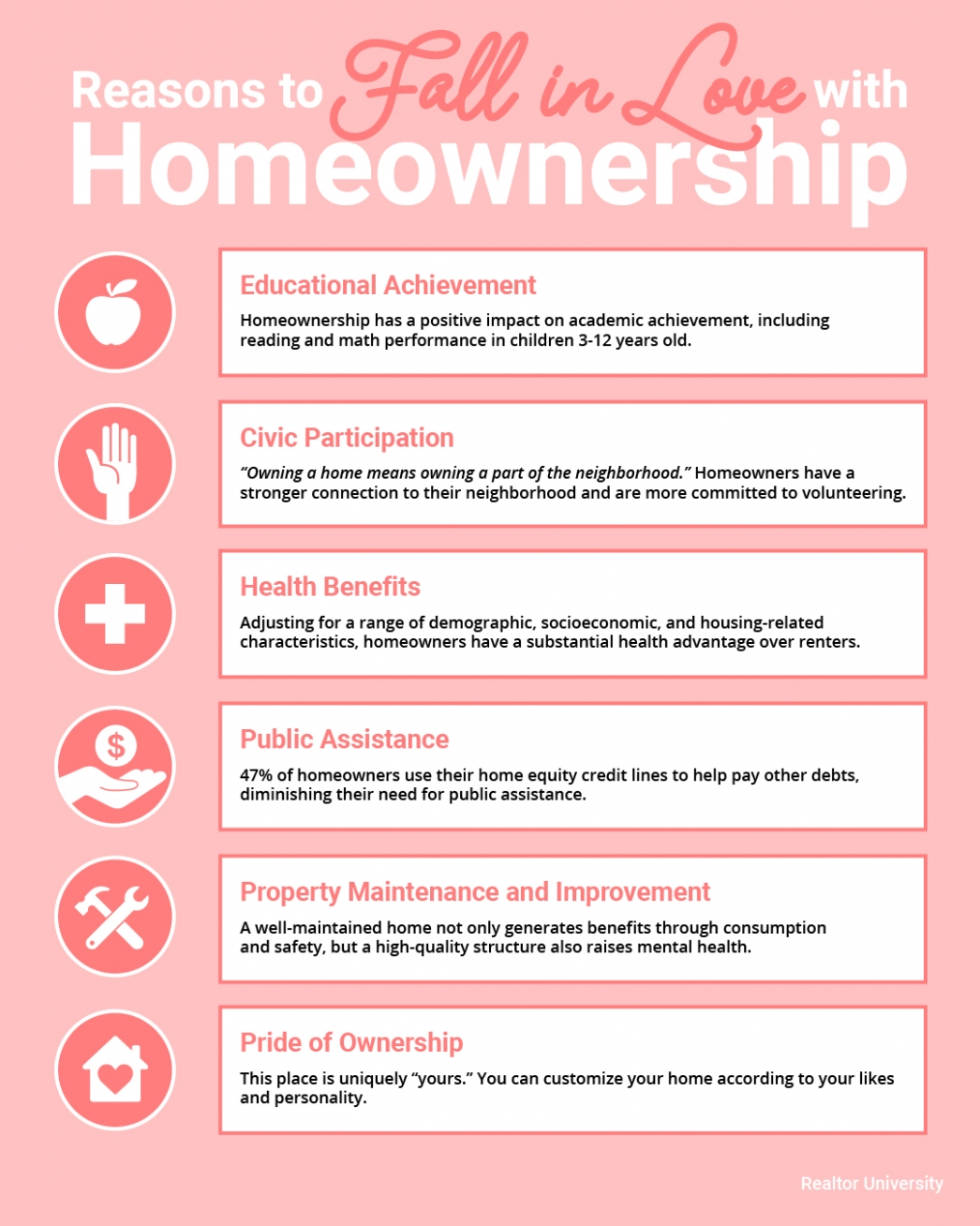

Reasons to Fall in Love with Homeownership

Reasons to Fall in Love with Homeownership Some Highlights: There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these...