Buyer Demand Surging in Utah as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

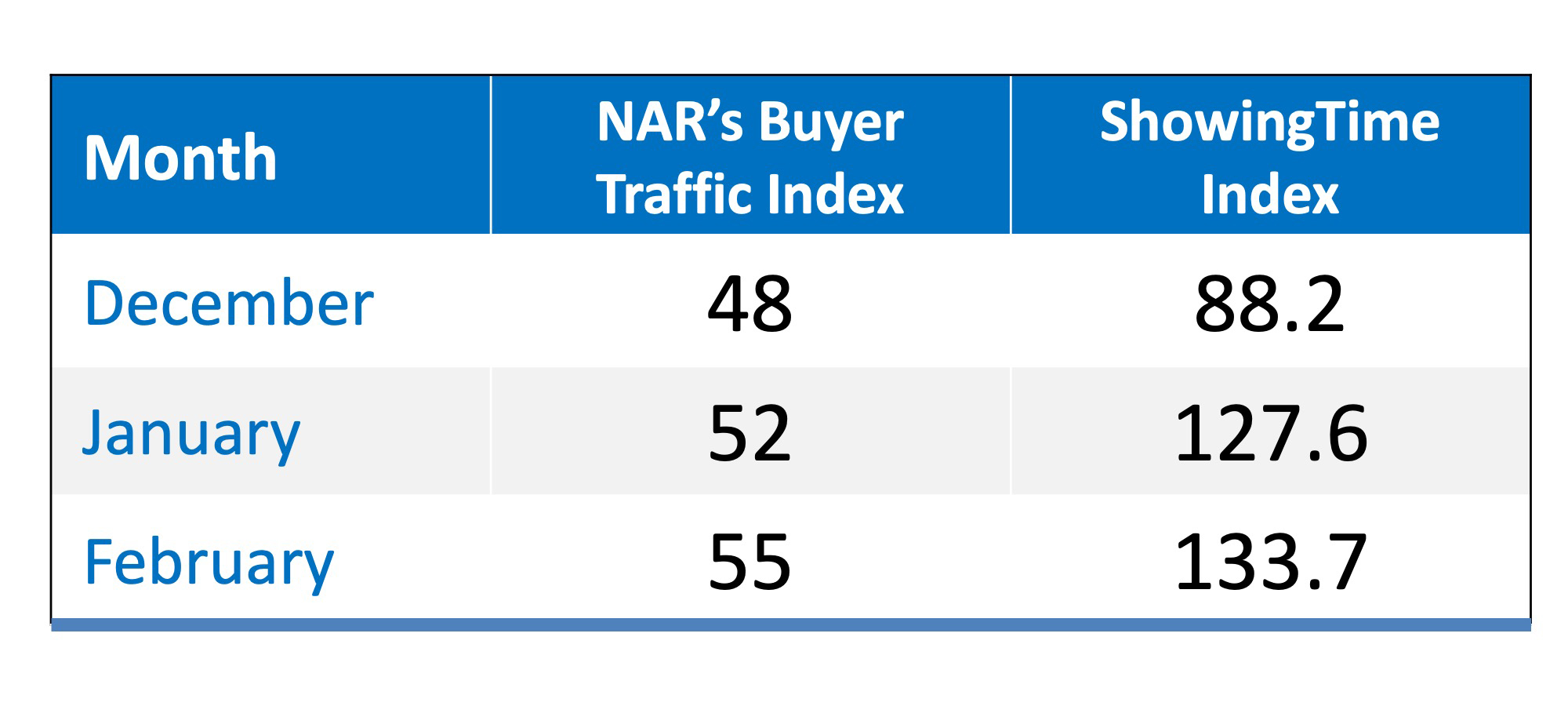

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

*The methodology behind the indices:

The ShowingTime Showing Index

“The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.”

The National Association of REALTORS® Buyer Traffic Index

“In a monthly survey of REALTORS®, NAR asks respondents ‘Compared to the same month last year, how would you rate the past month’s traffic in neighborhood(s) or area(s) where you make most of your sales?’ NAR compiles the responses into an index, where an index above 50 indicates that more respondents reported “stronger” traffic than “weaker” traffic.”

Secrets to a Successful Sale of Your Home

In the intricate dance of real estate, where emotion meets investment, the art of selling your home demands a blend of strategy, finesse, and keen insight. As navigators through the ever-evolving property landscape , homeowners poised to make their move must...

Why Buying Beats Renting in Salt Lake County Utah

In the current real estate climate, making the decision between buying a home and renting is more crucial than ever, particularly within the vibrant communities of Salt Lake County. This article delves into the five fundamental reasons why purchasing a property...

Evaluating Your Options: Should You Sell Your Home In 2024?

In contemplating the future of one’s real estate investments, the decision to sell a home in 2024 demands a meticulous evaluation of the current economic landscape, market trends, and individual financial goals. This article aims to provide homeowners with a...

Are Home Prices Going To Come Down?

Are Home Prices Going To Come Down? Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking...

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...