Buyer Demand Surging in Utah as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

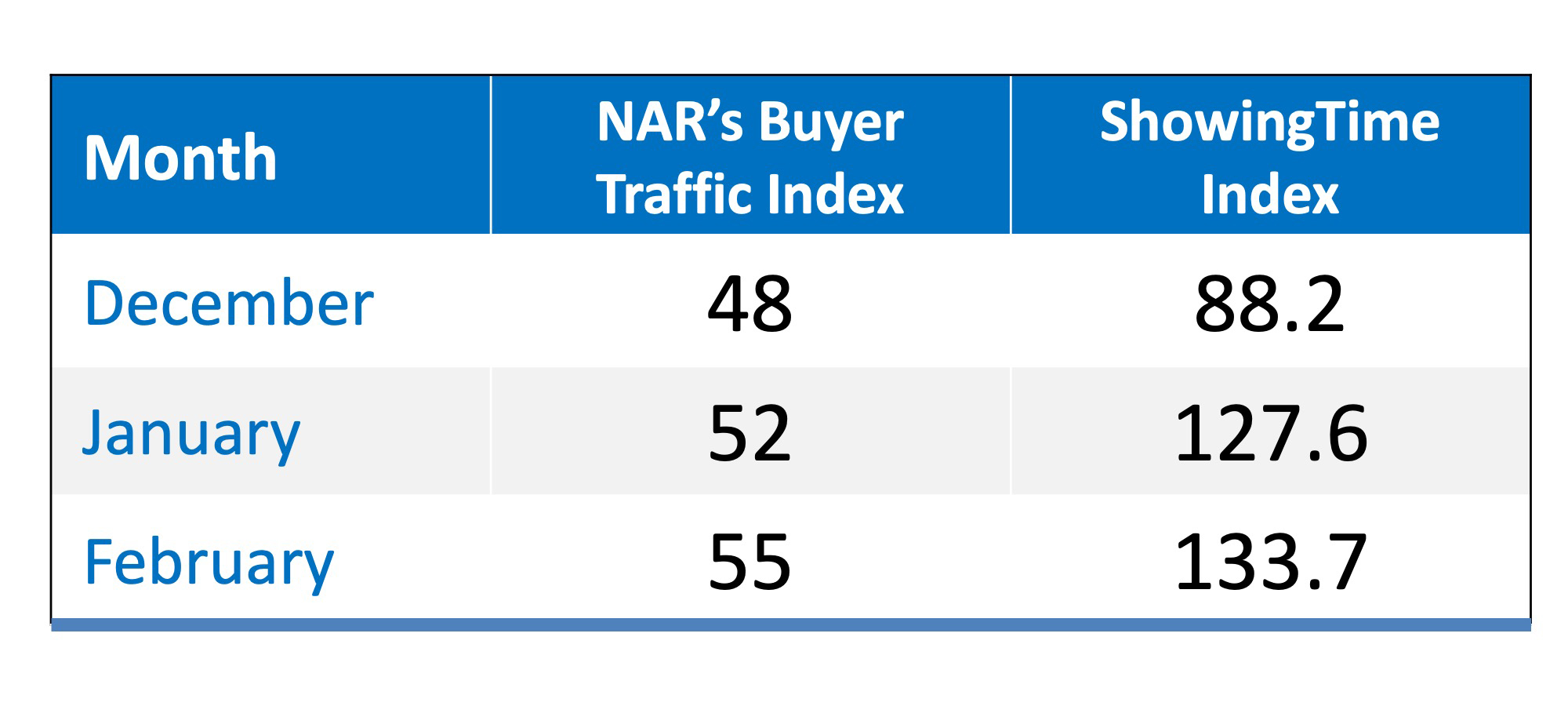

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

*The methodology behind the indices:

The ShowingTime Showing Index

“The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.”

The National Association of REALTORS® Buyer Traffic Index

“In a monthly survey of REALTORS®, NAR asks respondents ‘Compared to the same month last year, how would you rate the past month’s traffic in neighborhood(s) or area(s) where you make most of your sales?’ NAR compiles the responses into an index, where an index above 50 indicates that more respondents reported “stronger” traffic than “weaker” traffic.”

Avoid Mortgage Mistakes Buyers Make: Expert Tips

Key mortgage mistakes to avoid include not getting pre-approved, overlooking credit scores, and failing to compare mortgage options. Buyers should budget for total homeownership costs, including property taxes and maintenance. Skipping home inspections and neglecting...

Top Strategies to Sell Your Home Fast in 2025

Price your home right from day one to attract more offers and avoid sitting on the market too long. Boost curb appeal with simple upgrades—fresh paint, landscaping, and clean entryways make a strong first impression. Use professional photos and staging to showcase...

5 Smart Tips to Save Money on Home Closing Costs

Closing costs can add up to more than $10,000, but buyers have strategies to reduce them. Local banks may offer grants, credits, or fee waivers that cut costs without repayment obligations. Conventional loans with larger down payments often reduce costs compared to...

5 Key Takeaways: How to Negotiate to Cut Costs When Closing on a Home

Homebuyers can save money by negotiating key aspects of the purchase, including repairs found during inspections, closing costs, and the closing date. Buyers may also negotiate for home contents like appliances and furniture to be included, as well as for sellers to...

Chasing 4%: The Future of Mortgage Rates

Mortgage rates are expected to gradually ease over the coming years, though a return to 4% remains a longer-term possibility. Past 4% levels were achieved during periods of strong monetary support, showing rates can fall when economic conditions shift significantly. A...

Will 2029’s Home Prices Surpass Pre-Bubble Levels?

National home prices expected to rise by 19.8% through 2029, averaging 3.7% annual growth. Price Growth 2025 (+3.4%) 2026 (+6.8%) 2027 (+10.8%) 2028 (+15.2%) 2029 (+19.8%)

8 Tips for First-Time Home Buyers

First-time homebuyers should save for a down payment, typically 20%, and budget for additional costs like fees, moving, and furniture. Choose a neighborhood that fits long-term needs, prioritize must-haves, and get a home inspection to avoid surprises. Use a mortgage...

5 Reasons Enticing Me to Buy a Home Before 2025 Ends

Slide 1 Mortgage rates dropped to around 6%, down from the 7.79% peak in 2023. Slide 2 Housing supply rose 15.7% in 2025, giving buyers 1.55 million homes to choose from. Slide 3 Home prices are still high but rising slower, with just 2.9% annual growth mid-2025....

22 Real Estate Investment Strategies

Real estate investing offers strategies for wealth building, passive income, and portfolio diversification, including buy-and-hold, fix-and-flip, REITs, and rental property diversification. REITs have shown stability and often outperform stocks over time, while...

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...