No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

It’s easy to tell yourself that your house is just a building made of walls and ceilings and light fixtures and flooring, but when it comes time to sell, you may start to feel the sting of grief.

After all, you don’t know if the new owners will take care of the rows and rows of brilliant iris that line the fence in the spring or if they’ll cut down the crepe myrtle because they don’t realize it waits for the first kiss of summer heat to spring back to life.

Will they paint your son’s former bedroom and cover up the mural he spent so much time creating? Will they take out the built-in desk and bookcases you made for your daughter?

Maybe saying goodbye isn’t the easy process you thought it would be.

When you’re selling your family home, it’s not just a building that you’re saying goodbye to. It’s all the memories you made there, the familiariarity and, maybe most importantly, the security of that one place you could always fall back to if life started kicking you too hard. This goes for the house that you raised your kids in as well as the house where you were raised — both are genuine losses.

“You’re dismantling something that was once precious, and you have to go through grief and mourning when this happens.” psychologist Dr. Arthur Kovacs explained in an interview with the Chicago Times.

Of course, that’s only part of the story. Another element that makes it so hard to quit a family home is the link between memory and physical space. When your memories are tangled in with your home, it can be hard to let go.

“We have memories and associations that are connected to all of those things that make houses so heavily connected to ourselves,” Duke University’s department of psychology and neuroscience chair, Dr. Scott Huettel, goes on to explain the phenomenon to the New York Times.

Much of the time when you’re looking to sell a family home, it’s due to a big change in life. Maybe your kids have all left home and you’re planning to downsize or maybe your parents have died and you’re having to liquidate their estate. No matter the reason, it’s one of the hardest things you can do, even if you think you’re totally prepared.

How do you get ready for such a big sacrifice? It’s all about your mindset. Start to detach from the house by taking down and packing anything that’s personal. This includes photos, crafted decorations, paintings and so forth. As you take these things off the walls, the space starts to become more generic, less personal and it gets easier to consider selling the house.

If you’re still feeling the pain at this point, work on other parts of the house. Remember that crack in the wall from four years ago when the game controller flew from your daughter’s hand and hit the drywall at full force? Patch that up. Your buyer probably won’t even notice it, but you will. Sterilize your home until you can bear to sign the papers

The day will come that you get an offer. Resist the urge to flat out reject it, no matter the price. This is where the rubber meets the road — it’s now grossly apparent that you’re selling the house you poured so much of yourself into rather than just thinking about it.

It’s time for a wake.

Maybe you’d be better to call it a “remembrance party” or something a little cheerier, but the whole point is to say goodbye in a big way so you can get the closure you need. Some people go room by room to have one last good walk down memory lane, others celebrate by doing something they hadn’t gotten around to doing, like hosting a luau.

Your goodbye will be best if you do it in a way that’s meaningful to you and your family. There aren’t really any shortcuts when it comes to grief, unfortunately. Don’t beat yourself up, it’s not “just a house.” That’s the building that sheltered and protected you year after year. That’s the stuff that attachment is made of.

The market’s heating up even as you’re reading this blog. If you’ve been thinking about downsizing, this is a great time to sell that big home and move into something more energy efficient and easier to care for. You’re not alone in your efforts, your HomeKeepr community has your back all the way. With the best real estate agents, movers, handymen, painters and other home pros at your disposal, your sale will go smoothly so that all you have to focus on is your last hurrah in your home.

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

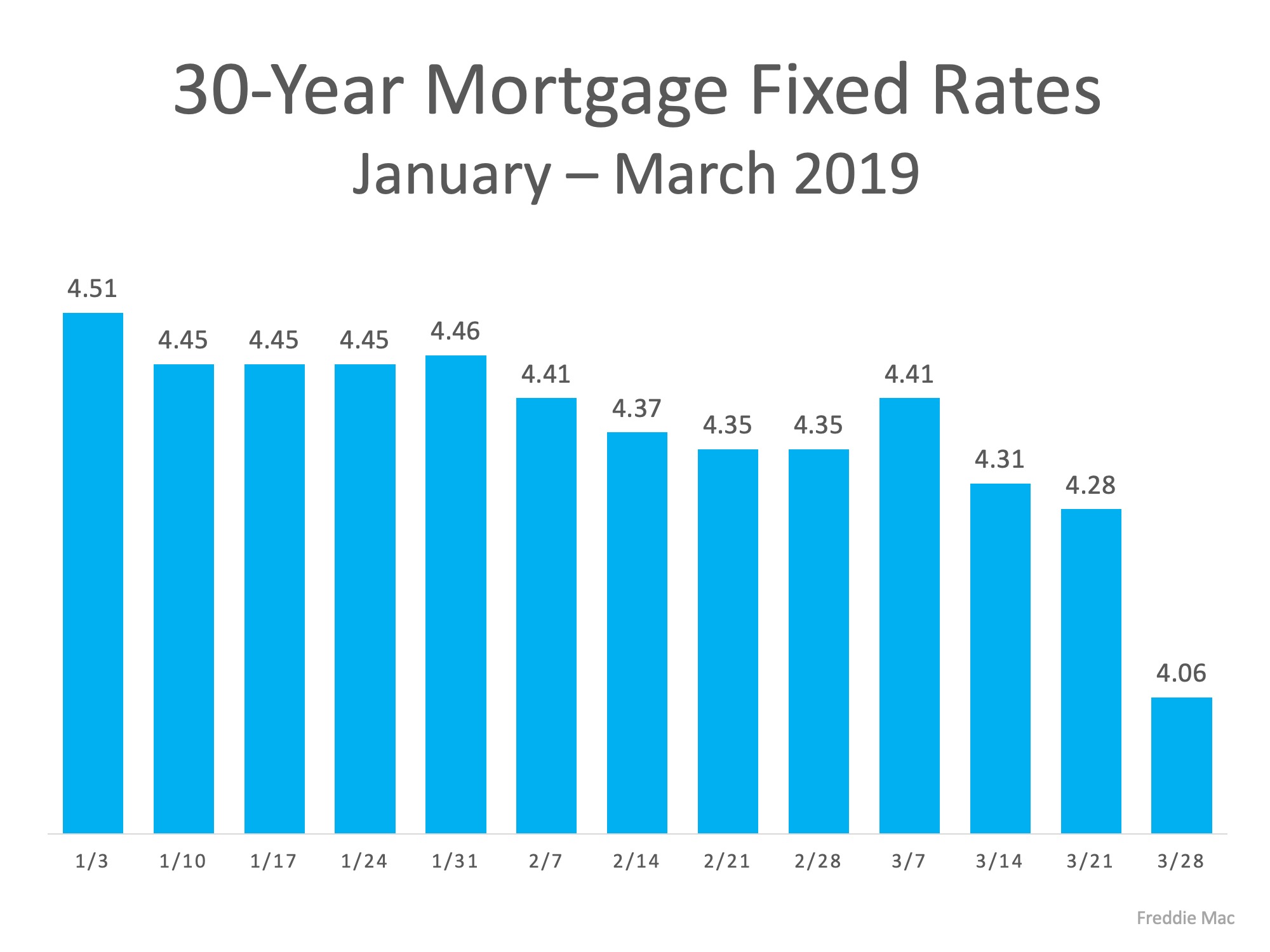

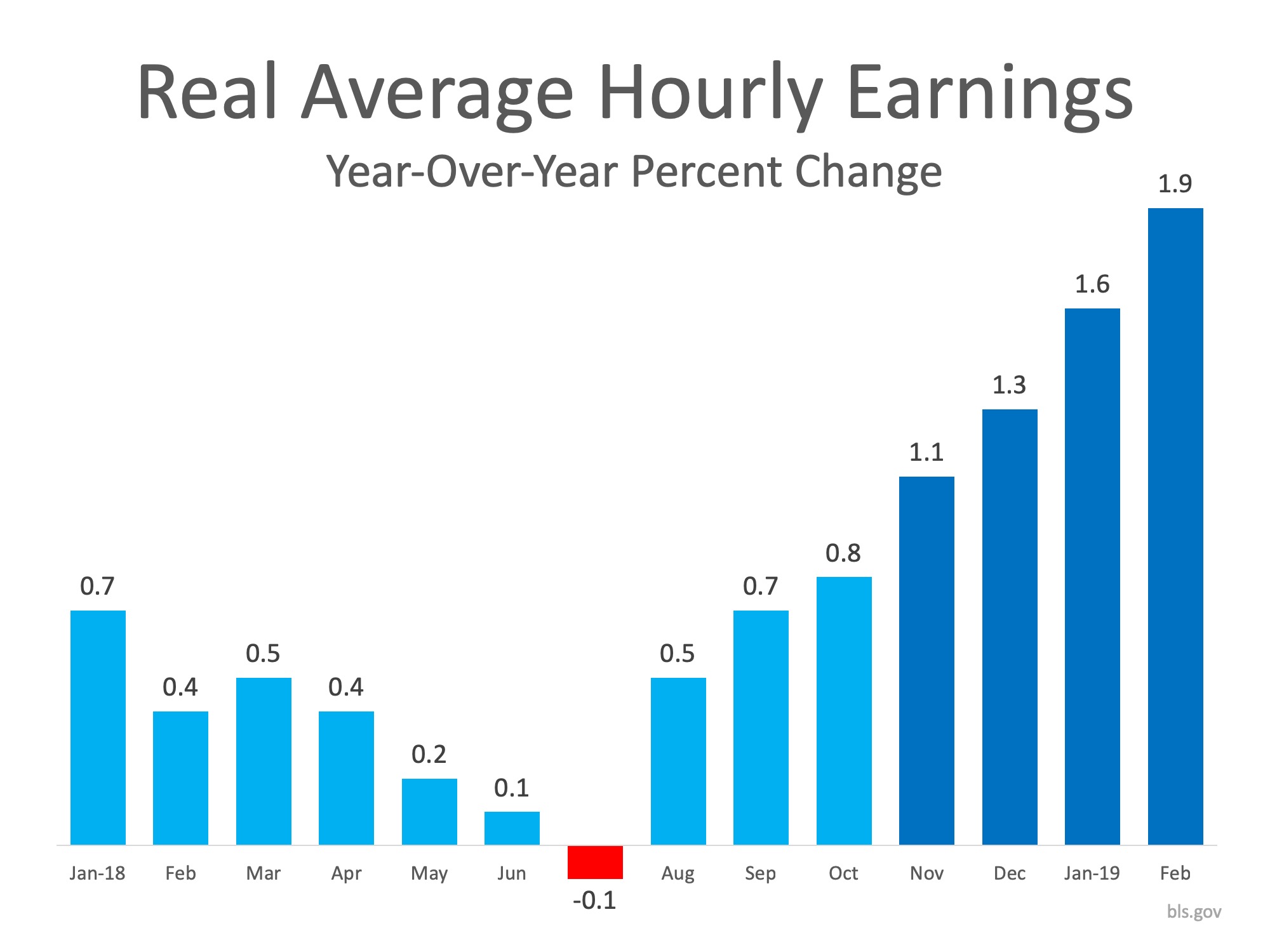

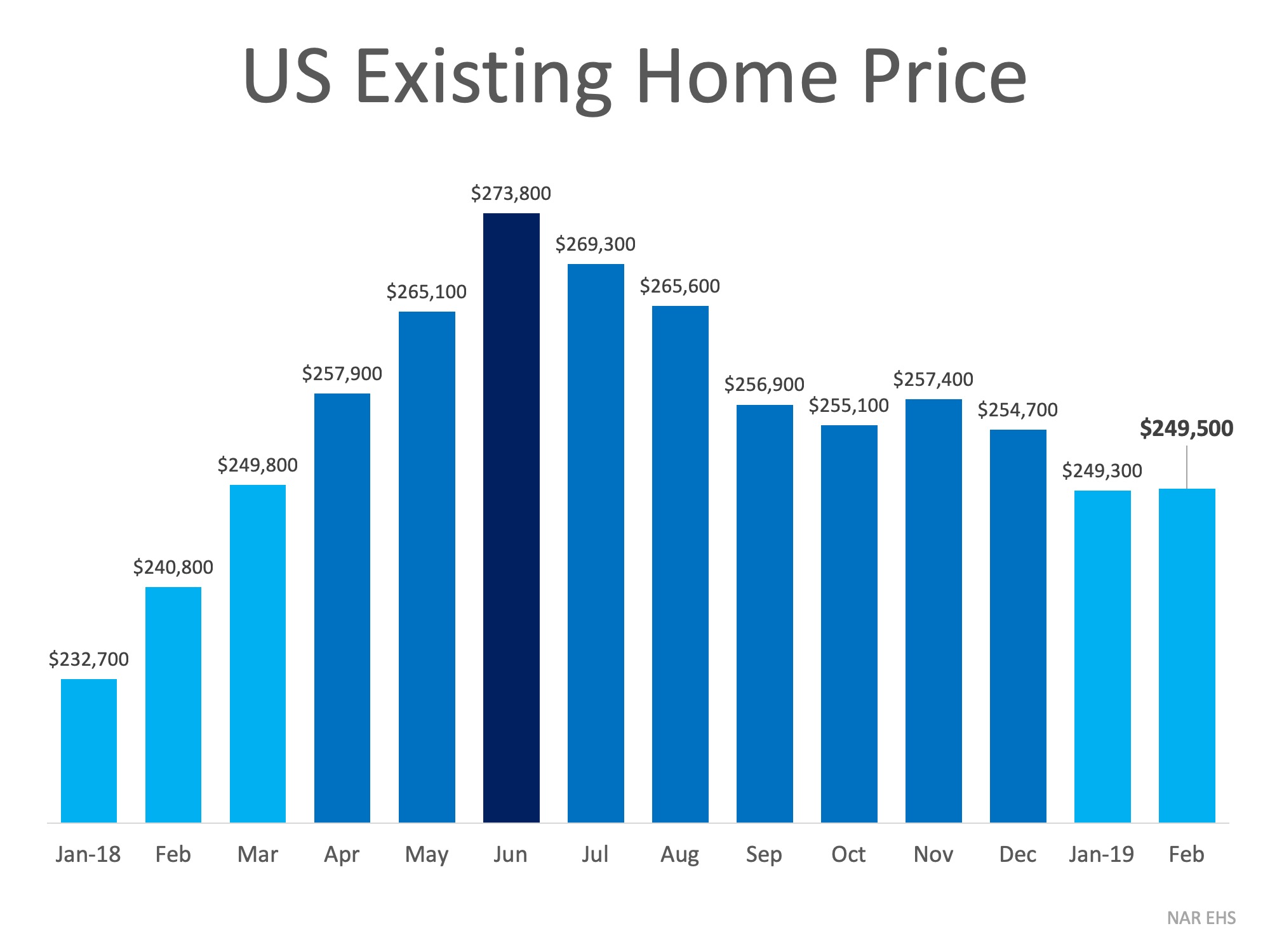

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the higher end! This is great news for homeowners who want to upgrade from their current house and move-up to a premium home.

Much of the demand for housing over the past couple years has come from first-time buyers looking for their starter home, which means that many of the more expensive homes that have been listed for sale have not seen as much interest.

This mismatch in demand and inventory has created a Buyer’s Market in the luxury and premium home markets according to the ILHM’s latest Luxury Report. For the purpose of the report, a luxury home is defined as one that costs $1 million or more.

“A Buyer’s Market indicates that buyers have greater control over the price point. This market type is demonstrated by a substantial number of homes on the market and few sales, suggesting demand for residential properties is slow for that market and/or price point.”

The authors of the report were quick to point out that the current conditions at the higher end of the market are no cause for concern,

“While luxury homes may take longer to sell than in previous years, the slower pace, increased inventory levels and larger differences between list and sold prices, represent a normalization of the market, not a downturn.”

Luxury can mean different things to different people. It could mean a secluded home with a ton of property for privacy to one person, or a penthouse in the center of it all for someone else. Knowing what characteristics you are looking for in a premium home and what luxury means to you will help your agent find your dream home.

If you are debating upgrading your current house to a premium or luxury home, now is the time!

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.